Why Understanding Your Insurance Coverage Matters Right Now

Does my insurance cover the treatment you or your loved one desperately needs? This question keeps countless people awake at night. When facing a crisis like addiction, unexpected medical bills can add crushing weight to an already overwhelming situation. Understanding your health insurance isn’t just about managing costs—it’s about accessing the care you need without delay.

Many people don’t know where to start. Confusion about insurance is a significant barrier to treatment. You might worry that addiction treatment isn’t covered, but the truth is often much better than you think.

Quick Answer: What Your Insurance Likely Covers

- Mental health and substance use disorder treatment as an essential health benefit

- Inpatient and outpatient addiction services, including detox and counseling

- Preventive care, often at 100% with no out-of-pocket costs

- Emergency services, even if you go out-of-network

- Prescription medications listed on your plan’s formulary (drug list)

To verify your specific coverage:

- Check your Summary of Benefits and Coverage (SBC)

- Sign in to your insurance portal online

- Call the number on your insurance card

- Ask your treatment provider to verify benefits for you

This guide will walk you through a clear, step-by-step process to find out exactly what your insurance covers. You’ll learn how to read your benefits documents, who to call, and how federal laws protect your access to addiction and mental health treatment.

At Addiction Helpline America, we help individuals and families steer the insurance verification process every day. We understand that figuring out does my insurance cover addiction treatment can feel overwhelming, which is why we’ve created this guide to empower you with the knowledge to get clear answers fast.

Decoding Your Health Insurance Plan: The First Step to Clarity

Before you can figure out does my insurance cover a specific treatment, you need to understand the basic language of your plan. These terms might seem confusing, but knowing them makes everything else click into place.

Key Terminology

- Covered Benefit: A service or item your health plan agrees to pay for, in whole or in part. Most plans cover doctor visits, lab tests, and mental health and addiction treatment.

- In-Network vs. Out-of-Network: In-network providers have a contract with your insurer to charge negotiated rates, saving you money. Out-of-network providers do not, which means you’ll pay significantly more (except in emergencies).

- Prior Authorization: Pre-approval required from your insurer before you receive certain services. Skipping this step when it’s required can lead to your claim being denied.

