Navigating Your Path to Recovery with UMR

UMR Insurance Coverage for Drug and Alcohol Rehab is available to millions of Americans through their employer-sponsored health plans. Here’s what you need to know right now:

Quick Answer:

- Yes, UMR typically covers addiction treatment – including detox, inpatient rehab, outpatient programs, and therapy

- UMR is not an insurance company – it’s a third-party administrator (TPA) that manages benefits for self-funded employer plans

- Coverage varies by plan – your specific benefits depend on what your employer has chosen to include

- Federal laws require coverage – the Affordable Care Act (ACA) and Mental Health Parity Act mandate substance use disorder treatment

- You must verify your benefits – call the number on your insurance card or contact the rehab facility directly

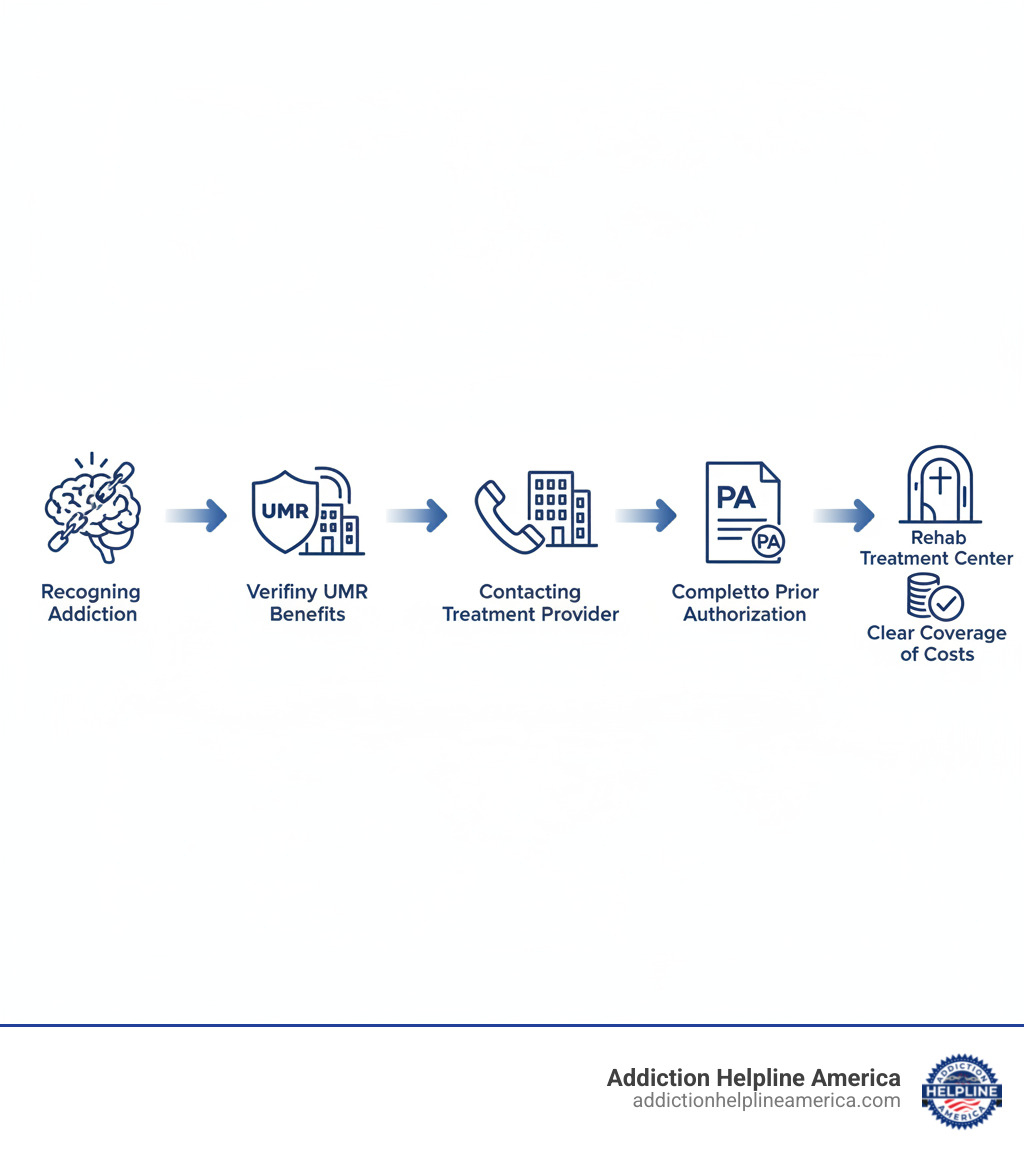

To use your coverage:

- Call UMR member services or check your online portal

- Verify what addiction treatment services are covered

- Get prior authorization if required

- Find an in-network treatment provider

- Understand your out-of-pocket costs (deductible, copay, coinsurance)

Finding the right treatment when you or a loved one is struggling with addiction can feel overwhelming. The financial burden adds another layer of stress to an already difficult situation.

The good news? Most UMR-administered health plans cover drug and alcohol rehabilitation services. This includes medical detox, residential treatment, outpatient programs, therapy, and medication-assisted treatment (MAT).

But here’s the challenge: UMR is not a direct insurance provider. It’s the nation’s largest third-party administrator, serving over 6 million members across more than 3,800 benefit plans. This means your coverage depends entirely on the specific plan your employer has designed.

Understanding your benefits is the critical first step.

Without verification, you could face unexpected costs or delays in getting the help you need. Some plans cover 30 days of residential treatment after a deductible. Others may require prior authorization for certain services. Still others might cover outpatient care more generously than inpatient stays.

The complexity doesn’t mean coverage isn’t there—it just means you need to know how to access it.

At Addiction Helpline America, we’ve helped thousands of individuals and families steer UMR Insurance Coverage for Drug and Alcohol Rehab, connecting them with treatment options that match their benefits and clinical needs. Our team understands the unique challenges of self-funded plans and can guide you through the verification process, so you can focus on what matters most: recovery.

