24/7 Free & Confidential Behavioral Health Insurance Helpline

Behavioral health insurance plans are specialized coverage options that help pay for treatment related to mental health conditions and substance use disorders. Here’s what you need to know:

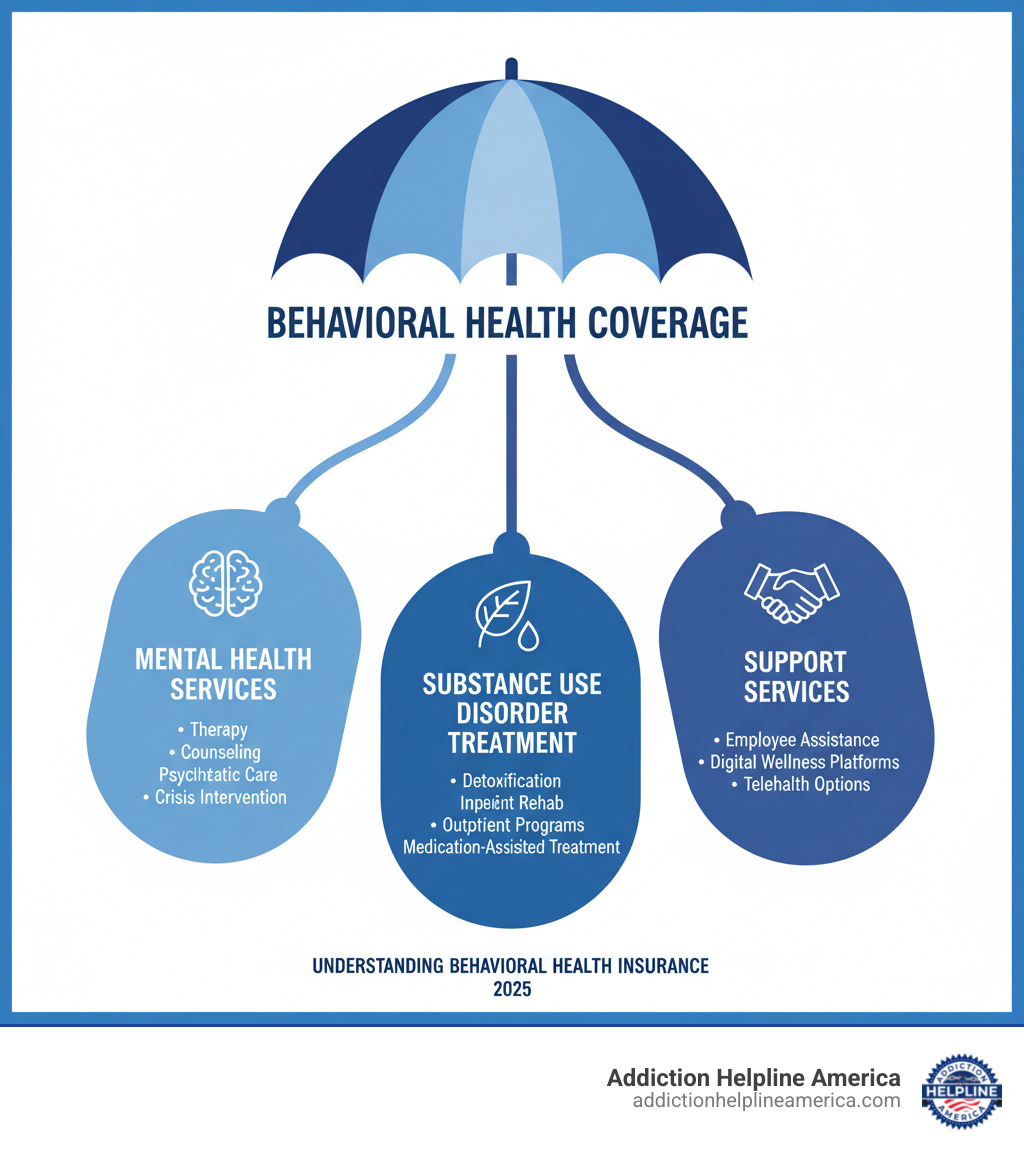

Key Coverage Areas:

- Mental Health Services: Therapy, counseling, and psychiatric care for conditions like anxiety and depression.