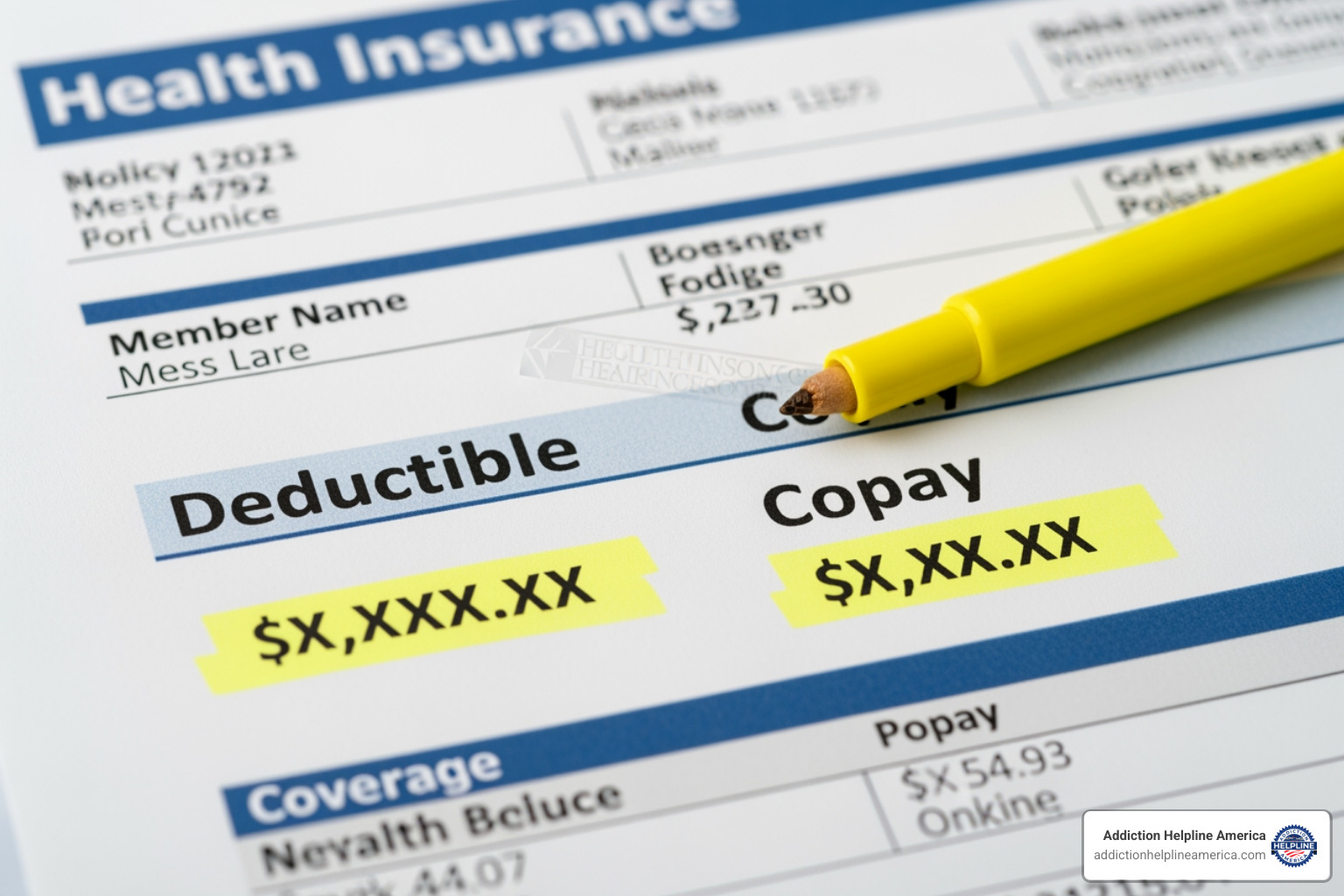

Cost-Sharing Explained

Cost-sharing is how you and your insurer split the costs of your care.

- Deductible: The amount you must pay out-of-pocket for covered services before your insurance starts to pay.

- Copayment (Copay): A fixed dollar amount you pay for a specific service, like a $25 copay for a therapy session.

- Coinsurance: A percentage of the cost you pay for a service after meeting your deductible. If your coinsurance is 20% for a $100 service, you pay $20.

- Out-of-Pocket Maximum: The absolute most you will pay for covered services in a plan year. After you reach this limit, your insurance pays 100% of covered costs.

For a more detailed breakdown, the Centers for Medicare & Medicaid Services has a helpful guide: Learn about health insurance costs (PDF | 1.6 MB).

Common Types of Health Insurance Plans and How They Affect Coverage

The type of plan you have, most commonly an HMO or PPO, shapes which providers you can see and how much you’ll pay.

| Feature | HMO (Health Maintenance Organization) | PPO (Preferred Provider Organization) |

|---|---|---|

| Network Restrictions | Usually limits coverage to doctors and other providers within the plan’s network. | Covers care from both in-network and out-of-network providers. |

| Referral Requirements | Typically requires a referral from your primary care physician (PCP) to see a specialist. | Generally, you don’t need a referral to see a specialist. |

| Out-of-Network Costs | No coverage for out-of-network care, except in emergencies. | Covers out-of-network care, but at a higher cost to you. |

| Cost | Often has lower monthly premiums and out-of-pocket costs. | Typically has higher monthly premiums but more flexibility in choosing providers. |

| Flexibility | Less flexibility in choosing providers. | More flexibility in choosing providers. |

With an HMO, you must stay in-network and usually need referrals from a primary care physician (PCP) to see specialists. This structure typically means lower costs. PPO plans offer more freedom to see specialists without referrals and to go out-of-network, but usually at a higher premium. Knowing your plan type helps you anticipate costs and requirements when seeking addiction treatment.

