Understanding the Real Cost of Recovery in Los Angeles

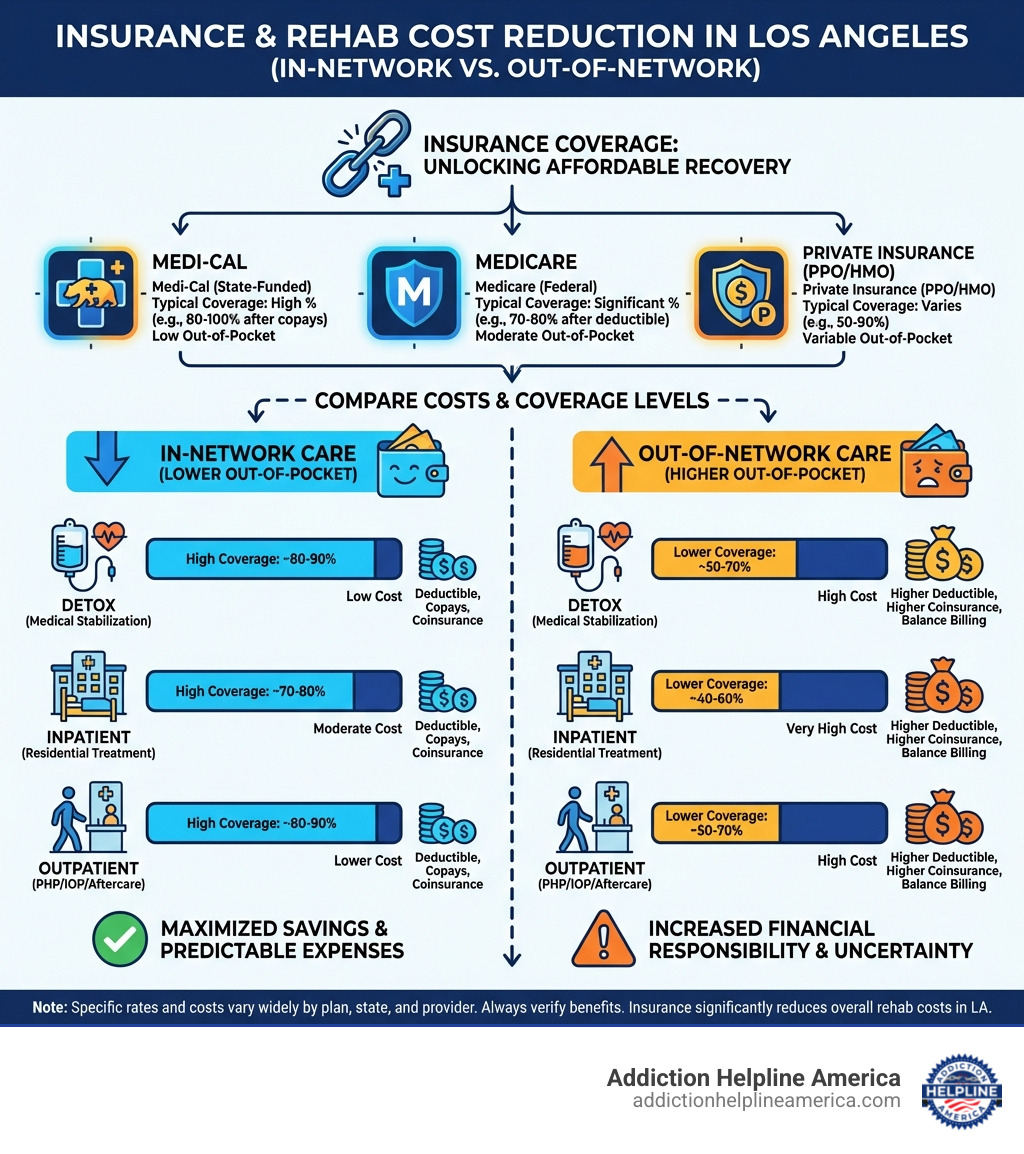

How Does Insurance Coverage Impact the Cost of Rehab in Los Angeles? Insurance can dramatically reduce what you pay for addiction treatment. Depending on the plan, it may cover a significant portion of the costs for medically necessary services after your deductible is met.

