Understanding Substance Abuse Insurance: Your Questions Answered

Substance abuse insurance is health coverage that helps pay for drug and alcohol addiction treatment, including detox, rehab, and therapy. Here’s what you need to know:

Quick Insurance Coverage Facts:

- Most plans cover treatment: In 2021, over 91% of Americans had health insurance, and federal laws mandate that most plans include substance abuse benefits (Source: KFF).

- Federal law protects you: The Mental Health Parity and Addiction Equity Act (MHPAEA) requires equal coverage for addiction and physical health conditions.

- No pre-existing condition denials: The Affordable Care Act (ACA) prevents insurers from denying coverage for substance use disorders.

- Multiple treatment types covered: Medical detox, inpatient rehab, outpatient programs, therapy, and medications.

- Your privacy is protected: Federal laws like HIPAA and 42 CFR Part 2 prevent your employer from accessing your treatment details without your consent.

Common Coverage Includes:

- Medical detoxification

- Inpatient/residential treatment

- Outpatient programs (IOP, PHP)

- Medication-assisted treatment (MAT)

- Individual and group therapy

- Dual diagnosis treatment

Navigating insurance for addiction treatment can feel overwhelming, especially during a crisis. The good news is that most health plans are required by law to cover substance use disorder treatment just like any other medical condition.

“The passage of laws like the ACA and MHPAEA was a monumental step forward,” states Dr. Alaina Ross, a public health policy expert. “They transformed the landscape by treating addiction as the healthcare issue it is, removing discriminatory barriers and opening doors to recovery for millions who were previously shut out.”

While many people delay getting help due to confusion about coverage or costs, treatment is almost always more affordable than active addiction. At Addiction Helpline America, we help individuals and families use their insurance benefits to access life-saving treatment. Our free, confidential service connects you with the resources you need to understand your coverage and start recovery.

Understanding Your Substance Abuse Insurance Policy

To understand your substance abuse insurance coverage, grasp some key terms that directly impact your out-of-pocket costs.

- Deductible: The amount you must pay for covered services before your insurance plan begins to pay. For example, with a $2,000 deductible, you pay the first $2,000 of treatment costs.

- Copayment (Copay): A fixed amount (e.g., $30) you pay for a covered service, like a therapy session, after meeting your deductible.

- Coinsurance: Your share of the cost for a service, calculated as a percentage (e.g., 20%) after your deductible is met. If your plan covers 80%, your coinsurance is 20%.

- In-network vs. Out-of-network:

- In-network providers have a contract with your insurer for negotiated rates, resulting in lower costs for you.

- Out-of-network providers do not have a contract with your insurer. Using them may lead to higher costs or no coverage at all, except in emergencies.

- Pre-authorization (or Prior Authorization): A requirement from your insurer to approve a service as medically necessary before you receive it. Many inpatient services require pre-authorization to be covered, and without it, your claim may be denied.

“Understanding these terms is the first step in financially preparing for treatment,” advises financial advocate Mark Chen. “So many families are hit with unexpected bills because they didn’t clarify their deductible or confirm a provider was in-network. A five-minute call can save you thousands.”

Understanding these terms is crucial for managing the costs of addiction treatment. For more details, you can refer to resources like this PDF from CMS on health insurance terms.

Common Types of Healthcare Plans

Your health plan type affects how your substance abuse insurance works. The three most common are HMO, PPO, and POS plans.

- Health Maintenance Organization (HMO): HMOs usually require you to use providers within their network and get a referral from your primary care provider (PCP) for specialists, including addiction treatment. Costs are lower when you stay in-network.

- Preferred Provider Organization (PPO): PPOs offer more flexibility, allowing you to see in-network and out-of-network providers without a referral. However, your costs will be significantly higher for out-of-network care.

- Point of Service (POS): POS plans are a hybrid of HMOs and PPOs. You typically choose a PCP for referrals to stay in-network and pay less, but you have the option to go out-of-network for a higher cost.

