The High Cost of Addiction vs. The Hope of Recovery

Does insurance cover rehab? Yes, in most cases, your health insurance will cover at least part of your addiction treatment costs. Here’s what you need to know:

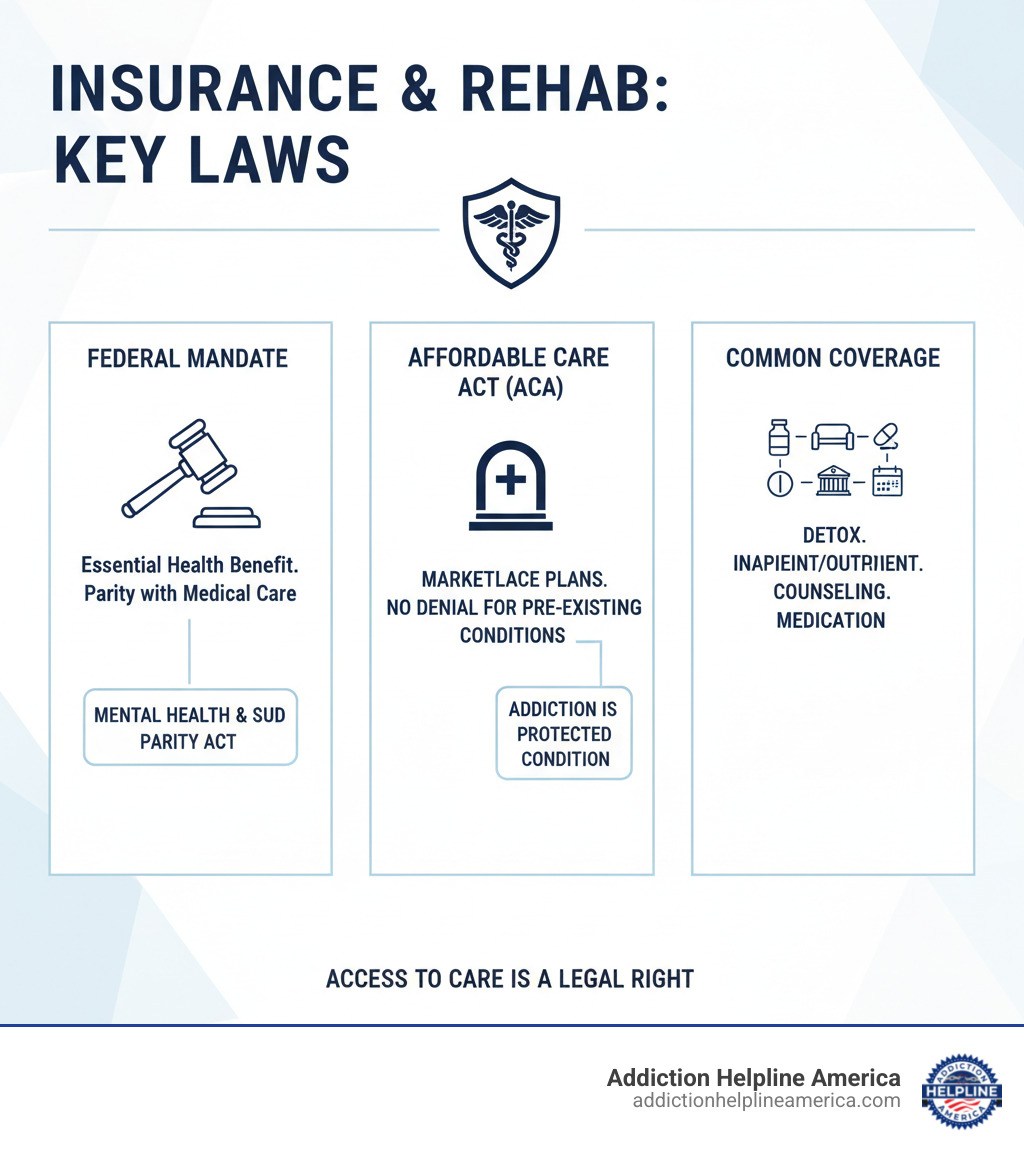

- Federal law requires most health insurance plans to cover substance use disorder treatment.

- The Affordable Care Act (ACA) mandates this coverage as an essential health benefit in Marketplace plans.

- Pre-existing conditions like addiction cannot be used to deny you coverage or charge you more.