What is UMR and How Does It Work?

Ever feel like navigating health benefits is like solving a puzzle with missing pieces? That’s where UMR steps in! Think of them as your expert guide, making sure all the parts of your health plan work smoothly. UMR, which stands for United Medical Resources, is actually the largest Third-Party Administrator (TPA) in the United States.

This means something important: UMR doesn’t sell insurance policies itself. Instead, they handle the daily tasks of health plans for employers. This includes everything from processing your medical claims to helping you with customer service questions.

UMR helps over 3,800 different benefit plans and serves more than 6 million people across the country. This includes members in all 50 states and the District of Columbia. They have over 70 years of experience in managing health benefits, so they really know their stuff! You can find out even more about them on their official website: About UMR.

UMR’s Role vs. a Traditional Insurance Company

Here’s the main difference: a traditional insurance company collects money (premiums) and then uses its own funds to pay for your medical bills. With UMR, it’s a bit different. They mostly work with self-funded employers. This means your employer actually pays for your healthcare costs directly. UMR then handles all the paperwork and services for them.

So, what does UMR do for you and your employer? They offer many key services:

- Claims Processing: They make sure your medical claims are handled correctly and quickly.

- Benefit Management: UMR helps employers design and manage their specific health plans. They tailor these plans to best fit what their employees need.

- Network Access: They give you access to a huge network of doctors, hospitals, and other healthcare providers.

- Customer Service: If you have questions about your benefits or need help finding your way through the healthcare system, UMR is your go-to contact.

- Administrative Services: This covers a wide range of tasks, like managing provider networks, helping with care, setting up wellness programs, and handling pharmacy benefits.

In short, UMR acts as a very important link. They simplify the often-confusing world of healthcare benefits for both employers and their team members. This makes getting the care you need, like UMR Insurance Coverage for Drug and Alcohol Rehab, much smoother.

