Why Verifying Insurance is Your First Step to Peace of Mind

Insurance verification for rehab is the process of checking what your health insurance plan will cover for addiction treatment. It’s a crucial first step toward getting help without financial guesswork.

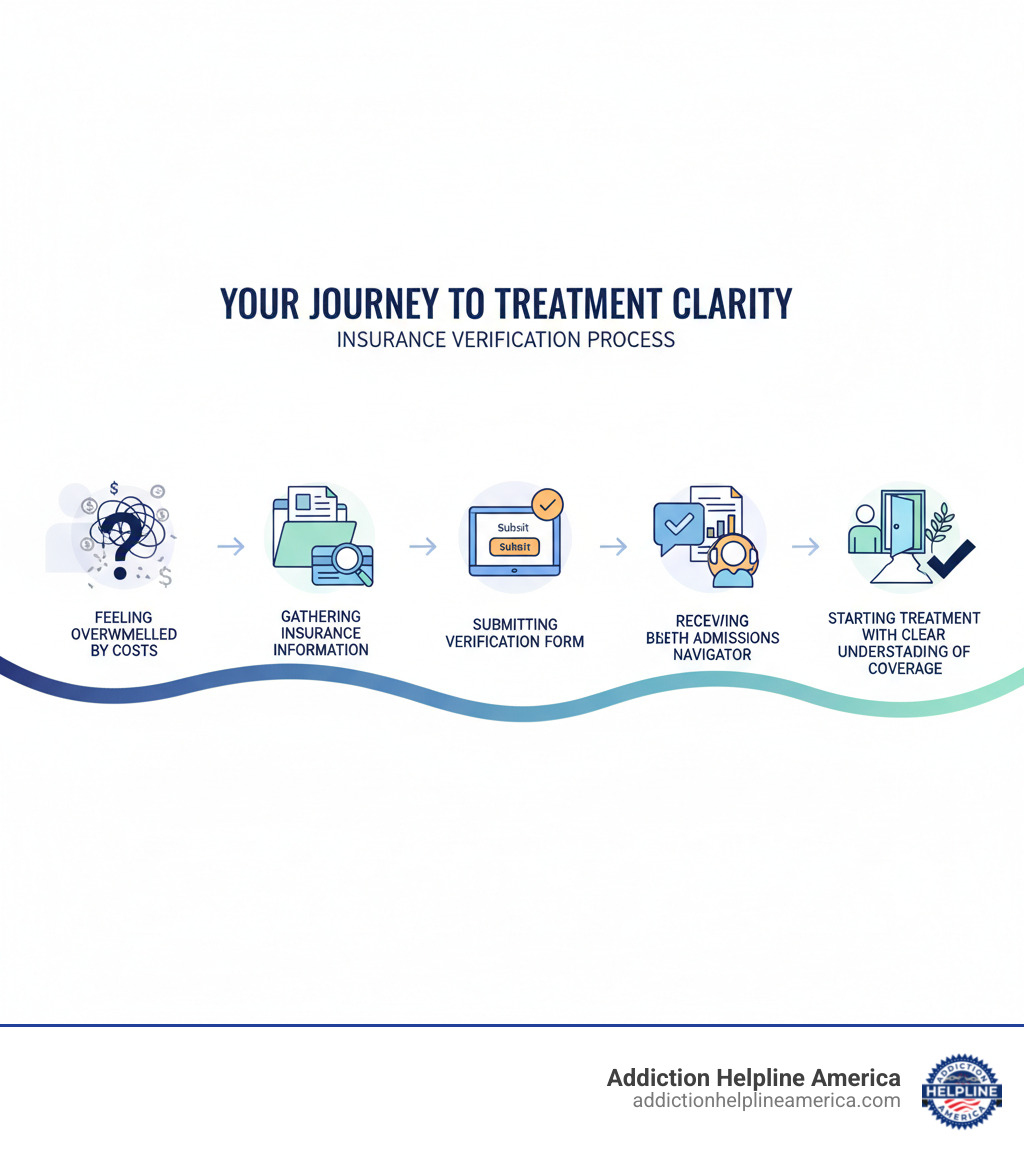

Quick Answer: How to Verify Insurance for Rehab

- Gather your insurance information – Member ID, Group Number, and insurance company name from your card.