We at Addiction Helpline America can help you understand the nuances of your specific plan. Learn more about insurance coverage for rehab at Addiction Helpline America.

What if I Have Multiple Insurance Providers?

Having more than one health insurance policy triggers a process called “coordination of benefits.” One plan is designated the primary payer and the other the secondary payer. The primary plan pays first, and the secondary plan may cover some or all of the remaining costs.

Common scenarios include:

- Marriage: If you and your spouse are on each other’s plans, your own plan is typically primary.

- Under 26: If you’re on a parent’s plan and have your own through an employer, your employer’s plan is primary.

- Medicare: If you have Medicare and other insurance (like from an employer), which plan is primary depends on specific circumstances detailed by Medicare.

Inform all providers about your multiple plans to ensure claims are processed correctly and your costs for substance abuse insurance are minimized.

What’s Covered? Key Laws and Protections

Landmark legislation has shaped substance abuse insurance to ensure fair access to treatment, mandating that insurers provide coverage comparable to that for physical health conditions.

The Mental Health Parity and Addiction Equity Act (MHPAEA) of 2008 is a cornerstone protection. This law requires health plans to provide mental health and substance use disorder benefits that are comparable to medical/surgical benefits. It prevents stricter limits on:

- Deductibles

- Copayments

- Coinsurance

- Out-of-pocket maximums

- Treatment limitations (e.g., number of visits)

“MHPAEA is fundamentally a civil rights law,” explains healthcare legal expert Sarah Jenkins, JD. “It says that an illness in the brain must be covered the same way as an illness in the body. This has been critical in forcing insurance companies to approve necessary, evidence-based care for addiction.”

Patient confidentiality is also protected by the 42 Code of Federal Regulations (CFR) Part 2. This regulation provides stricter privacy protections for substance use disorder records than HIPAA, requiring your explicit written consent before your treatment information can be shared, especially with employers (Source: SAMHSA).

These laws remove barriers to care, making it safer to seek treatment. For more details, explore resources like More on the Parity Law from the APA.

How the ACA Impacts Substance Abuse Insurance Coverage

The Affordable Care Act (ACA) of 2010 significantly expanded substance abuse insurance coverage. A key ACA provision mandates that most health plans cover 10 Essential Health Benefits (EHBs), which explicitly include mental health and substance use disorder services. This ensures that Marketplace plans and most small group plans cover addiction treatment.

The 10 Essential Health Benefits include:

- Ambulatory patient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative and habilitative services and devices

- Laboratory services

- Preventive and wellness services

- Pediatric services, including oral and vision care

This mandate, combined with MHPAEA, prohibits insurers from denying coverage based on pre-existing conditions like a substance use disorder. The ACA has broadened treatment options, giving millions of Americans new or expanded access to substance abuse treatment. We recommend visiting Healthcare.gov for more health benefits & coverage information.

What Specific Services and Costs Are Typically Covered?

Thanks to laws like the ACA and MHPAEA, most evidence-based addiction treatment services are covered by substance abuse insurance.

Typically covered services include:

- Medical Detoxification: Safely managing withdrawal symptoms under medical supervision. This is almost always covered when medically necessary.

- Inpatient/Residential Rehab: Living at a treatment facility for intensive, structured care (e.g., 30-90 days). Coverage is common, but the length of stay may require ongoing approval.

- Outpatient Programs (PHP, IOP): Partial Hospitalization (PHP) and Intensive Outpatient (IOP) programs offer structured therapy with more flexibility than inpatient care and are widely covered.

- Medication-Assisted Treatment (MAT): Combines therapy and medications (like buprenorphine or naltrexone) to treat substance use disorders. As an evidence-based practice, MAT is increasingly covered.

- Dual Diagnosis Treatment: Addresses co-occurring substance use and mental health disorders (e.g., depression, anxiety) simultaneously. Parity laws ensure this integrated care is covered.

- Therapy and Counseling: Individual, group, and family therapy are fundamental to recovery and are generally covered.