Key Ways Insurance Impacts Your Rehab Costs:

- In-Network Care – Lowest out-of-pocket costs, with insurance covering most expenses after deductibles

- Out-of-Network Care – Higher costs, with you paying a larger percentage

- Plan Type Matters – PPO, HMO, Medi-Cal, and Medicare each have different coverage levels

- Treatment Level – Detox, inpatient, and outpatient programs have different coverage rates

- Your Financial Responsibility – Deductibles, copays, and coinsurance determine what you actually pay

If you’re struggling with addiction in Los Angeles, the cost of treatment is a major concern. According to the 2021 National Survey on Drug Use and Health, 93.5% of people aged 12 or older with a substance use disorder did not receive any treatment, with cost and insurance barriers being significant factors.

The good news is that federal and state laws now require most insurance plans to cover addiction treatment as a medical condition. The Affordable Care Act and the Mental Health Parity and Addiction Equity Act have made rehab accessible to millions who couldn’t afford it before.

But navigating insurance can be confusing. “Understanding your plan’s coverage, costs, and network is critical when you’re already dealing with an overwhelming situation,” says Sarah Jenkins, a certified patient advocate. “Don’t be afraid to call your insurance provider or a helpline to get clear answers.”

In Southern California, where drug-related overdoses remain a serious public health issue according to the Los Angeles County Department of Public Health, getting help quickly is vital. Financial concerns shouldn’t be a barrier. Understanding how insurance works for rehab in Los Angeles helps you make informed decisions and access treatment faster.

The reality is that most major insurance plans now cover:

- Medical detox services

- Inpatient and residential treatment

- Outpatient programs (PHP and IOP)

- Medication-assisted treatment

- Dual diagnosis care for co-occurring mental health conditions

Your specific coverage depends on your plan, provider network, and level of care. Some people pay very little out-of-pocket, while others face deductibles and copays.

At Addiction Helpline America, we help people understand their insurance benefits and connect them with affordable treatment options in Los Angeles. Our free, confidential guidance removes the stress of financial uncertainty so you can start your recovery journey.

Understanding Insurance for Rehab in California: The Basics

Addiction, or substance use disorder (SUD), is a treatable medical condition, similar to other chronic diseases like diabetes or heart disease, as defined by the National Institute on Drug Abuse (NIDA). This recognition is crucial because it means health insurance coverage for SUD treatment is now mandated by law.

In California, key legislation ensures access to treatment. The Mental Health Parity and Addiction Equity Act (MHPAEA) of 2008 requires insurance plans to provide mental health and substance abuse benefits that are comparable to medical and surgical care. As explained by the Centers for Medicare & Medicaid Services (CMS), this means your plan can’t have stricter limits or higher costs for rehab than for physical health issues.

Additionally, the Affordable Care Act (ACA) expanded coverage by making mental and behavioral health treatment, including for SUD, one of the 10 essential health benefits. This means your insurance must provide some coverage for medically necessary SUD treatment. The ACA also forbids insurers from denying coverage for pre-existing conditions like substance misuse.

Insurance plans are generally either private or public.

- Private insurance is from an employer or a marketplace like Covered California. Common types include:

- HMOs (Health Maintenance Organizations): Usually require referrals and have lower premiums but less flexibility.

- PPOs (Preferred Provider Organizations): Offer more flexibility to see specialists without referrals, including out-of-network providers at a higher cost.

- EPOs (Exclusive Provider Organizations): A mix of HMO and PPO, they don’t require referrals but generally don’t cover out-of-network care.

- Public insurance includes government-funded programs:

- Medi-Cal: California’s Medicaid program for low-income individuals and families, covering a wide range of SUD services.

- Medicare: Federal insurance for people 65 or older and some with disabilities, which also covers addiction treatment.

- TRICARE: For service members, retirees, and their families, offering SUD treatment coverage.

According to the California Health Care Foundation, an estimated 9% of Californians age 12 and older had an SUD in the prior year, highlighting the widespread need for accessible care. Understanding these coverage options is the first step toward recovery. For a broader view of treatment options, explore our Guide to California Rehab Centers.

What Rehab Services Does Insurance Typically Cover in Los Angeles?

Thanks to federal and state mandates, most insurance plans cover a comprehensive range of medically necessary services for addiction treatment. According to a guide from the Substance Abuse and Mental Health Services Administration (SAMHSA), here’s a list of commonly covered services:

- Medical Detox: Medically supervised withdrawal is often the first step and is typically covered for patient safety.