The UMR and UnitedHealthcare (UHC) Connection

It’s great to know that UMR is part of the UnitedHealth Group family. This is the same big company that owns UnitedHealthcare! This close connection is a real plus for UMR members. Even though UMR manages your plan, you often get to use UnitedHealthcare’s large network of healthcare providers across the nation.

This partnership brings some excellent benefits to the table:

- Extensive Provider Network: UMR works with over 150 different preferred provider organizations (PPO) and other networks. This includes the vast national networks from UnitedHealthcare itself. With over 3,000 healthcare providers in their network, you have a better chance of finding the right in-network treatment center for your needs.

- Shared Resources: Because they’re connected, UMR and UnitedHealthcare can share tools and knowledge. This often means your claims are handled more efficiently, and you get better support as a member.

- Simplified Claims: If you use providers that are in-network, especially with PPO plans, you usually don’t need referrals. You also won’t have to fill out lots of complicated forms. This makes the whole process easier and can even save you money on medical bills.

Your Guide to UMR Insurance Coverage for Drug and Alcohol Rehab

When you’re ready to take that brave step toward healing from a substance use disorder, having clear information about insurance coverage can make all the difference. The wonderful news is that UMR Insurance Coverage for Drug and Alcohol Rehab is typically available for most members! Your specific UMR-administered health plan usually includes comprehensive behavioral health benefits. This means a wide array of services, from intensive inpatient care to flexible outpatient programs, are often covered. It’s about getting you the support you deserve.

How Federal Laws Mandate Addiction Treatment Coverage

It’s truly a relief to know that federal laws have stepped in to make sure that getting help for addiction isn’t an impossible financial challenge. These important rules create a strong foundation for your UMR Insurance Coverage for Drug and Alcohol Rehab.

First up is The Affordable Care Act (ACA). This landmark law, passed back in 2010, made a huge difference. It said that mental health and substance use disorder treatment are “essential health benefits.” This means that most health insurance plans, including those managed by UMR, must provide coverage for these vital services. The ACA helps ensure that addiction treatment is seen and treated just like any other medical condition. You can explore more about this at The Affordable Care Act (ACA).

Then there’s the Mental Health Parity and Addiction Equity Act (MHPAEA) from 2008. This act is all about fairness. It basically says that if your health plan covers addiction treatment, it has to do so at the same level as it would for, say, a broken arm or a heart issue. In simpler terms, coverage for mental health and substance use disorders can’t be more restrictive than for other medical benefits. UMR and the plans they administer fully respect this law, which is a big win for everyone seeking mental health support.

Types of Rehab Services Typically Covered by UMR

UMR-administered plans are designed to support your entire recovery journey, and that means covering a wide range of addiction treatment services. While the exact details always depend on your specific plan, here’s a look at the types of care that are typically included. For a broader overview of treatment options, you can check out Substance Use Disorder Treatment options.

Often, the very first step to recovery is Medical Detoxification (Detox). This crucial stage helps you safely manage withdrawal symptoms under careful medical supervision. UMR plans typically understand the importance of this, covering medically supervised detox to ensure your safety and comfort. If you’re specifically looking into alcohol detox, you can find more detailed information here: Alcohol Detox Treatment.

For those who need a deeply structured and supportive environment, Inpatient/Residential Treatment is an excellent option. Here, you live at the facility 24/7, receiving round-the-clock care that includes counseling, medication management, group therapy, and continuous medical support. Many UMR plans cover a significant portion of residential programs, often after you meet your deductible. To learn more about what a residential stay might look like, especially a 30-day program, visit 30-Day Inpatient Rehab.

If you need more flexibility to balance treatment with your daily life, Outpatient Programs like Partial Hospitalization Programs (PHP) and Intensive Outpatient Programs (IOP) are often covered. PHPs offer intensive treatment for several hours a day, multiple days a week, letting you return home in the evenings. IOPs provide a structured schedule with fewer hours, great for those with a stable home life and strong support. There’s also Standard Outpatient Rehab, which is the least intensive, typically involving weekly therapy sessions.

