The short answer is yes, most insurance plans do cover drug rehab. Thanks to federal laws, substance use disorder treatment is now considered an essential health benefit, meaning your insurance is legally required to offer some form of coverage.

But that’s where the simple part ends. “Coverage” is almost never a blank check, and the real answers live in the fine print.

Why Insurance for Rehab Is Yes and No

When you ask, “Will my insurance cover rehab?” it helps to think of it less as a simple yes-or-no question and more like ordering from a restaurant menu. Some things are included in the price, while others are a la carte, each with different costs and conditions attached. The key is figuring out exactly what your specific plan includes.

Federal laws like the Mental Health Parity and Addiction Equity Act (MHPAEA) are on your side. They mandate that insurance companies must cover substance use disorders at a level that’s comparable to their coverage for other medical conditions, like heart disease or diabetes.

However, getting insurers to fully comply is an ongoing battle. A 2023 STAT News report highlighted how insurers still throw up roadblocks, like imposing restrictive limits on treatment that create unnecessary hurdles for patients who desperately need care.

Understanding Treatment Levels and Your Plan

Your final coverage really boils down to two main things: the level of care your doctor determines is medically necessary, and the type of insurance plan you have (like an HMO or PPO). Each level of treatment has a different intensity and goal, which directly impacts how an insurer decides to pay for it.

Our detailed guide on how insurance covers rehab can give you more specific insights into this process.

Key Takeaway: “While the law says your plan has to cover rehab, the extent of that coverage—how much the insurer pays versus what comes out of your pocket—is all down to your specific policy and the kind of treatment you need.”

To give you a clearer picture, it’s helpful to understand the different stages of treatment and what you can generally expect from your insurance provider at each step.

Levels of Addiction Treatment and Typical Insurance Coverage

The table below breaks down the common stages of drug rehab and what you can generally expect from insurance coverage for each level of care.

| Level of Care | Description | Typical Insurance Coverage Focus |

|---|---|---|

| Detoxification (Detox) | Medically supervised withdrawal management to safely clear substances from your body. | Often covered when deemed medically necessary, especially to manage severe or dangerous withdrawal symptoms. |

| Inpatient/Residential | 24/7 care in a structured, live-in facility. This is the most intensive level of treatment. | Insurers require strong proof of medical necessity and often pre-authorization due to the high cost. |

| Outpatient Programs | Flexible treatment where you attend therapy and sessions while living at home. | Generally well-covered and often preferred by insurers as a cost-effective alternative to inpatient care. |

Navigating these levels and getting the right approvals is where the process can get tricky, but understanding the language and requirements is the first step toward maximizing your benefits.

Making Sense of Your Insurance Policy for Rehab

Let’s be honest, trying to read an insurance policy can feel like you’re trying to translate a foreign language. The documents are often loaded with jargon that seems intentionally confusing, but getting a handle on these terms is the key to understanding if your insurance will cover drug rehab. Once you learn the language, you gain the confidence to make informed decisions.

Think of it this way: your insurance plan is your financial partner for the road trip of a lifetime—your journey to recovery. And just like any good road trip, you need to be clear on who’s paying for what before you even turn the key.

Key Terms You Absolutely Need to Know

Let’s break down the most common terms you’ll encounter, using our road trip analogy. These four concepts are the ones that really determine how much you’ll pay out-of-pocket for your treatment.

Deductible: This is the specific amount of money you have to pay for covered health services before your insurance company starts chipping in. On our road trip, this is like the cash you have to spend on gas and snacks before your travel partner even opens their wallet. Once you hit that number, their financial help kicks in.

Copay (or Copayment): A copay is a fixed, flat fee you pay for a specific covered service, like a doctor’s appointment or a therapy session. Think of these as the small, predictable tolls you pay along your route. You know exactly what they cost each time, no surprises.

Coinsurance: This is your share of the cost for a covered service, but it’s calculated as a percentage of the total bill. After you’ve met your deductible, you might split the ongoing costs (like a huge fill-up at the gas station) with your insurance. For example, a common split is 80/20, where they pay 80% and you pay 20%.

Out-of-Pocket Maximum: This is the absolute most you will have to pay for covered services in a single plan year. Once you hit this limit, your insurance company steps up and pays 100% of the allowed costs for the rest of the year. This is your financial safety net—the point in your trip where your partner says, “Don’t worry, I’ve got all the expenses from here on out.”