- Substance Use Treatment: Detoxification, inpatient rehab, outpatient programs, and medication-assisted treatment.

- Crisis Support: Emergency mental health services and 24/7 crisis intervention.

Your Rights:

- All Marketplace plans must cover mental health and substance abuse services as essential health benefits.

- Plans cannot deny coverage or charge more for pre-existing mental health conditions.

- No yearly or lifetime dollar limits on most behavioral health services.

What You’ll Pay:

- Costs vary by plan type (PPO, HMO, EPO).

- In-network providers cost significantly less than out-of-network providers.

If you’re struggling with addiction or mental health, understanding your insurance can feel overwhelming. Cost is a major barrier for many, with over half of young adults citing it as an obstacle to getting help.

The good news is that federal laws like the Mental Health Parity and Addiction Equity Act and the Affordable Care Act require most insurance plans to cover behavioral health treatment at the same level as other medical care. But knowing what’s covered and how to access it can still be confusing.

This guide will walk you through everything from covered services to your legal rights, helping you find the right plan. At Addiction Helpline America, our experienced specialists can help you understand your coverage options so you can focus on recovery.

Understanding What’s Covered by Behavioral Health Insurance

Thanks to the Affordable Care Act (ACA), mental health and substance abuse services are “essential health benefits.” This means all Marketplace plans and most employer-sponsored plans must include this coverage, recognizing behavioral health as equal to other medical treatment.

From day one, you should have access to a range of services. The two main categories are inpatient care (overnight stays at a hospital or residential facility for intensive, 24/7 support) and outpatient care (treatment while living at home, including therapy sessions and medication management).

For substance use disorders, coverage typically includes several levels of care:

- Detoxification: Medically supervised withdrawal from drugs or alcohol.

- Residential Treatment: A live-in program providing comprehensive therapy, usually for 30-90 days.

- Partial Hospitalization Programs (PHPs): Intensive treatment for several hours a day, multiple days a week, while you return home at night.

- Intensive Outpatient Programs (IOPs): Structured therapy for a few hours a day, a few times a week, offering more flexibility for work or family.

These levels create a “continuum of care,” allowing you to step down to less intensive services as you progress. To verify what your specific plan covers, you can check out more info about treatment services.

Common services covered by behavioral health insurance plans

Your behavioral health insurance plans should cover a variety of services to support your mental health and recovery.

- Psychotherapy and Counseling: Often called “talk therapy,” these sessions with a licensed professional (individual, group, or family) help you develop coping strategies and address root causes.

- Medication Management: Visits with a psychiatrist or other prescriber to find the right medication and dosage for conditions like depression, anxiety, or bipolar disorder, and monitor its effectiveness.

- Crisis Intervention: Emergency services, including ER visits or access to urgent care during a mental health crisis. Many plans also connect to the 988 Suicide & Crisis Lifeline.

- Co-occurring Disorders Treatment: It’s common to have both a mental health condition and a substance use disorder. Good plans provide integrated treatment that addresses both issues simultaneously.