Another highly effective, evidence-based approach is Medication-Assisted Treatment (MAT). This combines behavioral therapy with medications, often used for opioid and alcohol addiction. Medical experts widely consider MAT the “gold standard” for substance abuse treatment, and it’s proven to significantly reduce drug-related deaths. UMR-administered plans generally cover MAT when it’s deemed medically necessary for your recovery. For specific information on opioid addiction treatment, explore Opioid Addiction Treatment.

Of course, Therapy and Counseling are cornerstones of lasting recovery. UMR plans typically cover various behavioral therapies, such as Cognitive Behavioral Therapy (CBT) and Dialectical Behavioral Therapy (DBT), whether it’s individual, group, or family counseling. Many modern rehab centers also weave in Holistic and Therapeutic Support, like mindfulness practices or nutrition counseling, into their broader covered programs, though specific coverage for these can vary.

Finally, recovery is a marathon, not a sprint. That’s why Aftercare Services are so important. UMR-administered plans may also help cover ongoing support like case management, follow-up therapy, and alumni programs to help you maintain long-term sobriety.

Understanding Your Plan’s Potential Out-of-Pocket Costs

While UMR Insurance Coverage for Drug and Alcohol Rehab is truly a lifesaver, it’s important to know that most insurance plans don’t cover 100% of treatment costs. Understanding your potential out-of-pocket expenses upfront is a smart move. It helps with financial planning and avoids any unwelcome surprises down the road. These costs generally include:

Let’s break down those common terms you might see. Your Deductible is the amount you pay for covered healthcare services before your insurance plan even begins to pay. For instance, you might see a UMR Bronze Plus plan with a $2,000 deductible per person, or a Silver plan with a $15,000 deductible – these numbers can really vary!

Then there are Copayments (Copays). This is a set amount you pay for a specific covered service, like a doctor’s visit, after you’ve met your deductible. It’s usually a fixed, smaller fee.

Coinsurance is your share of the costs for a covered service, shown as a percentage. So, if your plan covers 80% after your deductible, you’d pay the remaining 20% in coinsurance. For example, a UMR Bronze Plus plan might cover 30% after the deductible, meaning you’d pay 70% in coinsurance. It’s a percentage, not a fixed dollar amount.

Don’t forget your Out-of-Pocket Maximum. This is the absolute most you’ll have to pay for covered services in a given plan year. Once you reach this amount, your UMR plan will then cover 100% of any further covered benefits. It’s a fantastic safety net!

Here’s a quick look at how some example UMR plan tiers might break down for in-network addiction and mental health services:

| Plan Tier | Deductible (Per Person) | Deductible (Per Family) | Coverage After Deductible |

|---|---|---|---|

| Bronze Plus | $2,000 | $4,000 | 30% |

| Silver | $15,000 | $3,000 | 20% |

| Gold | $600 | $1,200 | 20% |

| Platinum | $250 | $500 | 10% |

Note: These figures are examples from research and your specific plan details may vary significantly.

It’s also super important to understand the difference between In-Network vs. Out-of-Network Costs. Choosing a provider that has a contract with UMR or UnitedHealthcare (an “in-network” provider) will almost always save you money. Out-of-network providers can come with higher deductibles, copays, or coinsurance – or your plan might not cover their services at all. Sticking with in-network options can genuinely help you save a good chunk of money, sometimes up to 20-30% on your medical bills. These examples are general; your actual costs depend on your employer’s specific plan. For a deeper dive into understanding rehab costs, check out How Much Does Rehab Cost?.

How to Verify and Use Your UMR Benefits for Treatment

You’ve learned that UMR Insurance Coverage for Drug and Alcohol Rehab exists, and you understand the types of services typically covered. Now comes the practical part: actually accessing those benefits and using them to get treatment. Think of this as turning knowledge into action—the moment where understanding becomes real help.