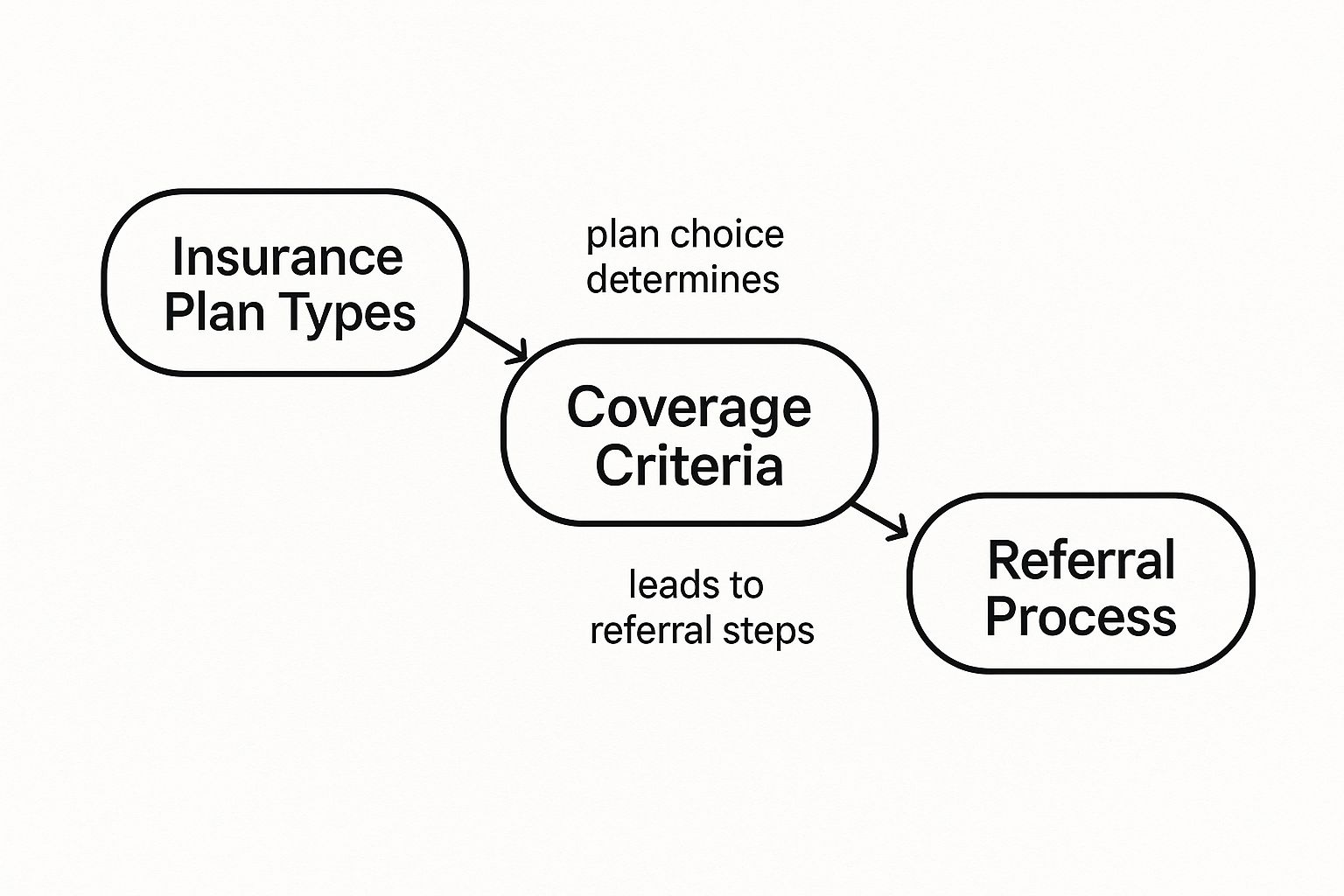

This image helps visualize how the type of plan you have can directly affect coverage rules and the steps you’ll need to take.

As you can see, the kind of insurance you carry sets the stage for everything that follows, including the medical criteria and authorizations needed for rehab.

Putting It All Together

Getting a solid grasp on these terms changes everything. You go from being a passive passenger to an empowered driver in your own healthcare journey. It gives you the power to anticipate costs, ask the right questions, and truly advocate for the quality care you deserve. For more guidance on health insurance terminology, you can reference the official Healthcare.gov glossary.

For a more detailed look, you can explore more about the specifics of rehab insurance coverage here. By mastering this vocabulary, you can have confident, clear conversations with both your insurance provider and the rehab facility, making sure there are no unexpected financial roadblocks on your path to recovery.