The Role of Different Behavioral Health Professionals

Understanding the different types of mental health professionals can help you find the right fit and know what your insurance will cover.

| Professional Type | Qualifications | Key Services | Insurance Coverage Implications (US) |

|---|---|---|---|

| Psychiatrist | MD, specializing in mental health. Can prescribe medication. | Diagnosis, medication management, psychotherapy (often for complex cases). | Covered by medical insurance as they are medical doctors. |

| Psychologist | PhD/PsyD in psychology. Cannot prescribe medication. | Psychological assessment, diagnosis, various forms of therapy. | May be covered by private health insurance. |

| Therapist/Counselor | Master’s degree in counseling or related field (e.g., LPC, LMFT). | Individual, group, and family therapy. | May be covered by private health insurance, often with limits. |

| Clinical Social Worker | Master’s degree in social work (LCSW). | Psychotherapy, case management, connecting to resources. | May be covered by private health insurance, often with limits. |

Psychiatrists are medical doctors (MDs) who can prescribe medication and are generally covered like any other physician. Psychologists have doctoral degrees (PhD/PsyD) and specialize in assessment and therapy. Licensed therapists, counselors (LPC, LMFT), and clinical social workers (LCSW) hold master’s degrees and provide various forms of talk therapy. Coverage for non-MD professionals is common, but check your specific policy for details on session limits or other restrictions. The best provider is one you feel comfortable with and who has experience with your concerns.

How Virtual Care and Support Services Expand Access

Digital tools have made behavioral health care more accessible than ever, and many behavioral health insurance plans now cover virtual options.

- Employee Assistance Programs (EAPs): Often offered by employers, EAPs provide a set number of confidential counseling sessions at no cost to you. They are ideal for short-term support for work or personal issues.

- Digital Wellness Platforms: Many insurers offer online platforms with resources like guided meditation, self-help modules for anxiety or depression, and online cognitive behavioral therapy (CBT) programs.

- Telehealth: Therapy sessions with psychiatrists, psychologists, or counselors via phone or video call are now widely covered. This eliminates travel time and provides access to care for those in rural areas or with busy schedules. Some plans integrate services like Teladoc Mental Health for a broad network of virtual providers.

These virtual options make quality mental health support available to more people, regardless of location or schedule.

Your Rights and Protections: Mental Health Parity Explained

Understanding your rights is essential when dealing with behavioral health insurance plans. For years, insurers could impose stricter limits on mental health care, but federal laws have changed that.

The Mental Health Parity and Addiction Equity Act (MHPAEA) of 2008 is a landmark law requiring insurance companies to treat mental health and substance use disorder benefits equally to medical and surgical benefits. In practice, this means your plan can’t charge a higher copay for therapy than for a doctor’s visit or impose stricter limits on mental health services.

The Affordable Care Act (ACA) expanded on this by making mental health and substance use disorder services one of the ten “essential health benefits” that most plans must cover. Together, these laws ensure equal coverage by preventing insurers from applying financial requirements (copays, deductibles) or treatment limitations (visit limits, prior authorization) more restrictively to behavioral health care.

These are not just guidelines; they are legal protections you can enforce.

Pre-Existing Conditions and Lifetime Limits

Before the ACA, insurers could deny coverage or charge exorbitant rates for pre-existing mental health conditions. Those discriminatory practices are now illegal.

Under the ACA, guaranteed coverage means that Marketplace and most private insurance plans cannot deny you coverage or charge you more because of a pre-existing condition, including a history of depression, anxiety, or addiction. Your past does not disqualify you from getting help now.

The ACA also eliminated annual and lifetime dollar limits on essential health benefits. This is a critical protection for those with chronic conditions, ensuring your coverage won’t run out when you need it most. These essential health benefits protections guarantee that a full range of behavioral health services are covered without arbitrary caps.

To learn more, check out this resource: Learn more about your rights to coverage (PDF).

Red Flags for Potential Parity Violations

Even with strong laws, violations can occur. Be aware of these red flags that suggest your behavioral health insurance plans may not be treating you fairly:

- Higher cost-sharing: Paying a higher copay or coinsurance for therapy sessions compared to visits with other medical specialists.

- Stricter pre-authorization: Needing to get approval for every therapy session when it’s not required for other types of medical care.

- Lower visit limits: Having your therapy sessions capped at a low number (e.g., 20 per year) while physical therapy or other medical visits are unlimited.