The verification process might feel intimidating, but it doesn’t have to be. You’re essentially asking three simple questions: What’s covered? How much will I pay? What steps do I need to take? Let’s walk through this together.

Step 1: Verifying Your Specific UMR Insurance Coverage for Drug and Alcohol Rehab

Getting accurate information about your specific coverage is absolutely essential. While general information helps, your exact benefits depend on the plan your employer has designed. Here’s how to get the real answers:

The fastest way is to call the member services number on the back of your UMR insurance card. Have your card handy when you call, and be ready with your policy number. The representative can tell you exactly what your plan covers, but you need to ask the right questions.

Don’t be shy about getting specific. Ask about coverage for medical detox, inpatient residential treatment, and outpatient programs like PHP and IOP. Find out if there are limits on the number of treatment days or therapy sessions. Get clear numbers on your deductible, copayment amounts, and coinsurance percentages for addiction services.

You’ll also want to ask about prior authorization requirements and whether you need a referral from your primary care doctor. Some plans require these steps, others don’t—knowing upfront prevents frustrating delays later.

The UMR online member portal offers another convenient option. You can log in to review your benefit information, search for providers, and access your Summary of Benefits and Coverage document. This portal gives you 24/7 access to your plan details, though it’s still wise to confirm coverage specifics with a representative.

Speaking of that Summary of Benefits and Coverage (SBC) document—your employer should provide this to you. It’s a standardized form that outlines what your plan covers and what you’ll pay. While helpful for getting an overview, it might not answer all your questions about addiction treatment specifics.

Here’s something that makes this easier: many treatment centers, including our team at Addiction Helpline America, can verify your benefits for you. We work with UMR every day and know exactly what questions to ask. We can contact UMR directly on your behalf, get the detailed coverage information, and explain it to you in plain language. This takes the burden off your shoulders when you’re already dealing with so much.

Step 2: The Prior Authorization Process

You might encounter something called “prior authorization” as you pursue treatment. Don’t let the formal-sounding term throw you—it’s simply UMR’s way of making sure the treatment is medically necessary before approving coverage.

Prior authorization means your doctor or treatment provider needs UMR’s approval before you start certain services. It’s a bit like getting a second opinion, except the insurance company is checking that the proposed treatment matches their medical guidelines and is appropriate for your situation.

Your healthcare provider typically handles this entire process. They submit clinical information to UMR explaining why you need the specific level of care—whether that’s inpatient rehab, intensive outpatient treatment, or medication-assisted therapy. UMR’s medical reviewers look at this information and determine if it meets their criteria for medical necessity.

This step is crucial because skipping required prior authorization can result in denied claims. If UMR requires authorization and doesn’t get it, they may refuse to pay for the service, leaving you responsible for the full cost. That’s why clear communication between you, your treatment provider, and UMR is so important.

The good news? In emergency situations, prior authorization typically isn’t required. If you need immediate medical detox or crisis intervention, get the care first. Just make sure to contact UMR as soon as possible afterward to ensure continued coverage and avoid any issues.

Most reputable treatment centers are very familiar with the prior authorization process and will handle it as part of their admissions procedure. They know what documentation UMR needs and how to present your case effectively. You don’t have to become an expert in insurance procedures—lean on the professionals who do this every day.

Step 3: Finding an In-Network Rehab Center

Once you understand your coverage and the authorization requirements, it’s time to find the right treatment facility. Choosing an in-network provider makes a significant difference in your out-of-pocket costs.

In-network facilities have negotiated contracts with UMR or UnitedHealthcare. These contracts mean lower rates and, more importantly for you, reduced deductibles, copayments, and coinsurance amounts. You could save 20-30% compared to using an out-of-network provider. In-network facilities also handle billing directly with UMR, so you’re not stuck in the middle managing paperwork and reimbursement claims.

The UMR provider directory is your official resource for finding in-network rehab centers. You can search by location, specialty, and facility type. Since UMR often uses UnitedHealthcare’s extensive network, you’ll find options across all 50 states and the District of Columbia.

