Why Understanding Your Insurance Coverage is Essential Before Starting Treatment

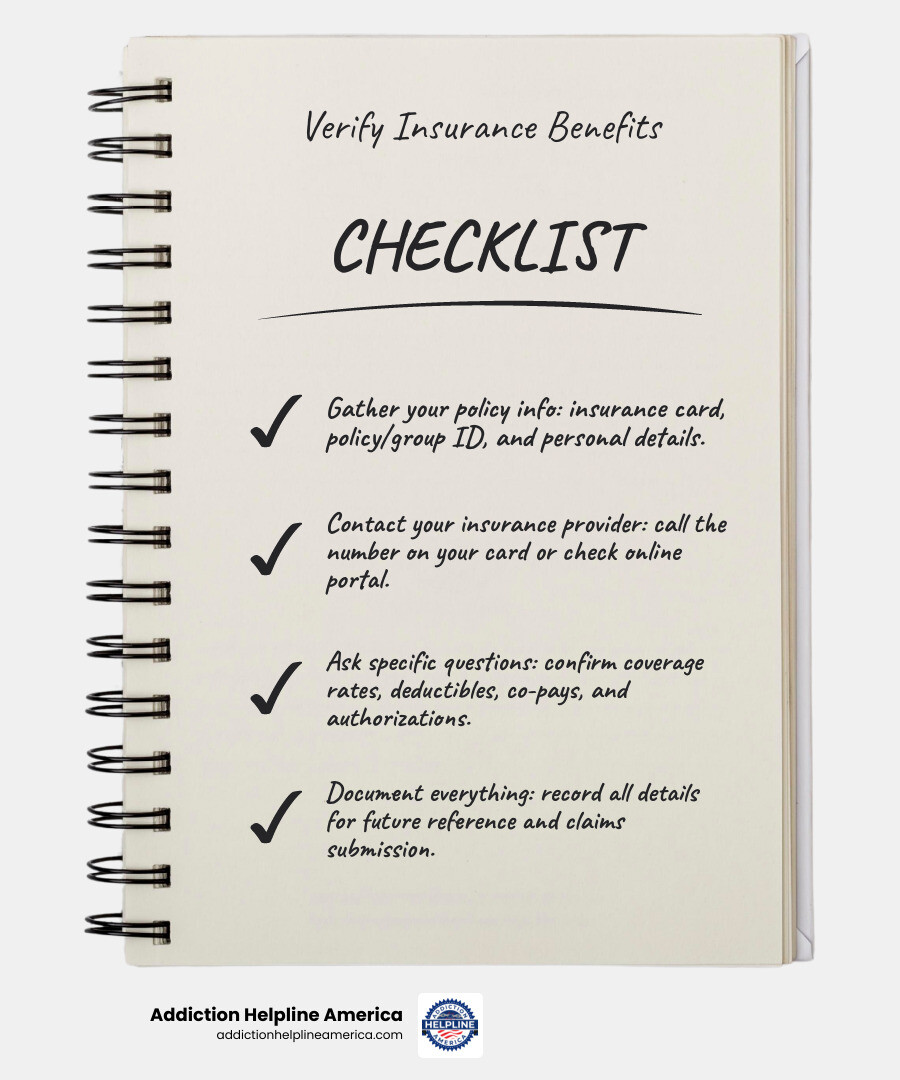

Verify insurance benefits by following these four key steps:

- Gather your policy information – Collect your insurance card, policy number, group ID, and personal details

- Contact your insurance provider – Call the number on your card or check their online portal

- Ask specific questions – Confirm coverage rates, deductibles, co-pays, authorization requirements, and in-network providers

- Document everything – Record all details for future reference and claims submission

Remember the game of telephone? A simple message gets passed around, and by the end, “I need help with treatment” might sound like “I don’t know about payment.” The same confusion happens when trying to verify insurance benefits for addiction treatment. You might hear one thing from a friend, another from a website, and something completely different from your insurance company. This uncertainty can feel overwhelming when you or a loved one desperately needs help.

The truth is simpler than it seems. Most health insurance plans do cover addiction treatment—but the details matter. Without verifying your benefits upfront, you risk surprise bills for denied claims that, according to the Center for American Progress, can range from hundreds to tens of thousands of dollars. Even worse, the fear of unknown costs might delay getting the help you need. As HHS Assistant Secretary for Mental Health and Substance Use, Miriam E. Delphin-Rittmon, has stated, ensuring all Americans have access to life-saving care is a top priority, and understanding your insurance is a key part of that access.

Verifying your insurance doesn’t have to be complicated. Whether you have private insurance, Medicare, Medicaid, or VA benefits, understanding your coverage gives you financial peace of mind and removes a major barrier to recovery. When you know exactly what’s covered—from detox to counseling to medication-assisted treatment—you can focus on healing instead of worrying about bills.