- Separate deductibles: Being required to meet one deductible for medical care and a separate, often higher, one for behavioral health services.

- Unfair denials: Being denied coverage for residential or intensive outpatient treatment while similar levels of care are covered for medical issues.

If you notice these patterns, contact your insurance company for an explanation. If you’re not satisfied, contact your state’s Department of Insurance. At Addiction Helpline America, we can also help you steer these challenges and understand your options.

Navigating the Costs and Limits of Behavioral Health Insurance Plans

Understanding the financial side of your behavioral health insurance plans is key to getting care without surprise bills. Without insurance, therapy can be costly, with sessions ranging from $100 to over $250. Annually, this could amount to $4,800 to $12,000, making it unaffordable for many.

Insurance makes this care manageable. Instead of the full cost, you’ll typically pay a much smaller copay or a percentage of the cost after meeting your deductible. While some plans may have annual benefit maximums, they still offer significant savings. Understanding a few key terms will help you predict your expenses.

Understanding Your Financial Responsibility

When you use your insurance, you and your insurer share the costs. Here’s how it works:

- Deductible: The amount you must pay out-of-pocket before your insurance begins to pay. For example, if your deductible is $1,500, you pay the first $1,500 of covered services.

- Copayment (Copay): A flat fee you pay for each service, such as $30 for a therapy session.

- Coinsurance: A percentage of the cost you pay after your deductible is met. If your plan has 20% coinsurance, you pay 20% of the bill, and your insurer pays 80%.

- Out-of-Pocket Maximum: The absolute most you will pay for covered services in a plan year. Once you hit this limit, your insurance pays 100% of covered costs.

Your costs are also heavily influenced by whether a provider is in-network (contracted with your insurer for lower rates) or out-of-network (no contract, leading to much higher costs for you). Always verify a provider’s network status before your first appointment.

For a detailed breakdown, see this guide: Learn about health insurance costs (PDF).

Common Pitfalls: Coverage Caps and Waiting Periods

While behavioral health insurance plans are beneficial, be aware of potential limitations.

- Coverage Maximums: While ACA-compliant plans can’t have dollar limits on essential benefits, some older or grandfathered plans might. These could cap the total amount paid per year or for specific services like residential treatment.

- Session Limits or Caps: Some plans may limit the number of therapy sessions covered annually (e.g., 20 visits) or cap the reimbursement amount per session. If your therapist charges more than the cap, you pay the difference.

- Waiting Periods: Some employer plans may have a waiting period (e.g., 30-90 days) before certain benefits are available, though crisis care is usually covered immediately.

- Medical Necessity Criteria: Insurers use these standards to approve treatment. They might deny a higher level of care (like an intensive program) if they believe a lower level is sufficient, leading to appeals and delays.

To avoid surprises, read your policy documents, ask questions before starting treatment, and challenge unfair decisions. Addiction Helpline America can help you understand your plan’s parameters and find the right treatment.

How to Choose the Best Plan for Your Needs

Finding the right behavioral health insurance plans starts with a clear strategy. First, assess your needs: Are you looking for long-term therapy, medication management, or substance use treatment? Do you prefer in-person or virtual care?

Next, compare plan types. The most common in the U.S. are:

- HMO (Health Maintenance Organization): Lower premiums, but requires you to use in-network providers and get referrals for specialists.

- PPO (Preferred Provider Organization): More flexibility to see out-of-network providers without referrals, but with higher premiums.

- EPO (Exclusive Provider Organization): A hybrid that doesn’t require referrals but restricts you to an in-network list of providers for non-emergency care.

Always review the Summary of Benefits and Coverage (SBC), a standardized document that outlines costs and coverage. Most importantly, check the plan’s provider network to ensure accessible therapists and treatment centers are included before you enroll.

What to look for in behavioral health insurance plans

When comparing behavioral health insurance plans, prioritize these features:

- Robust Provider Network: More choices of in-network therapists, psychiatrists, and treatment centers in your area.