- Contact a treatment provider – Call a confidential helpline or fill out an online verification form.

- Receive your benefits breakdown – Learn what’s covered, your out-of-pocket costs, and in-network options.

- Get connected to care – An admissions navigator helps you understand the next steps.

Timeline: Most verifications are completed within minutes to a few hours.

Financial concerns are a major barrier to treatment, but they don’t have to be. Thanks to the Affordable Care Act and the Mental Health Parity and Addiction Equity Act, most insurance plans are required to cover addiction treatment. You likely have more coverage than you realize.

Insurance verification for rehab removes the guesswork. Instead of worrying about affording help, you’ll know exactly what your plan covers, what you’ll pay, and which treatment centers are in your network. This knowledge brings peace of mind when you need it most.

The process is completely confidential and protected by HIPAA. Your insurance company isn’t notified when you verify benefits. In 2024 alone, over 12,000 people took this simple first step, and over 78% were accepted for treatment at a facility that worked with their insurance.

At Addiction Helpline America, we’ve helped thousands of families steer insurance verification for rehab. Our experienced team understands that clarifying your coverage is the critical first step toward healing.

Insurance verification for rehab terms you need:

The Step-by-Step Process for Insurance Verification for Rehab

Verification of Benefits (VOB) is the process of checking what your insurance plan will cover for addiction treatment. It provides a clear answer about your coverage before you commit, eliminating surprises.

The entire process is completely confidential and protected by HIPAA. Your personal and health information stays private, and your insurance company will not know you’re exploring treatment options. The information is strictly between you and the treatment provider.

When you contact Addiction Helpline America, you’ll work with an admissions navigator who understands insurance policies. They will help you find in-network centers across our nationwide network that match your coverage and specific needs.

What Information is Needed for Insurance Verification for Rehab?

To start the insurance verification for rehab process, have your insurance card ready. This will make everything go much faster.

Here’s what we’ll need:

- Your Full Name (as it appears on your card)

- Your Date of Birth

- Your Insurance Company Name (e.g., Aetna, Blue Cross Blue Shield, Cigna)

- Your Member ID Number

- Your Group Number (if applicable)

- The Provider Phone Number (usually on the back of your card)

Our navigators can help if you’re missing information, but having these details ready can speed up the process significantly.

How to Verify Your Coverage

We offer two simple ways to verify your coverage:

- Call us directly. Our admissions navigators can walk you through the process over the phone, collecting your information and answering questions in real-time.

- Use our online verification form. Fill out our secure, confidential form on our website anytime. We’ll handle the rest.

Either way, you’re connecting with our confidential helpline for judgment-free assistance. Most insurance verification for rehab requests are completed within minutes to a few hours. We’ll keep you updated if more detailed information is required from your insurer.

What Happens After My Insurance Verification for Rehab is Complete?

Once your coverage is verified, we’ll provide a clear financial picture. We’ll review your benefits, explaining your deductible, copayments, coinsurance, and out-of-pocket maximum in simple terms.

If your plan requires pre-authorization, we’ll handle the paperwork for you. This allows you to focus on preparing for treatment instead of dealing with bureaucracy.

Finally, we’ll help you understand your next steps for admission. With your coverage details, we can match you with facilities that fit your clinical and financial needs. People who verify their insurance through our form have over a 78% acceptance rate at one of our network facilities. We’re here to remove financial barriers so you can focus on recovery.

Understanding Your Coverage: What Your Plan Means for Treatment

Understanding insurance terms can save you stress and money. Here’s a quick breakdown:

- Deductible: The amount you pay before your insurance begins to cover costs.