In-Network Versus Out-of-Network and Your Wallet

When you ask, “Will my insurance cover drug rehab?” a huge part of the answer boils down to one crucial decision: choosing an in-network or out-of-network facility. This choice is one of the single biggest financial factors in your entire treatment journey. Getting it wrong can leave you with staggering, unexpected bills.

Think of your insurance company’s in-network providers as members of an exclusive club. Your insurer has already sat down with these rehab centers and negotiated special, lower rates. By choosing one of these partners, you unlock the absolute best coverage and lowest out-of-pocket costs your plan has to offer. It’s the financially safe route.

On the other hand, going out-of-network is like shopping at a store where you have no discounts. That rehab facility has no pre-arranged deal with your insurer, so they charge their full, undiscounted price. Your insurance plan will then cover a much smaller slice of that bigger bill—if it covers anything at all.

The Financial Risks of Going Out-of-Network

Choosing an out-of-network provider can trigger some serious financial consequences that might even jeopardize your ability to finish treatment. The costs add up fast, and often in ways you don’t see coming.

- Higher Costs: You are on the hook for the difference between what the out-of-network center charges and what your insurance agrees is a “reasonable” amount. This gap, a practice known as balance billing, can easily run into the tens of thousands of dollars.

- Separate Deductibles: Many insurance plans have a completely separate—and much higher—deductible for out-of-network care. You could be forced to pay thousands more out of your own pocket before your limited benefits even kick in.

- Increased Coinsurance: Your coinsurance split gets a lot worse. Instead of a typical 80/20 split you might get in-network, you could be looking at a 50/50 split, leaving you with a massive portion of the bill.

- Risk of Denial: Insurance companies scrutinize claims for out-of-network rehab far more heavily. They are much more likely to be denied outright, leaving you responsible for 100% of the cost.

“The bottom line is crystal clear: Staying in-network is almost always the most secure and affordable path. It protects your finances and ensures you get the maximum benefits you’ve been paying for with your insurance policy.”

This decision also has a ripple effect on the type of care you might receive. For a closer look at how this plays out, you can learn about the differences between inpatient versus outpatient rehab options. Always, always verify a facility’s network status directly with your insurance provider before you commit to treatment. It’s a simple call that can save you a world of financial pain.

Call Now – Your Journey to Recovery Begins Today!

Take the first step towards a healthier life! Call now to connect with our compassionate team and start your recovery journey today. Your path to healing awaits!

Our recovery specialists are available 24/7 to provide support, and all calls are confidential and free. Reach out anytime – we’re here to help!

How to Verify Your Insurance Benefits Step-by-Step

Okay, you’ve got a handle on the key insurance terms. But theory only gets you so far. Now it’s time to get down to brass tacks and confirm exactly what your specific plan will cover for drug rehab.

This part can feel a little intimidating, but I promise it’s a manageable task. With a bit of preparation, you can turn that confusing policy document into clear, concrete answers.

Step 1: Contact Your Insurer Directly

Your first move is simple: grab your insurance card. Flip it over, and you’ll find a phone number for “Member Services” or “Behavioral Health.” That’s your direct line to the people with the answers.

When you call, make sure you have your insurance card in front of you. They’ll need your member ID number to pull up your policy. This call is the single most reliable way to get accurate information straight from the source.

Step 2: Ask Targeted Questions

Whatever you do, don’t just ask, “Do you cover rehab?” That’s way too broad. To really understand what you’ll pay, you need to get specific. It’s a good idea to have a list of questions ready so you don’t forget anything important in the moment.

Here are the crucial questions to ask:

- Is prior authorization required for residential or inpatient treatment?

- What are my exact copays, deductibles, and coinsurance amounts for both in-network and out-of-network facilities?

- Is there a limit on the number of covered days or sessions for detox, inpatient care, or outpatient therapy?

- Does my plan cover medication-assisted treatment (MAT)?

That last point about MAT is especially important. Coverage for addiction medications has gotten much better, particularly for those on Medicaid. A recent study found that 90% of Medicaid managed care plans cover at least one FDA-approved medication for alcohol use disorder without needing prior authorization, though some gaps still exist.

Step 3: Let the Rehab Facility’s Admissions Team Help

You don’t have to tackle this alone. The admissions team at your chosen rehab facility are pros at navigating the insurance maze. They do this all day, every day, and know exactly what to ask and who to talk to.