- Coverage for Specific Needs: Confirm the plan covers the type of therapy you need (e.g., CBT, family therapy) and that your medications are on the prescription drug formulary.

- Telehealth Options: Look for plans that explicitly cover virtual therapy, as this adds convenience and accessibility.

- Low Cost-Sharing: Compare deductibles, copays, and coinsurance for behavioral health services to find the most affordable option for you.

Ask your potential provider specific questions about annual limits, referral requirements, and reimbursement for online therapy.

Resources for Insufficient or Denied Coverage

If you face a coverage denial, you have options. Don’t give up.

- Appeals Process: You have the right to appeal a denied claim. Review the denial letter, gather supporting documents from your provider, and follow your insurer’s internal and external review processes.

- State Insurance Departments: These state agencies can investigate complaints and help enforce parity laws.

- Non-Profit and Community Resources: Organizations can offer guidance on appeals and finding affordable care. Federally funded Community Health Centers often provide services on a sliding scale based on income.

- Crisis Support: For immediate help, call or text the 988 Suicide & Crisis Lifeline or visit 988 Suicide & Crisis Lifeline to chat online.

We’re here to help you steer these challenges and connect you with the support you need.

Frequently Asked Questions about Behavioral Health Insurance

Does insurance cover therapy for anxiety and depression?

Yes. Under the Affordable Care Act (ACA), treatment for conditions like anxiety and depression is an essential health benefit. This means most behavioral health insurance plans must cover services like psychotherapy and medication management. Your specific costs, such as copays and deductibles, will depend on your plan.

Can an insurance plan refuse to cover my pre-existing mental health condition?

No. The ACA prohibits insurance plans sold on the Marketplace or through most employers from denying you coverage or charging you more because of a pre-existing condition, including any mental health or substance use disorder. Your coverage for these conditions begins on day one of your plan.

What’s the difference between in-network and out-of-network behavioral health providers?

This distinction is crucial for your costs:

- In-network providers have a contract with your insurer to offer services at a negotiated, lower rate. Your out-of-pocket costs (copays, coinsurance) will be significantly lower.

- Out-of-network providers do not have a contract with your insurer. Using them will result in much higher out-of-pocket costs, and some plans (like HMOs) may not cover them at all.

Always verify a provider is in your network before scheduling an appointment to avoid surprise bills.

Conclusion

Navigating behavioral health insurance plans can be complex, but understanding your coverage is a powerful tool for accessing life-changing care. We’ve explored the essential services covered, your crucial rights under mental health parity laws, and the financial aspects to consider.

Key takeaways from our guide include:

- Behavioral health services are essential benefits for most plans, covering everything from therapy to substance use disorder treatment.

- Federal laws protect you from discrimination based on pre-existing conditions and ensure mental health care is treated on par with physical health.

- Understanding your plan’s financial details (deductibles, copays, network status) is vital to managing costs.

- Virtual care and EAPs are expanding access and convenience, offering more ways to get support.

- Resources are available if you face insufficient coverage or denials.

Empowerment through knowledge is your greatest asset. By proactively researching your options and asking informed questions, you can find a plan that meets your unique mental health and substance use treatment needs. Finding the right treatment is possible, and we believe everyone deserves access to quality care.

At Addiction Helpline America, we are dedicated to connecting individuals nationwide to addiction and mental health treatment centers. Our free, confidential, and personalized guidance helps you find the right recovery program from our vast network. We encourage you to take the next step: Verify your insurance coverage for behavioral health treatment today.

Our helpline is 100%

free & confidential

If you or someone you care about is struggling with drug or alcohol addiction, we can help you explore your recovery options. Don’t face this challenge alone—seek support from us.

Programs

Resources

Will my insurance

cover addiction

treatment?

We're ready to help

Find the best

drug or alcohol treatment

center

Are you or a loved one struggling with addiction? Call today to speak to a treatment expert.