- Common covered services include detox, inpatient and outpatient rehab, counseling, and medication-assisted treatment.

- Out-of-pocket costs like deductibles and copays will vary by plan.

For many, the cost of treatment feels like an impossible barrier. In 2021, over 46 million Americans had a substance use disorder, but a staggering 94% did not receive treatment. A primary reason is the perceived cost.

The good news is that addiction treatment is now recognized as essential healthcare. Whether you have private insurance, Medicare, Medicaid, or a plan through the ACA Marketplace, you likely have coverage for rehab services.

At Addiction Helpline America, we help people steer the complexities of insurance to access the care they need. Understanding your coverage is often the first critical step toward recovery.

Why Your Health Insurance Must Cover Rehab

Does insurance cover rehab? For most Americans, the answer is a firm yes. This isn’t a courtesy from insurance companies—it’s the law. Thanks to landmark federal legislation, most health plans must treat addiction like any other medical condition.

If you have health insurance, you have legal protections that guarantee access to substance use disorder treatment. These protections stem from two key laws: the Affordable Care Act (ACA) and the Mental Health Parity and Addiction Equity Act (MHPAEA).

The Affordable Care Act (ACA) and Its Impact

The ACA, passed in 2010, classified mental health and substance use disorder services as Essential Health Benefits. This means any new individual or small group plan, including all Marketplace plans, must cover these services.

What this means for you:

- Treatment is an essential benefit: Your ACA-compliant plan must include coverage for substance use disorder treatment.

- Marketplace plans have you covered: Every plan on the Health Insurance Marketplace includes mental health and substance abuse services. You can learn more at Healthcare.gov’s mental health and substance abuse coverage page.

- No denials for pre-existing conditions: Insurers cannot deny you coverage or charge higher premiums because of a past substance use disorder. This practice is now illegal.

- No lifetime or annual limits: The ACA eliminated dollar limits on essential health benefits, so your insurer can’t cap how much they’ll pay for your addiction treatment over your lifetime or in a given year.

Understanding the Mental Health Parity and Addiction Equity Act (MHPAEA)

While the ACA ensures plans include addiction treatment, the MHPAEA ensures that coverage is fair. This 2008 law requires insurers to provide the same level of benefits for mental health and substance use treatment as they do for medical and surgical care.

This means parity in several key areas:

- Financial requirements: Deductibles, copays, and out-of-pocket maximums for addiction treatment can’t be more restrictive than those for physical health care.

- Treatment limitations: Insurers cannot impose stricter limits on the number of treatment days or visits for substance use disorders than they do for other medical conditions.

- Network coverage: If your plan covers out-of-network medical doctors, it must provide comparable coverage for out-of-network addiction treatment providers.

These laws are powerful protections. To learn more, you can read the official Mental Health Parity and Addiction Equity Act (MHPAEA) factsheet. The bottom line is that insurance coverage for rehab is your right, protected by federal law.

What Types of Addiction Treatment Are Typically Covered?

We’ve established that the answer to does insurance cover rehab is generally yes. But what specific services does that include? Most insurance plans cover a wide range of evidence-based treatments, reflecting the understanding that recovery is a process with different stages.

Addiction treatment is often described as a “continuum of care,” with different levels of support available. Your plan will typically cover services deemed “medically necessary.” This includes core clinical services, but usually not luxury amenities. Covered services often include medical detox, inpatient/residential treatment, partial hospitalization (PHP), intensive outpatient programs (IOP), standard outpatient counseling, medication-assisted treatment (MAT), and various forms of therapy (individual, group, and family).

Call Now – Your Journey to Recovery Begins Today!

Take the first step towards a healthier life! Call now to connect with our compassionate team and start your recovery journey today. Your path to healing awaits!

Our recovery specialists are available 24/7 to provide support, and all calls are confidential and free. Reach out anytime – we’re here to help!

Inpatient vs. Outpatient Rehab Coverage

Understanding the difference between inpatient and outpatient coverage is key.

Inpatient or residential treatment involves living at a facility with 24/7 medical supervision and structured therapy. It’s ideal for those with severe SUDs or who need a trigger-free environment. Because it’s the most intensive level of care, it almost always requires pre-authorization from your insurer to confirm it is medically necessary.