- Inpatient/Residential Treatment: Provides 24/7 care in a structured setting. Coverage usually includes accommodation, therapy, and medical care.

- Outpatient Programs (PHP/IOP):

- Partial Hospitalization Programs (PHP): Offer intensive daytime therapy and medical monitoring.

- Intensive Outpatient Programs (IOP): Provide structured treatment with a more flexible schedule, allowing individuals to maintain work or family responsibilities.

- Medication-Assisted Treatment (MAT): Uses medications in combination with counseling to treat SUDs. Coverage is common due to its high effectiveness, as supported by SAMHSA.

- Dual Diagnosis Treatment: For individuals with co-occurring mental health conditions like depression or anxiety, insurance typically covers integrated programs that address both the addiction and mental health disorder simultaneously.

“The key term for insurance coverage is ‘medical necessity,'” notes Dr. David Chen, a clinical psychologist specializing in addiction. “This means a licensed healthcare provider has determined a specific level of care is required to treat your condition. Insurers use this determination to approve coverage for services like inpatient or outpatient care.”

Differences in coverage for inpatient vs. outpatient:

Insurance coverage differs based on the intensity of care. Inpatient programs have a higher overall cost but may receive significant coverage for acute cases. Outpatient programs are less expensive per day and also receive substantial coverage. Your insurance provider will evaluate the medical necessity of a particular level of care to determine what is covered. For information on local treatment options, you can consult resources like the Los Angeles County Addiction Treatment Center.

How Does Insurance Coverage Impact the Cost of Rehab in Los Angeles?

The central question for many is, “How Does Insurance Coverage Impact the Cost of Rehab in Los Angeles?” The answer is that insurance can transform a prohibitive expense into an affordable path to recovery. The extent of this impact depends on your plan, and particularly whether a facility is in-network or out-of-network.

Here’s a general comparison of how costs might look:

| Service Type | Estimated Cost (No Insurance) | Estimated Cost (In-Network, with Insurance) | Estimated Cost (Out-of-Network, with Insurance) |

|---|---|---|---|

| Medical Detox (7-10 days) | $3,000 – $10,000 | $500 – $2,000 (after deductible/copay) | $1,500 – $5,000+ (higher deductible/coinsurance) |

| 30-Day Inpatient Rehab | $15,000 – $30,000+ | $1,000 – $6,000 (after deductible/copay) | $5,000 – $15,000+ (higher coinsurance/less coverage) |

| 60-Day Inpatient Rehab | $30,000 – $60,000+ | $2,000 – $12,000 (after deductible/copay) | $10,000 – $30,000+ (higher coinsurance/less coverage) |

| 90-Day Inpatient Rehab | $45,000 – $90,000+ | $3,000 – $18,000 (after deductible/copay) | $15,000 – $45,000+ (higher coinsurance/less coverage) |

| Outpatient Programs (PHP/IOP) | $5,000 – $15,000 (per 3 months) | $500 – $3,000 (after deductible/copay) | $2,000 – $7,500+ (higher coinsurance/less coverage) |

| Individual Therapy (per session) | $100 – $250 | $10 – $50 (copay) | $50 – $150 (coinsurance after deductible) |

| Medication-Assisted Treatment | $500 – $1,500 (per month) | $20 – $100 (copay/coinsurance) | $100 – $500+ (higher coinsurance) |

Note: These are general estimates based on industry data from sources like the National Institute on Drug Abuse (NIDA). Actual costs and coverage will vary significantly based on your specific insurance plan, the facility, and the duration/intensity of treatment.

In-network facilities have a contract with your insurer, resulting in the lowest out-of-pocket costs. Your insurer covers a larger percentage, and your costs are limited to your deductible, copayments, and coinsurance.

Out-of-network facilities are more expensive. You’ll pay a higher percentage of the bill, face a larger deductible, and your plan may not cover the care at all.

Your financial responsibility is determined by your deductible (what you pay before insurance kicks in), copayments (fixed fees per service), and coinsurance (a percentage of the cost you pay). These terms are defined by Healthcare.gov. These costs are capped by your out-of-pocket maximum.

How to Verify Your Insurance and Estimate Your Rehab Costs

“How can individuals in Los Angeles verify their insurance coverage for rehab?” Here are the steps:

- Contact Your Insurance Provider: Call the number on your insurance card. Ask about coverage for substance use disorder, what’s covered (detox, inpatient, outpatient), your costs (deductible, copay), and any pre-authorization requirements.