Be aware of potential costs that may not be fully covered:

- Luxury Amenities: Private rooms or non-essential amenities may incur extra charges.

- Alternative Therapies: Treatments like acupuncture or massage may not be deemed “medically necessary” and might not be covered.

- Travel Expenses: Costs for travel to and from a facility are typically not covered.

Always verify the specifics of your plan with your insurance provider or with us at Addiction Helpline America.

How to Verify and Use Your Insurance for Rehab

Verifying your substance abuse insurance coverage is the critical first step to accessing treatment and avoiding unexpected costs.

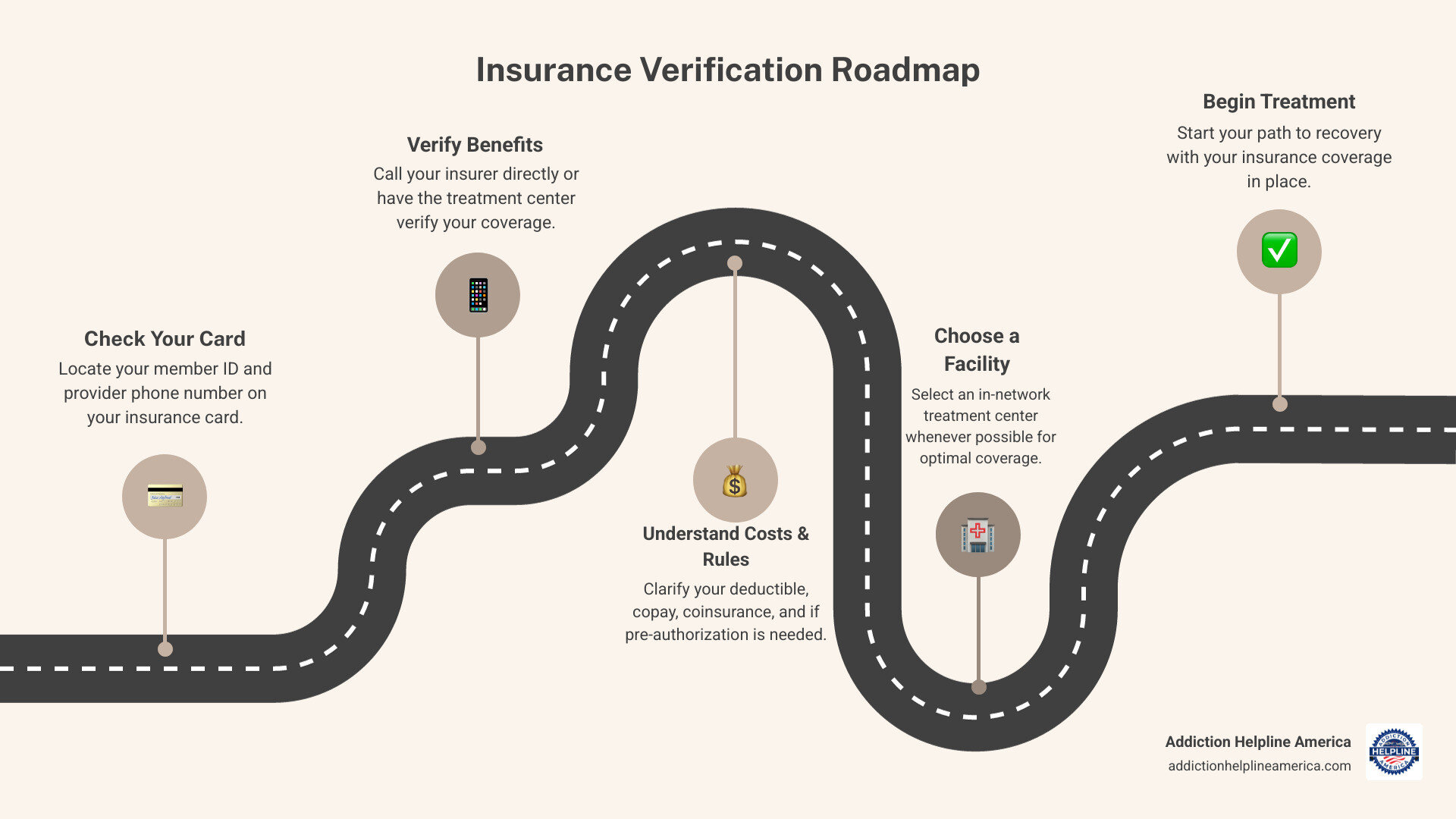

Here’s a step-by-step guide to verifying your insurance:

- Locate Your Insurance Information: Find your insurance card for your member ID, group number, and the customer service phone number.

- Contact Your Insurance Provider: Call the number on your card and ask specific questions about your substance use disorder benefits, including your deductible, copay/coinsurance rates, pre-authorization requirements, and a list of in-network facilities.

- Use a Treatment Center’s Verification Service: Many treatment centers, including those in our network, offer a free, confidential insurance verification service. Their admissions team will contact your insurer on your behalf, simplifying the process.

“Never assume what’s covered,” says Maria Flores, an admissions director with 15 years of experience. “I’ve seen policies that cover 30 days of inpatient care with no questions asked, and others that require daily clinical reviews to approve the next 24 hours. You must call and ask the specific questions for your exact plan to know where you stand.”

Key Questions to Ask About Your Substance Abuse Insurance

When speaking with your insurer or a treatment center, ask these questions to understand your costs and coverage:

- Is this facility/provider in-network with my plan?

- What is my deductible, and how much of it have I met this year?

- What are my copay/coinsurance rates for different levels of care (e.g., detox, inpatient, outpatient therapy)?

- Is pre-authorization required for the treatment I’m seeking?

- What is my out-of-pocket maximum for the year?

- Are there any limitations on the number of days or sessions covered?

- Does my plan cover medication-assisted treatment (MAT) and the associated medications?

- What is the process for appeals if a claim is denied?

We understand this can be overwhelming. That’s why we’re here to help. You can verify your benefits with our help at Addiction Helpline America. We’ll connect you with centers that understand your coverage.

Public Insurance and Other Financial Aid Options

If you lack private insurance or your plan is insufficient, government-funded programs and other financial aid can help you access treatment. Financial barriers should not stop you from getting help.

Medicare and Medicaid for Addiction Treatment

Medicare is a federal program for people 65 or older, some younger people with disabilities, and those with End-Stage Renal Disease. It covers a range of substance use disorder treatment services:

- Medicare Part A (Hospital Insurance): Covers inpatient hospital care for addiction treatment, including room, board, and nursing services.

- Medicare Part B (Medical Insurance): Covers outpatient services like therapy (individual and group), IOPs, PHPs, and services from behavioral health professionals.

- Medicare Part D (Prescription Drug Coverage): Covers many prescription drugs used in addiction treatment, including medications for opioid use disorder (MOUD).

For more details, visit Medicare.gov’s coverage details for substance use disorders.

Medicaid is a joint federal and state program providing health coverage for people with limited income. Thanks to the ACA, Medicaid now covers a wide range of substance abuse insurance services, though benefits vary by state. Services often include detoxification, rehab, MAT, and counseling. Those eligible for both Medicare and Medicaid (“dual eligibility”) may have very comprehensive coverage. To learn more, call your State Medical Assistance (Medicaid) office. For more on Medicare and Medicaid, see our pages on Medicare Insurance Coverage for Rehab and Medicaid Insurance Coverage for Rehab.

“Public resources are the safety net of our healthcare system,” says David Lee, director of a community health initiative. “State-funded programs, Medicaid, and community health centers exist for one reason: to provide care to those who need it, regardless of their financial situation. Don’t be afraid to ask for help—these programs are there for you.”

What If I Don’t Have Insurance?

The absence of substance abuse insurance should not be a barrier to treatment. Numerous options are available:

- State-Funded Programs: Many states provide free or low-cost treatment programs for residents who meet certain eligibility criteria.