Outpatient programs allow you to live at home while attending treatment. These range from intensive options like PHP and IOP to standard weekly counseling. Outpatient care offers more flexibility at a lower cost, making it a great option for those with strong support systems or as a step-down from inpatient care. Many insurance plans cover a progression through these levels of care, which is recognized as a highly effective path to recovery.

Does insurance cover rehab for detox and medication?

Yes, coverage for medical detox and medication is standard, as they are often life-saving components of recovery.

Medical detoxification is the process of safely managing withdrawal under medical supervision. For substances like alcohol and opioids, this is a critical safety measure, and insurers cover it as a medically necessary procedure.

Medication-Assisted Treatment (MAT) combines FDA-approved medications (like buprenorphine, often in Suboxone) with counseling. It is a highly effective, evidence-based approach for opioid and alcohol use disorders. As outlined by HHS guidance on Does Insurance Cover Treatment for Opioid Addiction?, insurance plans are increasingly covering both the medications and the required therapy.

Counseling and therapy are the foundation of recovery. Your insurance should cover individual, group, and family therapy just as it would for any other medical condition. These services are not optional extras; they are core components of effective treatment.

How to Verify Coverage and Understand Your Costs

Navigating insurance can be confusing, but understanding how can I verify what my specific insurance plan covers for rehab? is a manageable and vital step. Knowing a few key terms makes the process much simpler.

- In-network providers have a contract with your insurer to offer services at a negotiated, lower rate. Using them will minimize your costs.

- Out-of-network providers do not have a contract. Your plan may still cover some of the cost, but you will pay significantly more.

- Prior authorization is a required pre-approval from your insurer for certain services, especially inpatient rehab. It confirms the treatment is medically necessary. Skipping this step can lead to denied claims.

Does insurance cover rehab and what are the out-of-pocket expenses?

While insurance provides coverage, you will likely have some financial responsibility. Understanding these costs upfront prevents surprises.

- Deductible: The amount you must pay for covered services before your insurance begins to pay.

- Copayment (Copay): A fixed amount you pay for a specific service, like a therapy session.

- Coinsurance: A percentage of the cost you pay after your deductible is met. For example, you might pay 20% while your insurer pays 80%.

- Out-of-Pocket Maximum: The absolute most you will have to pay for covered services in a plan year. Once you hit this limit, your insurance pays 100% of covered costs.

A Step-by-Step Guide to Checking Your Benefits

Here’s how to get clear answers about your coverage:

Call your insurance provider. The member services number is on your insurance card. Ask about your benefits for inpatient and outpatient rehab, your specific costs (deductible, copays, etc.), whether you need prior authorization, and for a list of in-network facilities. Take notes, including the representative’s name and a call reference number.

Check your online member portal. Most insurers have a website where you can review your benefits, check your deductible status, and search for in-network providers.

Let the rehab facility help you. This is often the easiest route. Treatment centers like Addiction Helpline America have admissions specialists who can verify your insurance on your behalf and explain your coverage in plain English.

Review your Summary of Benefits and Coverage (SBC). This is a standardized document from your insurer that outlines your plan’s costs and coverage. You can usually download it from your member portal.

What to Do If Insurance Doesn’t Cover the Full Cost of Rehab

It’s a common worry: what if my insurance doesn’t cover the full cost of rehab? Or worse, what should I do if my insurance provider denies coverage for rehab? First, know that you have options. An initial denial or coverage gap is not the end of the road.

Most people do not pay the full sticker price for rehab. With persistence, you can find ways to make treatment affordable. At Addiction Helpline America, we guide families through these situations to find solutions that open doors to care.

Using Medicare or Medicaid for Rehab

Government-funded programs are a lifeline for many. If you’re eligible, your path to recovery may be more accessible than you think.

Medicare: This federal program for those 65+ or with certain disabilities generally covers addiction treatment. Part A covers inpatient services, Part B covers outpatient care (like therapy and IOPs), and Part D helps with prescription drug costs, including MAT medications. Services must be deemed medically necessary and provided by a Medicare-approved facility.

Medicaid: This joint federal and state program provides health coverage to low-income individuals. All states in our service area, from Alabama to Wyoming, offer Medicaid. It covers a broad range of addiction services, often with little to no co-pays. The key is finding a treatment center that accepts your state’s Medicaid plan.

Other Financial Options and Appealing a Denial

If there are still gaps in coverage, don’t despair. Many treatment centers offer financial solutions:

- Payment plans allow you to spread the cost of treatment over time.

- Sliding scale fees adjust the cost based on your income.