But here’s where things get easier: Addiction Helpline America maintains relationships with accredited rehab centers nationwide that accept UMR coverage. We know which facilities are in-network, what levels of care they offer, and what makes each one unique. Whether you’re in Alabama or Wyoming, California or Connecticut, we can help you identify treatment options that work with your UMR Insurance Coverage for Drug and Alcohol Rehab and match your specific needs.

Finding the right rehab isn’t just about insurance—it’s about finding a place where you’ll actually heal. Some people need a gender-specific program. Others benefit from faith-based treatment or holistic approaches. Location matters too, whether you want to stay close to home or prefer the fresh start of treatment in a new environment.

We take the time to understand what you’re looking for and connect you with facilities that fit. You can also explore rehab centers in your state to get a sense of what’s available in your area.

Taking this first step toward treatment is brave. You’re not just navigating insurance—you’re choosing hope and healing. The verification process might require a few phone calls and some patience, but every question answered brings you closer to recovery. And remember, you don’t have to figure this out alone. We’re here to help you through every step.

Navigating Treatment Duration, Co-Occurring Disorders, and Coverage Gaps

Recovery isn’t a one-size-fits-all journey. Some people need a few weeks of intensive treatment, while others benefit from months of structured care. Your UMR Insurance Coverage for Drug and Alcohol Rehab is designed to flex with these individual needs, though the specifics depend on your plan and clinical situation.

When you’re working with a loved one through addiction, understanding these nuances becomes even more important. You can find additional guidance at Helping a loved one.

How Long Will UMR Cover My Rehab Stay?

If there’s one question we hear more than any other, it’s this: “How long will my insurance actually pay for treatment?”

Here’s the truth: there’s no simple answer, but there is a clear process.

The length of your covered stay hinges on medical necessity. This isn’t an arbitrary decision. Your treatment team will evaluate your condition using established clinical guidelines, particularly the ASAM (American Society of Addiction Medicine) Criteria. These criteria help determine the appropriate level and duration of care based on factors like your substance use history, physical health, mental health, readiness to change, and recovery environment.

Your specific UMR plan plays a significant role too. While UMR itself doesn’t impose universal limits, the plan your employer designed will outline any restrictions on covered days for inpatient or outpatient programs. Some plans may reference general guidelines—like up to six weeks for inpatient rehab or up to 12 weeks for outpatient treatment—but these are starting points, not rigid rules.

In practice, most rehab programs are structured around common durations of 30, 60, or 90 days. However, what matters most isn’t hitting a specific number of days, but rather your individual progress and clinical needs. Addiction is a chronic condition, and effective treatment often requires sustained, personalized care.

For individuals who need more time, long-term behavioral health facilities offer extended residential treatment. Your UMR plan may cover these longer stays when medical necessity supports it. We can help you explore these options at Long-Term Behavioral Health Facilities.

The encouraging news? UMR works with insurance companies to encourage collaboration between insurers, patients, and doctors to determine appropriate lengths of stay. They recognize that recovery is deeply personal and confidential, and that the right duration depends on your unique circumstances.

UMR Coverage for Co-Occurring Disorders (Dual Diagnosis)

Here’s something many people don’t realize until they’re in treatment: addiction rarely travels alone.

Approximately 21.5 million adults in the United States struggle with both substance use and mental health challenges simultaneously. Depression, anxiety, PTSD, bipolar disorder—these conditions often coexist with addiction in what clinicians call a dual diagnosis or co-occurring disorders.

Think of it this way: trying to treat addiction without addressing underlying mental health issues is like trying to bail water out of a boat without fixing the hole. You might make temporary progress, but you’re not addressing the root problem. For more information on how these conditions interconnect, see Comorbidity of SUD and mental illness.

The good news is that integrated treatment—addressing both conditions simultaneously—is not only possible but typically covered under UMR Insurance Coverage for Drug and Alcohol Rehab. Thanks to the Mental Health Parity and Addiction Equity Act, if your plan covers mental health services, it must do so on equal terms with physical health benefits.