- Review Your Policy Documents: Your Summary of Benefits and Coverage (SBC) outlines what your plan covers. Look for the section on “Mental Health and Substance Use Disorder Services.”

- Use a Confidential Verification Service: Addiction Helpline America offers a free, confidential insurance verification service. We contact your provider on your behalf to get all the details, saving you time and stress. For a comprehensive guide, refer to our Verify Rehab Insurance: Complete Guide.

What Factors Influence Your Final Out-of-Pocket Cost for Rehab in Los Angeles?

Even with insurance, several factors influence your final out-of-pocket cost:

- Level of Care Needed: More intensive care like detox and inpatient rehab costs more than outpatient programs. Coverage rates vary by medical necessity.

- Program Duration: Longer stays cost more. Extended treatment may require re-authorization from your insurer.

- Facility Location and Amenities: Costs can be higher in major cities like Los Angeles. Luxury amenities (private rooms, spas) are not considered medically necessary and are not covered by insurance, increasing your out-of-pocket expenses.

Understanding these variables helps you plan for your financial contribution. For insights into treatment effectiveness, consider the Success Rates of Rehab Centers in Los Angeles.

The Role of Federal and State Laws in Your Coverage

Federal and state laws are critical in determining how Does Insurance Coverage Impact the Cost of Rehab in Los Angeles.

The Affordable Care Act (ACA) was a game-changer, mandating that substance use disorders are among the Essential Health Benefits most health plans must cover. Key ACA protections include:

- Pre-existing conditions protection: Insurers cannot deny coverage or charge more for pre-existing conditions, including substance misuse.

- Substance use disorder coverage mandate: Most private plans and all marketplace plans must cover mental health and SUD services.

- Young adult coverage (up to age 26): Young adults can stay on a parent’s health plan, which is significant as this age group has the highest rates of SUD, according to data from SAMHSA.

The Mental Health Parity and Addiction Equity Act (MHPAEA) ensures that financial requirements and treatment limitations for mental health and SUD benefits are no more restrictive than those for medical benefits. It mandates equal coverage for mental and physical health, as enforced by government bodies like the U.S. Department of Labor.

These laws legally obligate your insurance to provide substantial coverage for rehab in California. For more data, visit KFF.org.

How Does the ACA Specifically Impact Insurance Coverage for Rehab in Los Angeles?

The ACA’s influence is particularly strong in California:

- Increased Access to Care: The ACA opened doors for millions in Los Angeles to seek treatment who previously couldn’t afford it.

- Medi-Cal Expansion: California expanded its Medicaid program (Medi-Cal), giving more low-income adults access to comprehensive SUD treatment, as detailed by the California Department of Health Care Services (DHCS).

- Covered California: This marketplace offers ACA-compliant plans with SUD coverage. Many LA residents qualify for subsidies to lower premium costs through CoveredCA.com.

- Free Preventive Screenings: The ACA covers many mental health and alcohol screenings at no cost, encouraging early intervention.

These provisions have made addiction treatment more accessible and affordable across Los Angeles. To dive deeper into insurance options, check out our More info about behavioral health insurance plans.

Navigating Your Insurance: Providers, Plans, and Denials

Navigating insurance providers and plans can be complex. While many major providers cover rehab in Los Angeles, the specifics vary by plan.

Common plan types include:

- HMO (Health Maintenance Organization): Lower premiums, but requires referrals and use of in-network providers.

- PPO (Preferred Provider Organization): More flexibility to see out-of-network providers (at a higher cost) without a referral.

- EPO (Exclusive Provider Organization): A hybrid that doesn’t require referrals but won’t cover out-of-network care.

When choosing a plan, always verify its mental health and substance use disorder benefits.

What steps should someone in Los Angeles take if their insurance denies coverage for rehab?

Despite legal mandates, denials can happen. “A denial is not the end of the road; it’s the start of a process,” says Maria Ortiz, a healthcare legal advocate. “You have a legal right to appeal the decision, and many appeals are successful, especially with documentation from your doctor.”

If your insurance denies coverage, you have rights and options:

- Understand the Reason for Denial: Your insurer must provide a written denial explaining why. Common reasons include lack of medical necessity or using an out-of-network provider.