At Addiction Helpline America, we’ve helped thousands of individuals and families steer the often-confusing process to verify insurance benefits for rehab services, providing free and confidential support to remove barriers to treatment. Our team understands that taking this first step can feel daunting, which is why we’re here to guide you through every question about your coverage and connect you with the right care options.

Why Verifying Your Insurance is the Crucial First Step to Recovery

Insurance eligibility verification is the essential process of confirming your active insurance coverage and understanding your benefits before receiving healthcare services. For anyone seeking addiction or mental health treatment, this step is not just administrative; it’s foundational to your recovery journey. It ensures that when you walk through the doors of a treatment center, you have financial peace of mind, allowing you to fully focus on healing.

Imagine starting on the profound journey of recovery, only to be hit with an unexpected bill for services you thought were covered. This is the nightmare of a “surprise bill,” a common consequence when insurance benefits aren’t properly verified. These surprise denials can be incredibly costly, with some unexpected medical bills reaching into the tens of thousands of dollars. This financial burden can be a significant setback, not just for individuals but also for the healthcare providers who deliver care. When providers accurately verify your insurance, they are better equipped to ensure accurate billing and minimize these costly claim denials, which ultimately improves your overall patient experience by removing financial stress.

The Importance of Financial Transparency in Treatment

One of the most valuable outcomes of verifying your insurance benefits is achieving financial transparency. This means you have a clear understanding of your financial responsibilities before treatment even begins. Knowing your co-pays, deductibles, and what your plan truly covers allows you to budget for your recovery journey without the added stress of financial unknowns.

The Maryland Insurance Administration emphasizes the importance of understanding your financial responsibility before seeing a healthcare professional, and this couldn’t be more true for addiction treatment. When you’re transparent about your financial obligations, you can make informed decisions about your care, choose a program that fits your budget, and ultimately, dedicate all your energy to healing. This proactive approach helps reduce anxiety and allows you to concentrate on what matters most: getting well.

How Accurate Verification Prevents Costly Claim Denials

Accurate insurance verification is your shield against claim denials. It’s about more than just knowing you have “insurance”; it’s about understanding the nuances of your specific plan.

Here’s how it works:

- Confirm Active Coverage: This ensures your insurance policy is valid and active at the time you receive services. An inactive policy is a guaranteed denial.

- Understand Benefit Details: This involves identifying precisely what services are covered, what your co-pay or coinsurance amounts will be, what your deductible is, and your out-of-pocket limits. Without this, you might unknowingly receive services not covered by your plan.

- Address Authorization Issues: Many addiction treatment services, especially inpatient programs, require pre-authorizations from your insurance company. If these aren’t obtained beforehand, claims will likely be denied. By verifying benefits, we can identify these requirements and ensure they are met.

- In-Network vs. Out-of-Network: Knowing if a treatment provider is in-network with your plan is critical. Out-of-network services often come with significantly higher costs or may not be covered at all.

- Ensuring a Smooth Payment Process: By taking these steps, you and your chosen treatment center can submit accurate claims, leading to a smoother payment process and allowing you to avoid the headache of appeals and delayed revenue.

For healthcare providers, this process is equally crucial. As the Healthcare Financial Management Association (HFMA) notes, front-end revenue cycle processes like eligibility verification are critical for preventing denials and ensuring financial stability. This translates directly to fewer administrative burdens and a better experience for you, the patient.

A Step-by-Step Guide to Manually Verify Insurance Benefits

While automated systems are becoming more common for healthcare providers, for individuals, manually verifying your insurance benefits is still a crucial skill. According to the American Medical Association, tasks like prior authorization represent a significant and growing administrative burden for healthcare staff, making the process time-consuming. But with a little patience and persistence, you can get the answers you need.

The most common way to contact payers is often over the phone, which can feel like an endless game of “payer phone tag.” However, many insurance companies also offer online portals that can provide some of the information you need.

Step 1: Gather Your Policy Information

Before you contact your insurance provider, have all your essential information ready. This will make the process much smoother and prevent multiple calls or searches. You’ll need:

- Your Insurance Card: This little card is packed with vital details.

- Policy Number (or Member ID): This unique identifier links you to your specific insurance plan.

- Group Number (if applicable): Often used for employer-sponsored plans.

- Your Full Name and Date of Birth: For identification purposes.

- The Policyholder’s Full Name and Date of Birth: If you are covered under someone else’s plan (e.g., a parent or spouse).

- Secondary Insurance Information: If you have more than one insurance plan, gather details for both.

Step 2: Contact Your Insurance Provider

Once you have your information, it’s time to reach out.

- Call the Member Services Number: This is typically found on the back of your insurance card. Be prepared for potential hold times. When you connect, clarify that you want to verify benefits for addiction or mental health treatment.