All you have to do is give them your insurance information, and they can run a verification of benefits for you. This is often the fastest and easiest path. They can cut through the jargon and get the ball rolling on any necessary approvals, like prior authorization. If you’re feeling overwhelmed, looking into how to prepare for rehab can also provide some much-needed guidance.

To help you feel more confident, here’s a simple script you can use when you call your insurance company yourself:

“Hello, my name is [Your Name], and my member ID is [Your Number]. I’m calling to verify my benefits for substance use disorder treatment. My doctor has recommended a [level of care, e.g., residential treatment program]. Could you please confirm if this facility, [Facility Name], is in my network? I also need to understand my financial responsibility, including my deductible and coinsurance.”

How to Handle Insurance Denials and Hurdles

Getting that denial letter from your insurance company for rehab coverage feels like a punch to the gut. It’s frustrating and disheartening, but here’s what you need to know: it is almost never the final word.

Think of a denial not as a dead end, but as a roadblock. It’s a sign that you need to take a different route, and you absolutely have the right to challenge their decision. There are clear, established pathways to fight back and secure the coverage you deserve. The first step is to figure out why they said no.

Common Reasons for a Denial

Insurance companies are required to give you a specific reason for the denial in writing. More often than not, the reason is technical or bureaucratic, not a personal judgment on your need for help.

They usually boil down to a few common culprits:

- Not Medically Necessary: This is the big one. It means the insurance company’s internal reviewers didn’t feel the clinical information they received was strong enough to justify the level of care requested, like an inpatient stay.

- Failed Pre-Authorization: Sometimes it’s a simple administrative error. Your treatment provider may have forgotten to get the insurance company’s required approval before you started treatment, which triggers an automatic denial.

- Out-of-Network Service: You might have chosen a facility that doesn’t have a contract with your insurance plan. This can lead to a complete denial or drastically reduced benefits.

Let’s be honest, the high price tag on treatment is a huge reason these claims get so much scrutiny. With the average cost for residential treatment hovering around $50,469 per person, you can bet that insurers are going to look for any reason to push back.

Your Action Plan After a Denial

That denial letter isn’t just bad news; it’s the official starting whistle for your appeal. Don’t throw in the towel. It’s time to get organized and be persistent. This is your chance to build a much stronger case and prove why treatment is absolutely essential.

“The most important rule after a denial is to document everything. Keep a detailed log of every phone call—who you spoke to, the date, and what was said. Save every email and piece of mail. This paper trail is your most powerful tool in the appeals process.”

You’ll start by filing an internal appeal. This is a formal request asking the insurance company to take a second look at its own decision. Your appeal letter should be professional and armed with compelling evidence:

- A letter of medical necessity from your doctor or addiction specialist.

- Your personal story, explaining how addiction is impacting your life.

- Any supporting documents, like proof of failed attempts at lower levels of care.

If the internal appeal doesn’t work, you can escalate to an external review. This is where an independent third party gets the final, binding say. You can also file a formal complaint with your State Insurance Commissioner.

Remember, you have rights. Laws like The Mental Health Parity and Addiction Equity Act (MHPAEA) are on your side, and organizations like the SAMHSA National Helpline can offer free guidance. Our team can also help you figure out what to do when your insurance for rehab gets complicated.

Call Now – Your Journey to Recovery Begins Today!

Take the first step towards a healthier life! Call now to connect with our compassionate team and start your recovery journey today. Your path to healing awaits!

Our recovery specialists are available 24/7 to provide support, and all calls are confidential and free. Reach out anytime – we’re here to help!

Common Questions About Insurance for Rehab

Once you’ve got the basics down, the real-world questions start popping up. It’s one thing to understand the definitions, but it’s another to figure out what happens in your specific situation. This final section is all about tackling those common “what if” scenarios to give you the confidence to move forward.

Does My Insurance Have to Cover Medication-Assisted Treatment?

In almost all cases, the answer is yes. Thanks to the Mental Health Parity and Addiction Equity Act (MHPAEA), your insurance plan has to treat addiction care like any other medical care. If your plan covers prescriptions for conditions like high blood pressure, it must also provide comparable coverage for medications used to treat substance use disorders.

This means that FDA-approved medications like Suboxone, Vivitrol, or Naltrexone can’t just be excluded from your plan. However, that doesn’t mean it’s always a straight shot. You might run into a few hurdles:

- Prior Authorization: This is a big one. Your insurance provider will likely require your doctor to get their approval before they agree to cover the cost of the medication.