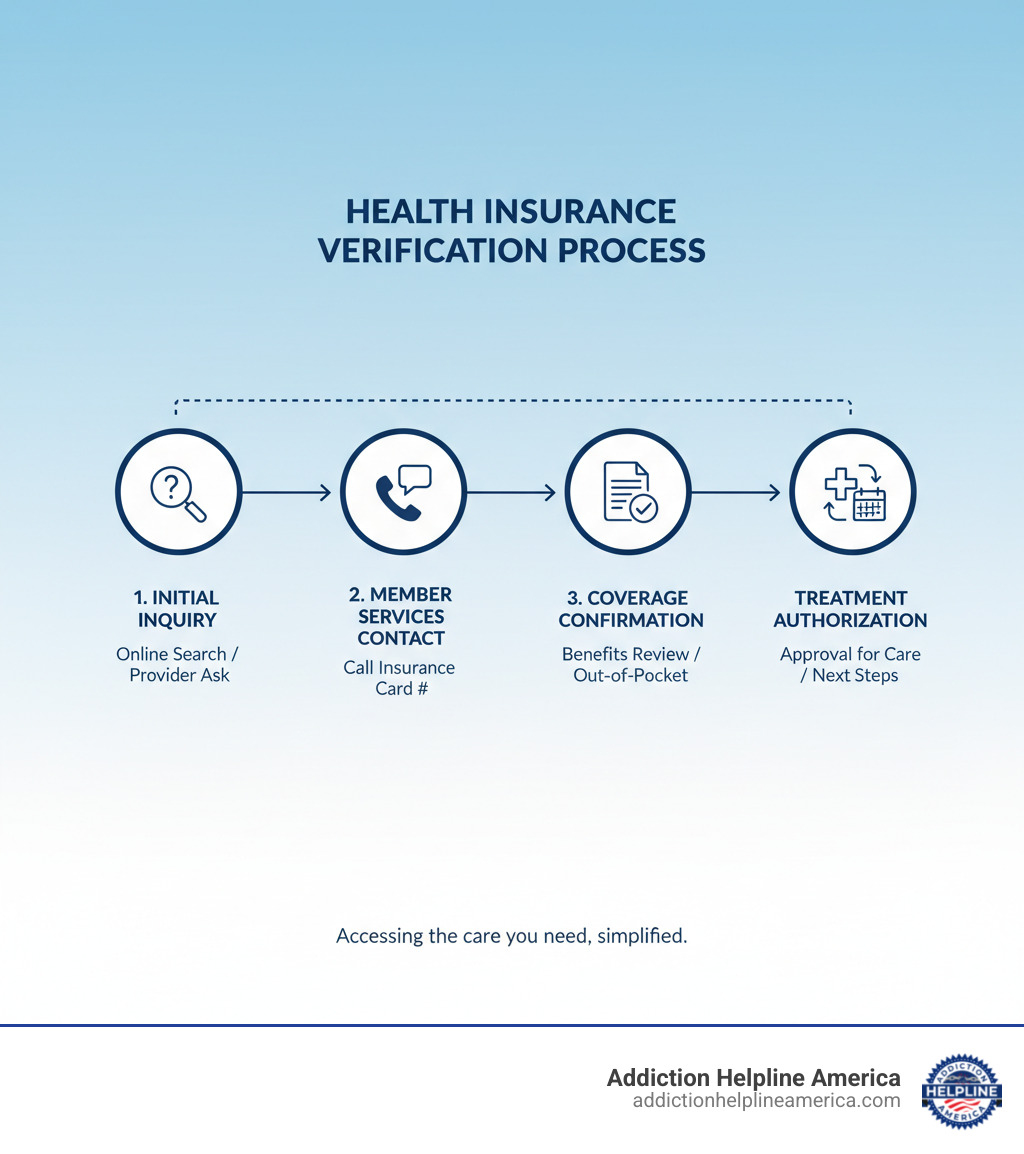

Your Step-by-Step Guide to Verifying Coverage

Now that you’re familiar with the basics, let’s walk through exactly how to find out what your health insurance covers. These steps will give you the clarity you need to move forward.

Step 1: Review Your Summary of Benefits and Coverage (SBC)

Your SBC is a straightforward, standardized document that all health plans must provide. It’s a snapshot of your plan, showing what’s covered and what you’ll pay. It clearly lists your deductible, copayments, coinsurance, and out-of-pocket maximum. The SBC also includes coverage examples for real-life situations, helping you estimate costs. You can find your SBC on your insurance company’s website, or you can call and ask for a copy. Here’s like this sample SBC (PDF) so you know what to look for.

Step 2: Use Your Insurer’s Online Portal and Tools

Your insurance company’s online portal is your source for personalized coverage information. After you sign in to your account with your member ID, you can access powerful tools to answer the question does my insurance cover this service.

- The provider search tool helps you find doctors, therapists, and treatment facilities that are in your network, which is key to saving money.

- Cost estimator tools can predict your out-of-pocket expenses for different services, from therapy sessions to inpatient treatment.