- Use Payer Websites/Portals: Many insurance companies offer online portals where you can log in to view your benefits, deductible status, and sometimes even get estimates for common services. Major carriers like Humana, United Healthcare, Aetna, and Cigna often have dedicated sections for members to check their benefits.

- Document Everything: Whether you’re on the phone or using a portal, write down the date, time, the name of the representative you spoke with, and every detail they provide. This documentation is invaluable if any discrepancies arise later.

Step 3: Ask the Right Questions to Verify Insurance Benefits

Having a checklist of questions is key to ensuring you get all the necessary information. Don’t be afraid to ask for clarification, even if it feels like you’re asking the same thing multiple ways.

Here’s a list of crucial questions to ask (and verify!):

- Is my policy active, and what are its effective dates?

- What is my remaining deductible for the current policy year? (And what is the total deductible amount?)

- What is my co-pay or coinsurance amount for addiction and mental health services? Specify for different levels of care, such as inpatient vs. outpatient rehab.

- What is my out-of-pocket maximum for the current policy year, and how much have I met?

- Are addiction and mental health treatments covered under my plan? Be specific:

- Does it cover inpatient mental health treatment?

- Does it cover outpatient mental health treatment?

- Is opioid use treatment covered, including medication-assisted treatment (MAT)?

- Is alcohol misuse counseling covered?

- Are detox services covered?

- What about specific therapies (e.g., individual therapy, group therapy, family therapy)?

- Are pre-authorizations required for any of these services? If so, what is the process, and what information is needed?

- Are there any annual limits on the number of days or sessions covered for addiction and mental health treatment?

- Do I need a referral from a primary care physician?

- Which providers or facilities are in-network for addiction treatment? This is crucial, as using out-of-network providers can significantly increase your costs.

- What is the claims address for submitting bills?

By diligently asking these questions, you’ll gain a comprehensive understanding of your benefits, helping you avoid unexpected costs and focus on your recovery.

Understanding Your Coverage: Key Terms and Common Plans

Navigating insurance can sometimes feel like learning a new language. But don’t worry, we’re here to help you decode the jargon so you can understand your policy details with confidence.

Decoding Common Insurance Terminology

Understanding these terms is fundamental to verifying your insurance benefits and knowing your financial responsibility:

- Deductible: This is the amount you must pay out-of-pocket for covered healthcare services before your insurance plan starts to pay. For example, if your deductible is $2,000, you’ll pay the first $2,000 of covered services yourself.

- Co-pay (or Copayment): A fixed amount you pay for a covered healthcare service after you’ve paid your deductible. For instance, a $30 co-pay for a doctor’s visit or therapy session.

- Coinsurance: Your share of the costs of a healthcare service, calculated as a percentage of the allowed amount for the service. For example, if your plan’s coinsurance is 20%, you pay 20% of the cost after your deductible, and your insurance pays 80%.

- Out-of-Pocket Limit (or Maximum): This is the most you’ll have to pay for covered services in a plan year. Once you reach this limit, your insurance plan pays 100% of the costs for covered benefits. This limit protects you from very high medical expenses.

- Premium: The amount you pay for your health insurance coverage each month.

These terms define how much you might have to pay for treatment. For more insights into these costs, you can refer to official government resources like Healthcare.gov, which explains health insurance costs and terminology in detail.

Navigating Different Types of Health Insurance Plans

The type of health insurance plan you have will significantly impact how you access care and how your benefits are applied. While there are many variations, here are some common types:

- HMO (Health Maintenance Organization): Typically requires you to choose a primary care provider (PCP) within the network who then refers you to specialists. Out-of-network care is usually not covered, except in emergencies.

- PPO (Preferred Provider Organization): Offers more flexibility. You don’t need a PCP referral to see specialists and can go out-of-network, though you’ll pay more for out-of-network services.

- EPO (Exclusive Provider Organization): Similar to an HMO in that it only covers in-network care, but you usually don’t need a PCP referral to see specialists.

- POS (Point of Service): A hybrid plan that combines elements of HMOs and PPOs. You might need a referral for in-network care but can go out-of-network for a higher cost.

Understanding your specific plan, especially whether a provider is “in-network” or “out-of-network,” is critical for managing costs. Our Behavioral Health Insurance Plans Guide offers more detailed information on how these plans apply to mental health and addiction treatment.

What Types of Treatment Will My Insurance Cover?

Most health insurance plans cover treatment for addiction and mental health, but the specifics can vary widely. Coverage often depends on the “medical necessity” of the treatment and the level of care required. It’s important to know your rights to coverage, as federal laws like the Mental Health Parity and Addiction Equity Act (MHPAEA) mandate that most health plans provide comparable benefits for mental health and substance use disorders as they do for medical and surgical care. We offer comprehensive rehab programs and can help you understand what your plan covers.