- File an Internal Appeal: Submit a written appeal to your insurance company with supporting letters from your doctor explaining why treatment is medically necessary.

- Request an External Review: If the internal appeal fails, you can request an independent review. In California, this is handled by the Department of Managed Health Care (DMHC) or the California Department of Insurance (CDI), and their decision is legally binding.

- Seek Advocacy: A rehab facility’s admissions team or a patient advocate can assist with the appeals process. Our team at Addiction Helpline America is also here to help.

Persistence is key. Your right to treatment is protected by law. For more information, explore resources like our page on Does Blue Cross Blue Shield Cover Drug & Alcohol Rehab?.

Frequently Asked Questions about Rehab Insurance in Los Angeles

Here are answers to common questions about using insurance for rehab in Los Angeles.

Can I go to rehab in Los Angeles without insurance?

Yes. A lack of insurance should not stop you from seeking life-saving treatment. Options include:

- State-funded programs: California offers low-cost or free treatment based on eligibility through the Department of Health Care Services (DHCS).

- Sliding-scale fees: Many facilities adjust costs based on your income.

- Private financing: This can include personal loans or payment plans offered by the facility.

- Non-profit options: Organizations like the Salvation Army provide free, often faith-based, programs.

- SAMHSA Grants: Find state-funded programs via the SAMHSA treatment locator.

Don’t let the absence of insurance stop you from exploring these avenues.

How many times will my insurance pay for rehab?

This depends on your specific plan and the concept of medical necessity.

- Medical Necessity: Insurers typically cover treatment as long as it’s deemed medically necessary. Since addiction is a chronic, relapsing disease, as defined by the National Institute on Drug Abuse (NIDA), subsequent treatment episodes are often covered if a doctor determines they are required.

- Plan Limits: Some older, non-compliant plans may have annual or lifetime limits on benefits. It’s crucial to check your specific policy for these details.

“Because addiction is a chronic condition, relapse can be part of the recovery process for some. Most modern, compliant insurance plans understand this and will cover multiple treatment episodes as long as they are medically justified,” explains Michael Carter, an admissions director at a California treatment center. Always verify with your provider.

Does insurance cover higher-end or luxury rehabs in Los Angeles?

Insurance may offer partial coverage, but it’s important to distinguish between medical care and amenities.

- Partial Coverage is Possible: Your insurance will cover the medically necessary components of treatment, such as detox and therapy, regardless of the facility type.

- Amenities Aren’t Covered: Insurance does not pay for luxury perks like private rooms, gourmet meals, spa services, or other non-clinical amenities.

- Out-of-Pocket Costs: You will be responsible for paying for all non-clinical, luxury services yourself.

While insurance can help make a luxury rehab more affordable by covering clinical services, be prepared for significant out-of-pocket expenses. For an overview of options, look into resources like Rehab in Los Angeles.

Conclusion: Your Path to Affordable Recovery in Los Angeles

Understanding how Does Insurance Coverage Impact the Cost of Rehab in Los Angeles is a key step toward healing. Laws like the ACA and MHPAEA have made treatment more accessible, requiring most insurance plans to cover these vital services. Cost should not be a barrier to seeking help.

Most plans—whether private, Medi-Cal, or Medicare—cover a range of services from detox to outpatient care. Choosing an in-network facility and understanding your benefits will dramatically reduce your financial burden. Even without insurance, options like state-funded programs and sliding-scale fees exist to ensure everyone has a path to recovery.

“Recovery is an investment in your future, and it’s more accessible than many people think,” says a representative from Addiction Helpline America. “The most important step is the first one: reaching out for help. We can help you navigate the financial questions so you can focus on healing.”

Addiction Helpline America is dedicated to helping you steer this landscape. We offer free, confidential guidance to connect you with the right recovery program that fits your needs and insurance coverage in Los Angeles. Don’t let financial concerns delay your journey to a healthier life.

Your recovery is an investment in your future. Let us help you take that first step. Find the right recovery program with our help. Visit our behavioral health insurance plans guide or call us today to learn more.

Our helpline is 100%

free & confidential

If you or someone you care about is struggling with drug or alcohol addiction, we can help you explore your recovery options. Don’t face this challenge alone—seek support from us.

Programs

Resources

Will my insurance

cover addiction

treatment?

We're ready to help

Find the best

drug or alcohol treatment

center

Are you or a loved one struggling with addiction? Call today to speak to a treatment expert.