- Copayment: A fixed amount you pay for a specific service, like a therapy session.

- Coinsurance: The percentage of costs you pay after your deductible is met (e.g., you pay 20%, insurance pays 80%).

- Out-of-Pocket Maximum: The most you’ll have to pay in a policy year. After you reach this limit, insurance covers 100% of eligible costs.

Choosing an in-network provider is crucial for managing costs. These providers have negotiated lower rates with your insurer, resulting in lower expenses for you. Out-of-network providers don’t have these agreements, so you’ll pay more, and some plans (like HMOs) may not cover them at all. Our insurance verification for rehab process focuses on finding affordable, in-network options. For more details, visit our Insurance & Medicare page.

Can I Use Insurance for Different Levels of Care?

Yes, most plans cover the full continuum of care to support your entire recovery journey.

- Medical Detox: A medically supervised process to manage withdrawal symptoms safely. It’s typically covered as a medical necessity.

- Inpatient/Residential Treatment: Live-in programs offering 24/7 care and intensive therapy. Insurance provides substantial coverage for these effective programs.

- Partial Hospitalization (PHP): Intensive day treatment while you live at home or in sober living. It’s a cost-effective step-down from inpatient care.

- Intensive Outpatient (IOP): Flexible treatment for a few hours, several times a week, allowing you to maintain daily responsibilities.

- Outpatient Programs: The least intensive option, usually involving weekly therapy to support stable recovery.

- Aftercare: Ongoing support like therapy and alumni programs to prevent relapse. Many plans continue to cover these services.

Our admissions navigators will help you understand what your plan covers at each stage of this journey.

Does Insurance Cover Mental Health and Substance Use Treatment?

Yes. The Mental Health Parity and Addiction Equity Act (MHPAEA) legally requires insurance plans to cover mental and substance use disorders at the same level as physical health conditions. This is vital for treating dual diagnosis or co-occurring disorders, where a mental health condition and a substance use disorder exist together. The best programs use integrated treatment plans to address both simultaneously, and your insurance should cover this comprehensive approach.

Which Insurance Providers Are Commonly Accepted?

We work with most major insurance providers. While coverage depends on your specific plan, treatment centers in our network commonly accept:

- Aetna

- Blue Cross Blue Shield (BCBS)

- Cigna

- Humana

- United Healthcare

- Tricare: For service members, veterans, and their families. Learn more at the Tricare website.

Government-funded options are also available:

- Medicare: For those 65+ or with certain disabilities. Enroll at the Medicare website.

- Covered California & Medi-Cal: California’s marketplace and Medicaid program. Visit Covered California or the DHCS website.

Plans vary greatly even within the same company. That’s why insurance verification for rehab is essential to understand what your specific plan covers.

Navigating Roadblocks: No Insurance or Coverage Denials

If you have no insurance or your coverage is denied, don’t give up hope. Financial barriers are common, but they are not the end of the road. There is almost always a path forward, and we can help you find it.

When insurance verification for rehab reveals limited coverage or a denial, it simply means we need to explore other options. If your claim was denied, you have the right to appeal the decision. Our admissions team can guide you through the appeals process.

Alternative Payment Options for Rehab

Many treatment centers offer flexible payment arrangements to make recovery accessible. For a detailed look at costs, see our guide on How Much Does Rehab Cost?. Options include:

- Private Pay: Paying out-of-pocket offers privacy and access to any facility. Many offer discounts for this option.

- Sliding Scale Fees: Treatment costs are adjusted based on your income.

- Payment Plans: The total cost is broken into manageable monthly installments.

- Healthcare Loans: Loans designed specifically for medical expenses, often with reasonable interest rates.

- Grants and Scholarships: Funds from non-profits or treatment centers that do not need to be repaid.

- State-Funded Programs: Free or low-cost treatment for residents who meet income requirements.