Coverage for Specific Addiction and Mental Health Services

When you verify insurance benefits, you’ll want to ask about coverage for these specific types of services:

- Inpatient Treatment: This involves staying overnight at a treatment facility for comprehensive care. Your insurance may cover inpatient mental health treatment, which can include medical supervision, therapy, and support groups.

- Outpatient Programs: These programs allow you to live at home while attending treatment sessions during the day or evening. This includes various levels, such as Partial Hospitalization Programs (PHPs) and Intensive Outpatient Programs (IOPs). Insurance often covers outpatient mental health treatment.

- Detox Services: Medically supervised detoxification helps manage withdrawal symptoms safely. This is often a crucial first step in addiction recovery and is typically covered if deemed medically necessary.

- Counseling and Therapy: Individual, group, and family therapy sessions are fundamental to addiction and mental health treatment. Coverage usually extends to various forms of counseling, including alcohol misuse counseling.

- Medication-Assisted Treatment (MAT): This combines medication with counseling and behavioral therapies for substance use disorders, particularly opioid use treatment. MAT is recognized as an effective approach and is increasingly covered by insurance plans.

Verifying Benefits with Government-Funded Plans

If you have a government-funded health plan, your coverage for addiction and mental health treatment will also have specific guidelines:

- Medicare: In most cases, Medicare will cover the majority of your treatment costs for mental health and substance use disorders. This includes inpatient and outpatient services, doctor visits, and prescription medications. You can find more detailed information on Medicare and your mental health benefits.

- Medicaid and CHIP (Children’s Health Insurance Program): These programs offer coverage for mental health, drug, and alcohol use treatment. However, the extent of coverage and the types of services paid for can depend significantly on the state you live in, as detailed by Medicaid.gov.

- VA Health Care: If you’re a Veteran, you can access comprehensive care for drug and alcohol use and mental health conditions through VA Health Care, even if you’re not currently enrolled.

- TRICARE: This health care program for uniformed service members, retirees, and their families covers mental health, drug, and alcohol misuse programs. You’ll need to check your specific TRICARE coverage details by calling the number on the back of your card or looking online.

Each of these plans has unique rules and benefits, so verify your specific coverage directly with them.

Let Us Help You Verify Insurance Benefits and Find Treatment

We understand that the process of verifying insurance benefits and finding the right treatment can feel overwhelming, especially when you or a loved one is already struggling. The good news is, you don’t have to steer this complex system alone. At Addiction Helpline America, we’re dedicated to providing free, confidential, and personalized guidance to connect you with the recovery program that fits your needs.

Simplify Your Journey to Recovery

Our team of experts is here to simplify your journey. We offer:

- No-Cost Verification: We can help you verify insurance benefits without any charge, taking the burden off your shoulders.

- Expert Guidance: Our specialists understand the intricacies of insurance policies and can help you understand what your plan covers for addiction and mental health treatment.

- Treatment Matching: Beyond just verification, we connect you with suitable treatment centers from our vast network, ensuring they are equipped to meet your specific needs. Whether you’re looking for free addiction resources, affordable rehab services in Los Angeles, or are trying to understand inpatient vs. outpatient rehab options, we can guide you.

Take the First Step Today

Don’t let insurance confusion delay your path to recovery. Our 24/7 helpline is available to provide immediate support and help you explore personalized treatment options. We’ve seen how accessing treatment can transform lives. In fact, over 29,000 people have used insurance to attend treatment at one of our facilities since 2020. Those who have submitted our verification forms have had over a 78% acceptance rate for one of our facilities, demonstrating the effectiveness of proper benefit verification.

Taking this first step is a powerful act of self-care.

Click here to verify your insurance coverage for rehab now or call our helpline anytime.

Conclusion

Verifying your insurance benefits is more than just a bureaucratic step; it’s an empowering act that lays a solid foundation for your recovery journey. By taking the time to gather your information, contact your provider, ask the right questions, and document everything, you gain invaluable financial peace of mind. This understanding helps prevent surprise bills, reduces the stress of claim denials, and allows you to focus your energy entirely on healing.

We’ve walked through the manual process, explored key insurance terminology, and discussed how various plans cover essential addiction and mental health services. While the healthcare landscape can seem complex, resources are available to help. At Addiction Helpline America, we are committed to providing free, confidential, and expert assistance to help you verify insurance benefits and connect with the treatment you deserve.

Your journey to recovery begins with action, and understanding your insurance is a vital first step. Don’t hesitate to reach out for support. Hope is within reach, and we’re here to help you find the treatment you need.

Our helpline is 100%

free & confidential

If you or someone you care about is struggling with drug or alcohol addiction, we can help you explore your recovery options. Don’t face this challenge alone—seek support from us.

Programs

Resources

Will my insurance

cover addiction

treatment?

We're ready to help

Find the best

drug or alcohol treatment

center

Are you or a loved one struggling with addiction? Call today to speak to a treatment expert.