- SAMHSA Grants and Resources: The Substance Abuse and Mental Health Services Administration (SAMHSA) provides grants to expand treatment access and offers a national helpline and treatment locator at FindTreatment.gov to find low-cost options.

- Community Health Centers: These centers often provide care on a sliding-scale fee basis, adjusting costs based on your income. You can find a health center near you.

- Treatment Center Scholarships: Some private facilities offer scholarships or financial aid to individuals who cannot afford the full cost.

- Payment Plans and Loans: Many centers offer payment plans, and specialized healthcare loans are also available.

- Free Rehab Programs: Non-profit, religious, or community groups may offer free treatment services.

Be open about your financial situation with providers; they can help you explore all available options.

Frequently Asked Questions about Substance Abuse Insurance

Does insurance cover medications for addiction treatment?

Yes, most substance abuse insurance plans cover medications for addiction treatment, which are considered a vital, evidence-based practice by leading health organizations like the National Institute on Drug Abuse.

- Withdrawal Management: Medications to ease withdrawal symptoms during detox are generally covered as part of a medical detox program.

- Medication-Assisted Treatment (MAT): Medications like buprenorphine (Suboxone), naltrexone, and methadone are crucial for treating opioid and alcohol use disorders. Most private plans, as well as Medicare and Medicaid, cover MAT, though specific rules and prior authorization may apply.

Always check your plan’s specific formulary and requirements. SAMHSA provides guidance on knowing what your insurance covers for treatment.

Is my treatment confidential if I use my employer’s insurance?

Yes, your treatment is confidential. Federal laws, including HIPAA and the even stricter 42 CFR Part 2, protect your privacy. These regulations prevent your employer from accessing specific information about your diagnosis or treatment without your explicit written consent (Source: SAMHSA). This is designed to allow you to seek help without fear of stigma or job discrimination.

What is dual diagnosis treatment and is it covered?

Dual diagnosis treatment is the integrated care for a substance use disorder (SUD) and a co-occurring mental health condition like depression or anxiety. Addressing both simultaneously is critical for lasting recovery.

“Treating addiction without addressing the underlying anxiety or depression is like mopping the floor while the sink is still overflowing,” says Dr. Emily Carter, a psychiatrist specializing in addiction. “Effective, lasting recovery depends on integrated dual diagnosis care. It’s the standard of care for a reason, and parity laws ensure it’s covered.”

Yes, dual diagnosis treatment is generally covered by substance abuse insurance. The Mental Health Parity and Addiction Equity Act (MHPAEA) mandates that insurers provide coverage for mental health and substance use disorders that is comparable to coverage for physical health conditions. This legal framework ensures that individuals with a dual diagnosis can receive comprehensive, integrated care without facing discriminatory coverage practices.

Your Path to Recovery Starts Here

Navigating substance abuse insurance can be complex, but it’s a powerful tool for accessing affordable, life-saving treatment. Federal laws ensure most health plans cover addiction treatment similarly to physical health conditions.

“The hardest step is often the first one: asking for help,” says Jameson Reed, a Certified Recovery Coach. “Don’t let insurance paperwork be the barrier that stops you. There are people and resources ready to help you through it. Your future is worth that first call.”

Don’t let confusion or cost concerns delay getting help. The investment in recovery is far less than the cost of addiction, and many financial resources are available, even without private insurance.

At Addiction Helpline America, we are dedicated to helping you understand your options. Our free, confidential service is available 24/7 to provide personalized guidance, verify your insurance benefits, and connect you with a trusted treatment center in our network that accepts your substance abuse insurance. Your path to recovery starts with a single step, and we’re here to guide you every step of the way.

Our helpline is 100%

free & confidential

If you or someone you care about is struggling with drug or alcohol addiction, we can help you explore your recovery options. Don’t face this challenge alone—seek support from us.

Programs

Resources

Will my insurance

cover addiction

treatment?

We're ready to help

Find the best

drug or alcohol treatment

center

Are you or a loved one struggling with addiction? Call today to speak to a treatment expert.