- Formulary Preferences: Every plan has a drug formulary, which is its official list of preferred drugs. They might insist you try a generic version of a medication before they’ll pay for the more expensive brand-name one.

- Step Therapy: Some plans require you to try a less expensive medication first. Only if that doesn’t work will they approve a more costly alternative.

To avoid getting caught by surprise at the pharmacy counter, always have your doctor or the rehab facility double-check the specifics of your prescription drug coverage. The National Institute on Drug Abuse (NIDA) offers extensive information on the effectiveness of these medications.

What if I Have No Insurance or My Plan Denies Coverage?

Getting a flat-out denial from your provider—or having no insurance in the first place—can feel like hitting a brick wall. But it’s absolutely not the end of the road. You have several other solid options to get the help you need, so don’t let cost be the thing that stops you.

Many people don’t realize they might be eligible for government-funded programs that can dramatically cut—or even eliminate—the cost of treatment.

Key Insight: “A denial or lack of a private plan isn’t a dead end. State and federal programs, along with non-profit resources, were created specifically to build a safety net for people in this exact situation.”

If you find yourself here, these are your best next steps:

- Explore State-Funded Rehab: Every state uses tax dollars to fund addiction treatment programs for residents who can’t afford it. These facilities often offer care at no cost or on a sliding scale based on your income. A good place to start is by contacting your state’s substance abuse agency.

- Check for Medicaid Eligibility: Medicaid provides health coverage to millions of Americans with limited income. Thanks to the Affordable Care Act (ACA), Medicaid eligibility was expanded in many states, and it now offers strong coverage for addiction treatment. You can check your eligibility at Medicaid.gov.

- Look into Grants or Scholarships: Many non-profit organizations and even some private rehab centers offer grants or scholarships for people who can show financial need. The Substance Abuse and Mental Health Services Administration (SAMHSA) is an excellent resource for finding these opportunities.

- Ask About Sliding-Scale Fees: Don’t be afraid to ask a treatment facility if they offer a “sliding scale.” This just means they’ll adjust their prices based on your income, making treatment much more affordable by aligning the cost with what you can actually pay.

- Consider Financing Options: Some rehab centers offer in-house payment plans or partner with third-party lenders. This allows you to finance the cost of treatment over time, similar to a loan.

Call Now – Your Journey to Recovery Begins Today!

Take the first step towards a healthier life! Call now to connect with our compassionate team and start your recovery journey today. Your path to healing awaits!

Our recovery specialists are available 24/7 to provide support, and all calls are confidential and free. Reach out anytime – we’re here to help!

How Is Medical Necessity Proven to an Insurance Company?

Proving that rehab is medically necessary is the single most important part of getting your insurance to approve treatment. This isn’t just about saying you want to go to rehab; it’s a formal, clinical process that gives the insurer the evidence they need to justify paying for it.

It all starts with a comprehensive assessment from a qualified professional, like a doctor, psychiatrist, or licensed addiction specialist. They will conduct an evaluation to formally document several key things:

- Your detailed history with substance use.

- A formal diagnosis of a substance use disorder (SUD), based on established clinical criteria.

- An expert recommendation for a specific level of care (like residential, PHP, or outpatient).

- A clear explanation for why that level of care is essential for your health, safety, and recovery.

This clinical assessment is the foundation of your entire case. The admissions team at your chosen rehab facility will take this documentation and present it to the insurance company during the prior authorization request. They’re the ones who build the official argument, using the clinician’s findings to show why your treatment isn’t just a good idea—it’s medically essential. To understand the clinical standards used, you can review the ASAM Criteria for addiction treatment.

For more on the complexities of health insurance, you can find helpful resources from the National Association of Insurance Commissioners. To learn more about your rights under federal law, the Centers for Medicare & Medicaid Services also provides detailed fact sheets.

If you or a loved one needs help navigating the complexities of insurance for rehab, Addiction Helpline America is here for you. Our experienced team can verify your benefits and connect you with trusted treatment providers who offer compassionate care. Take the first step toward a healthier future by visiting https://addictionhelplineamerica.com today.

Our helpline is 100%

free & confidential

If you or someone you care about is struggling with drug or alcohol addiction, we can help you explore your recovery options. Don’t face this challenge alone—seek support from us.

Programs

Resources

Will my insurance

cover addiction

treatment?

We're ready to help

Find the best

drug or alcohol treatment

center

Are you or a loved one struggling with addiction? Call today to speak to a treatment expert.