- You can also view your claims history to see how much you’ve paid toward your deductible for the year.

Step 3: How to Check: Does my insurance cover a specific prescription?

To find out if a specific medication is covered, you need to check your plan’s formulary, also known as a Prescription Drug List (PDL). This is the official list of medications your plan covers. Formularies are often organized into tiers, with lower-cost generic drugs in Tier 1 and higher-cost specialty drugs in higher tiers. For addiction treatment, medications like buprenorphine or naltrexone are often covered but may require prior authorization or step therapy (trying a lower-cost drug first). You can find the formulary on your insurer’s website.

Step 4: When in Doubt, Contact Member Services

If you need clear answers to complex questions, call Member Services. The phone number is on the back of your insurance card. Before you call, have your member ID card and details about the treatment you’re asking about. Be specific with your questions. For example, ask, “What are my out-of-pocket costs for weekly outpatient counseling with an in-network provider for substance use disorder?”

Document everything: the date, the representative’s name, and a reference number for the call. This creates a record that can protect you later. Also, be sure to ask about prior authorization requirements for any treatment you’re considering.

At Addiction Helpline America, we can help verify your benefits for addiction and mental health treatment at no cost, taking the stress out of this process.

What Does My Insurance Cover by Law? Essential Health Benefits

Federal law guarantees that most health insurance plans cover a wide range of services. Thanks to the Affordable Care Act (ACA), all plans sold in the Health Insurance Marketplace must cover a set of 10 “Essential Health Benefits” (EHBs). This provides a baseline of protection, no matter which plan you choose.

The 10 Essential Health Benefits

These 10 categories form the foundation of coverage in most individual and small group plans:

- Ambulatory patient services (outpatient care you get without being admitted to a hospital)

- Emergency services (covered even if you go to an out-of-network facility)

- Hospitalization (inpatient care, including surgery)

- Pregnancy, maternity, and newborn care

- Mental health and substance use disorder services, including behavioral health treatment. This means if you’re wondering does my insurance cover rehab, the answer is almost certainly yes. For more details, explore Mental health and substance abuse health coverage options.

- Prescription drugs

- Rehabilitative and habilitative services and devices (to help you recover skills after an injury or illness)

- Laboratory services

- Preventive and wellness services and chronic disease management (often at no cost to you)

- Pediatric services, including oral and vision care for children

Additional Required Benefits

Beyond the 10 EHBs, your plan must also cover birth control and breastfeeding support and equipment.

Applicability and Exceptions

Any plan in the Marketplace includes these benefits. You can learn more at Find out what Marketplace health insurance plans cover.

However, there are some exceptions:

- Grandfathered plans (created before March 23, 2010) are not required to cover EHBs, though many do.

- Self-insured employers (typically large companies) are also not required to provide EHBs, but most choose to.

- State-specific requirements can add to your benefits. Some states mandate coverage for services beyond the federal minimum. Check your state’s Department of Insurance to see if you have extra protections.

The bottom line is that you have more coverage than you might think. These legal protections ensure that when you ask does my insurance cover essential services like addiction treatment, the answer is almost always yes.

Navigating Coverage for Specific Needs

Beyond the general framework of benefits, let’s look at coverage for mental health, addiction treatment, and other specialized services.

Does my insurance cover mental health and substance use treatment?

If you’ve been asking, “does my insurance cover addiction treatment or mental health care?”—the answer is: Yes, it does.

Mental health and substance use disorder services are one of the 10 Essential Health Benefits. Federal laws like the Mental Health Parity and Addiction Equity Act (Parity Act) and the Affordable Care Act (ACA) ensure these services receive the same level of coverage as medical services. This means your plan cannot charge you more or deny you coverage for a mental health or substance use disorder. Your plan also cannot put yearly or lifetime dollar limits on this treatment.

Parity protections ensure that cost-sharing (deductibles, copays) and treatment limits (like the number of visits) are no more restrictive for mental health care than they are for medical care.

What’s covered?

- Behavioral health treatment like psychotherapy and counseling.

- Inpatient mental and behavioral health services.

- For substance use disorders: detoxification, inpatient residential treatment, and outpatient programs.

- Medication-assisted treatment (MAT) for opioid addiction.

For more information, review Mental health and substance abuse health coverage options from Healthcare.gov or our guide on Insurance That Covers Rehab.