Government and Marketplace Insurance Options

If you don’t have insurance, you may qualify for a government program that covers addiction treatment, often at little to no cost.

- Medicaid: A federal and state program providing health coverage to low-income Americans. It typically offers comprehensive coverage for SUD treatment.

- Medicare: Serves people 65+ and younger individuals with certain disabilities. You can enroll via the Medicare website.

- ACA Marketplace: A place to shop for insurance plans that must cover addiction treatment. You may qualify for subsidies to lower costs.

- Covered California & Medi-Cal: California’s state marketplace and Medicaid program. Apply at Covered California or the DHCS website.

- Tricare: Excellent coverage for service members, retirees, and their families. Learn about enrollment here.

Our admissions navigators understand these systems and can help you determine your eligibility, walk you through applications, and connect you with accepting treatment centers.

Frequently Asked Questions about Rehab Insurance Verification

It’s normal to have questions about insurance verification for rehab. Here are answers to some of the most common concerns.

Does filling out an insurance verification form notify my insurance provider?

No. When you fill out our insurance verification for rehab form, you are only sharing information with us at Addiction Helpline America. The process is completely confidential and protected by HIPAA. We use the information to check your available benefits.

Your insurance company will only learn about your treatment after you decide to move forward and a facility submits a pre-authorization request or a claim for services with your permission. Until then, you are simply gathering information confidentially.

What should I do if I have questions about my coverage or the verification process?

Contact us. Our admissions team is here to help you understand confusing insurance policies.

- Call our confidential helpline to speak with a navigator who can explain your benefits in plain English.

- Prepare a list of questions before you call. Ask about your deductible, what therapies are covered, or the duration of covered treatment.

- Ask about specific services you might need, such as medical detox, medication-assisted treatment, or family therapy. No question is too small when it comes to your recovery.

We are here to ensure you feel confident and informed about your coverage.

What if my insurance is not in-network with a particular rehab facility?

This is a common situation with several solutions.

- Ask about out-of-network benefits. PPO plans often provide some coverage for out-of-network providers, though your costs will be higher. We can help you understand what those costs will be.

- Discuss costs with the facility. Many rehab centers are willing to negotiate payment arrangements or reduced rates.

- Find an in-network alternative. Our nationwide network includes many high-quality programs that accept your insurance. Our navigators can help you find an excellent in-network facility that may be a perfect fit and save you money.

Whether your preferred facility is in- or out-of-network, we will work with you to find a solution that gets you the care you need at a manageable cost.

Take the Next Step Towards Recovery Today

You now know that insurance verification for rehab is a simple, confidential, and empowering step. It replaces confusion about costs with clarity about your path forward. Instead of wondering if you can afford treatment, you’ll know exactly what your plan covers.

Since 2020, over 29,000 people have used their insurance to attend treatment at one of our facilities. They all took the same first step you’re considering now and found that treatment was more accessible than they feared.

At Addiction Helpline America, our mission is to remove barriers to recovery. Our compassionate admissions navigators are experts at connecting you to the right treatment center from our network of facilities across all 50 states and the District of Columbia. We find options that fit your clinical needs, location, and insurance coverage.

Don’t let financial concerns stop you from exploring your options. We offer free, confidential guidance to find a solution, whether your insurance covers all of your treatment or you need to explore alternative payments.

What’s next is up to you. We’re here when you’re ready.

Verify your insurance now to get answers within minutes to a few hours, or call our confidential helpline to speak with a navigator. There’s no pressure or judgment—just honest information and genuine support.

Recovery is possible, and your journey can start today.

Our helpline is 100%

free & confidential

If you or someone you care about is struggling with drug or alcohol addiction, we can help you explore your recovery options. Don’t face this challenge alone—seek support from us.

Programs

Resources

Will my insurance

cover addiction

treatment?

We're ready to help

Find the best

drug or alcohol treatment

center

Are you or a loved one struggling with addiction? Call today to speak to a treatment expert.