- Rehab scholarships or grants from non-profits or treatment centers can cover a significant portion of the cost.

- Personal loans can cover immediate costs, but should be considered carefully.

If your insurance claim is denied, you have the right to appeal. Start by getting the reason for the denial in writing. Then, work with your provider to submit an internal appeal to the insurance company. If that is also denied, you can request an external review by an independent third party. Many denials are overturned on appeal. We at Addiction Helpline America can help you explore these options and connect you with facilities that can assist with this process.

Call Now – Your Journey to Recovery Begins Today!

Take the first step towards a healthier life! Call now to connect with our compassionate team and start your recovery journey today. Your path to healing awaits!

Our recovery specialists are available 24/7 to provide support, and all calls are confidential and free. Reach out anytime – we’re here to help!

Frequently Asked Questions About Insurance for Rehab

Navigating insurance for rehab brings up many questions. Here are straightforward answers to some of the most common ones we hear at Addiction Helpline America.

How do HMO vs. PPO plans affect rehab coverage?

The type of plan you have—most commonly an HMO or PPO—dictates how you access care.

HMO (Health Maintenance Organization) plans typically require you to use a specific network of providers and get a referral from your Primary Care Physician (PCP) before seeing a specialist or entering rehab. While more restrictive, HMOs often have lower premiums and copays.

PPO (Preferred Provider Organization) plans offer more flexibility. You don’t usually need a referral to see a specialist, and you have the freedom to see out-of-network providers, though at a higher cost. This flexibility often comes with higher monthly premiums.

Knowing your plan type is crucial. With an HMO, secure your referrals early. With a PPO, confirm which facilities are in-network to keep costs down.

Is addiction considered a pre-existing condition?

No. Thanks to the Affordable Care Act (ACA), addiction is not considered a pre-existing condition. It is illegal for an insurance company to refuse to cover you, charge you more, or deny treatment based on a history of substance use. This protection applies to all ACA-compliant plans, including those on the Marketplace and most employer-sponsored plans. Your coverage for addiction treatment begins when your plan does, with no waiting periods.

How long will insurance cover my stay in rehab?

There is no single answer, as the length of stay your insurance covers depends on your specific plan and what is deemed “medical necessity.”

Your clinical team will continuously assess your progress and provide documentation to your insurer to justify the need for your current level of care. The insurer uses this to authorize treatment in blocks of time. A common initial authorization for inpatient care is 30 days, but extensions are possible with proper clinical justification.

Insurers often favor a step-down care approach, where you transition from a higher level of care (like inpatient) to a lower one (like an Intensive Outpatient Program or IOP) as you progress. This is both clinically effective and cost-efficient. The best way to understand your plan’s specifics is to verify your benefits directly with your insurer or through the admissions team at a treatment center like Addiction Helpline America.

Take the First Step: Confirm Your Coverage Today

Knowing that you need help is a courageous first step. Let’s bring it all together so you can move forward with confidence.

Does insurance cover rehab? Yes. For most Americans, coverage for addiction treatment is legally mandated by federal laws like the ACA and MHPAEA. From Alabama to Wyoming, these protections ensure that addiction is treated as the essential healthcare issue it is.

However, verification is crucial. Every plan has unique deductibles, copays, and provider networks. You must confirm your specific benefits by calling your insurer, checking your online portal, or letting a rehab facility’s admissions team assist you.

Financial help is available even if insurance doesn’t cover the full cost. Options like Medicare, Medicaid, payment plans, and scholarships can bridge the gap. If a claim is denied, you have the right to appeal.

Most importantly, don’t let cost be a barrier to recovery. The cost of untreated addiction—in terms of health, relationships, and life itself—is infinitely higher than the cost of treatment.

At Addiction Helpline America, we help people steer this process every day. We offer free, confidential guidance to connect you with a treatment program that fits your clinical and financial needs. You don’t have to figure this out alone.

Take the first step right now. Verify your insurance coverage now and let us help you move forward. Recovery is possible, and it starts today.

Our helpline is 100%

free & confidential

If you or someone you care about is struggling with drug or alcohol addiction, we can help you explore your recovery options. Don’t face this challenge alone—seek support from us.

Programs

Resources

Will my insurance

cover addiction

treatment?

We're ready to help

Find the best

drug or alcohol treatment

center

Are you or a loved one struggling with addiction? Call today to speak to a treatment expert.