This means you can receive comprehensive care that treats your whole self, not just one piece of the puzzle. This holistic approach dramatically improves the chances of long-term sobriety and overall wellness. Your treatment team can develop a coordinated plan that addresses both your substance use and mental health needs, using evidence-based therapies that target both conditions effectively.

What Are My Options If UMR Doesn’t Cover the Full Cost?

Even with solid insurance coverage, you might face some out-of-pocket costs. High deductibles, coinsurance, or plan limitations can create financial stress at a time when you’re already dealing with enough.

But here’s what we want you to know: financial barriers should never stand between you and recovery.

Many treatment centers offer payment plans that allow you to spread remaining balances over time, making treatment more manageable for your budget. Some facilities provide sliding-scale fees based on your income and ability to pay, adjusting costs to match your financial reality.

Scholarships and grants are another valuable resource. Non-profit organizations and some treatment centers offer financial assistance to help cover costs. The Substance Abuse and Mental Health Services Administration (SAMHSA) also provides grants for individuals seeking treatment.

Other options include medical discount services that negotiate lower rates on your behalf, or medical credit lines specifically designed for healthcare expenses. While not ideal, personal savings or family loans can sometimes bridge temporary gaps.

For those with very limited financial resources, free or state-funded rehab centers provide quality care regardless of your ability to pay. These facilities receive government funding and often have sliding-scale options. We can help you explore these possibilities at Free Rehab Center options.

At Addiction Helpline America, we believe that everyone deserves access to quality addiction treatment, regardless of their financial situation. If your UMR plan doesn’t cover everything you need, our team will work with you to explore every available option. We’ve helped thousands of people find solutions they didn’t know existed, and we’re here to do the same for you.

Frequently Asked Questions about UMR Rehab Coverage

We know that navigating UMR Insurance Coverage for Drug and Alcohol Rehab can bring up a lot of questions. You’re not alone in feeling confused—the relationship between UMR, UnitedHealthcare, and your employer’s plan can feel like trying to solve a puzzle. Let’s clear up some of the most common questions we hear.

Is UMR the same as UnitedHealthcare?

This is probably the question we hear most often, and it’s a great one to start with. The short answer is no, but they’re definitely connected—think of them as close cousins in the same family business.

UMR is a third-party administrator (TPA) and operates as a UnitedHealth Group company. What does that mean in practical terms? UMR doesn’t actually provide insurance coverage itself. Instead, it handles all the behind-the-scenes administrative work for self-funded health plans—processing claims, managing benefits, answering member questions, and connecting you with providers.

UnitedHealthcare, on the other hand, is an insurance provider. UMR often uses UnitedHealthcare’s extensive provider network, which is why you might see both names on your insurance card or benefits materials. This partnership gives you access to one of the largest healthcare networks in the country while your employer maintains control over the actual plan design and funding.

So when you’re seeking treatment, you might be calling UMR for benefits verification, but visiting a provider who’s in the UnitedHealthcare network. It’s all part of the same coordinated system designed to get you the care you need.

Does UMR cover both inpatient and outpatient rehab?

Yes, and this is genuinely good news. Most UMR-administered plans recognize that recovery isn’t one-size-fits-all, which is why they typically cover a comprehensive continuum of care.

This usually includes inpatient or residential treatment, where you live at the facility and receive 24/7 care and support. It also covers various levels of outpatient treatment—from Partial Hospitalization Programs (PHP) that provide intensive daytime treatment, to Intensive Outpatient Programs (IOP) that offer flexibility for work or family commitments, to standard outpatient therapy sessions for ongoing support.

However—and this is important—the specific extent of your coverage depends on two key factors. First, your individual plan’s design, which your employer has chosen. Second, the determination of medical necessity by UMR. Your treatment team will work with UMR to demonstrate why a particular level of care is appropriate for your situation.