Understanding Costs for Addiction Treatment

While treatment is covered, your out-of-pocket costs depend on your plan, the type of treatment, and whether the facility is in-network. Coverage requires that the treatment be deemed a medical necessity by a doctor.

Treatment is offered at different levels of care, from inpatient residential to standard outpatient counseling, each with different cost implications. You will still be responsible for your out-of-pocket expenses, including your deductible, copays, and coinsurance. This is why verifying your benefits beforehand is so important.

Many treatment centers have specialists who can verify your benefits for free, determining exactly what your plan covers and what you’ll owe. We’ve created resources to help you understand potential costs: How Much Drug Rehab Centers Cost? and How Much Do Alcohol Treatment Centers Cost?.

Coverage for Other Services

- Preventive care: Most preventive services (screenings, immunizations, wellness visits) are covered at 100% with an in-network provider, with no copay or deductible.

- Pediatric vision and dental care: These are included in the 10 Essential Health Benefits. However, adult dental and vision are not, so you may need a separate plan for that coverage.

- Abortion services: Coverage varies by plan and state. You will need to contact a plan directly to understand its specific policies.

Frequently Asked Questions About Your Coverage

Let’s address some common questions that arise when you’re trying to figure out does my insurance cover a specific service.

What is an Explanation of Benefits (EOB) and how is it different from a bill?

An Explanation of Benefits (EOB) is a statement from your insurance company that breaks down how a claim was processed. It shows what the provider charged, what the insurer paid, and what portion you are responsible for.

Crucially, an EOB is not a bill. It is an informational summary. You will receive a separate bill from your healthcare provider for any amount you actually owe. Always compare your provider’s bill to the EOB to ensure they match before paying.

Are preventive services always free?

Yes, many preventive services are covered at 100% when you use an in-network provider, meaning no deductible or copay. This includes services like:

- Routine physical exams and wellness visits

- Screenings for blood pressure, cholesterol, and certain cancers

- Immunizations like flu shots

- Counseling for smoking cessation and diet

However, if a preventive visit leads to diagnostic testing or treatment (e.g., removing a polyp during a colonoscopy), those follow-up services may be subject to your deductible and coinsurance. Always confirm with your provider that a service will be billed as preventive.

What is a qualifying life event?

A qualifying life event is a major life change that allows you to enroll in or change your health insurance plan outside of the annual Open Enrollment Period. This triggers a Special Enrollment Period, which typically lasts 60 days from the date of the event.

Common qualifying life events include:

- Losing other health coverage (e.g., due to job loss or turning 26)

- Getting married or divorced

- Having a baby or adopting a child

- Moving to a new ZIP code with different plan options

Missing the 60-day window could mean waiting months for the next Open Enrollment. If you’re facing a crisis and need treatment, don’t let insurance confusion stop you. At Addiction Helpline America, we help people steer these situations every day.

Get Confidential, 24/7 Support for Addiction Insurance Coverage

Understanding your health insurance benefits is the first step toward taking control of your healthcare. It removes the fear and confusion that can stand between you and the care you or a loved one needs. You now have the tools to get clear answers to the question: Does my insurance cover this?

You know how to review your Summary of Benefits and Coverage, use your insurer’s online portal, check prescription coverage, and contact Member Services effectively. Most importantly, you know that federal law ensures that essential services, including mental health and substance use disorder treatment, are covered.

This knowledge puts you in the driver’s seat, empowering you to make informed decisions without letting financial worries delay necessary treatment.

At Addiction Helpline America, we see people every day who feel overwhelmed by this process. That’s why we exist. We offer free, confidential help to verify your insurance coverage for addiction and mental health treatment. Our team can explain your benefits, outline your out-of-pocket costs, and connect you with quality treatment centers across the country—from California to Florida, Texas to New York, and everywhere in between.

The hardest part of recovery is often taking that first step. Don’t let questions about insurance stop you. The answers are closer than you think, and we’re here to help you find them.

Verify your insurance coverage for addiction and mental health treatment today

Our helpline is 100%

free & confidential

If you or someone you care about is struggling with drug or alcohol addiction, we can help you explore your recovery options. Don’t face this challenge alone—seek support from us.

Programs

Resources

Will my insurance

cover addiction

treatment?

We're ready to help

Find the best

drug or alcohol treatment

center

Are you or a loved one struggling with addiction? Call today to speak to a treatment expert.