Think of it like this: the coverage is there, but the details matter. That’s why verifying your specific benefits before starting treatment is so crucial. We can help you with that verification process, taking the guesswork out of the equation.

What should I do if my claim for rehab is denied?

A denied claim can feel like a door slamming in your face, especially when you’re already dealing with the challenges of addiction or supporting a loved one through recovery. But here’s what you need to know: a denial is not the final word. You have rights, and you have options.

Start by understanding why the claim was denied. Contact UMR directly and ask for a detailed explanation. Sometimes denials happen for simple reasons—maybe prior authorization wasn’t obtained, or the wrong billing code was used. These issues can often be resolved quickly.

Next, gather your documentation. This is where your treatment provider becomes your ally. Work with them to compile all medical records, clinical notes, assessment results, and treatment plans that demonstrate the medical necessity of your care. The more thorough your documentation, the stronger your case.

Then, file an internal appeal. This means formally asking UMR to reconsider their decision. You’ll submit your gathered documentation along with a written explanation of why the treatment was necessary. Your treatment provider can often help you with this process—they’ve done it many times before and know what UMR needs to see.

If the internal appeal doesn’t succeed, you have the right to an external review. An independent third party, completely unaffiliated with UMR, will examine your case with fresh eyes. This external reviewer’s decision is typically binding.

Throughout this process, you don’t have to go it alone. At Addiction Helpline America, we’ve helped countless individuals steer the appeals process. We understand how to communicate with insurance administrators, what documentation strengthens your case, and how to advocate effectively for the coverage you deserve. If you’re facing a denial, reach out to us. We’re here to help you fight for your right to treatment.

Take the First Step Toward Recovery Today

Taking the first step towards recovery can feel like climbing a mountain, especially when you’re also trying to figure out insurance. But here’s some really good news: navigating your UMR Insurance Coverage for Drug and Alcohol Rehab doesn’t have to be a solo journey. We’ve walked alongside many individuals and families, helping them understand that quality treatment is within reach.

Let’s quickly recap what’s most important to remember. UMR might not be a traditional insurance company, but as the nation’s largest third-party administrator, it plays a huge role in getting you access to a wide range of addiction treatment services through the plans it manages. Thanks to important federal laws like the ACA and the Mental Health Parity Act, coverage for substance use disorders is now a priority, ensuring you’re treated fairly.

Most UMR plans typically cover a variety of treatment types, from the initial detox all the way through to long-term aftercare. Yes, there will likely be some out-of-pocket costs, but knowing your deductibles, copays, and coinsurance upfront is key to avoiding surprises. This is why verifying your specific benefits and understanding the prior authorization process are absolutely crucial steps on your path.

But what if your UMR plan doesn’t cover everything? Don’t let that stop you! We want to assure you that numerous financial options are available to help you access the care you need. There’s often a way forward, even when it feels like there isn’t.

The biggest takeaway? Recovery is not just a possibility; it’s an achievable reality for you. If you or someone you care about is struggling, please know that reaching out for help is the most powerful first step you can take. You don’t have to carry this burden alone.

Here at Addiction Helpline America, we’re dedicated to connecting people nationwide with the right addiction and mental health treatment centers. We offer free, confidential, and personalized guidance to help you find a recovery program that truly fits your needs and aligns with your UMR Insurance Coverage for Drug and Alcohol Rehab. We’re here to simplify the process, so you can pour all your energy into healing.

Ready to turn the page and start a new chapter? Take that brave step today. Verify your insurance coverage for drug rehab and let us help you begin your journey to a healthier, happier life.

Our helpline is 100%

free & confidential

If you or someone you care about is struggling with drug or alcohol addiction, we can help you explore your recovery options. Don’t face this challenge alone—seek support from us.

Programs

Resources

Will my insurance

cover addiction

treatment?

We're ready to help

Find the best

drug or alcohol treatment

center

Are you or a loved one struggling with addiction? Call today to speak to a treatment expert.