Understanding How Cigna Can Help You Access Addiction Treatment

Cigna Insurance Coverage for Drug and Alcohol Rehab is available to most Cigna members thanks to federal laws requiring mental health and substance use disorder treatment to be covered like other medical conditions. Here’s what you need to know:

- Yes, Cigna covers addiction treatment – including detox, inpatient, outpatient, and medication-assisted treatment

- Coverage is mandated by law – the Mental Health Parity and Addiction Equity Act (MHPAEA) ensures equal coverage

- 2,772 treatment centers accept Cigna nationwide

- Your specific coverage depends on your plan – Bronze, Silver, Gold, or Platinum tiers affect your out-of-pocket costs

- Both in-network and out-of-network options may be available, with in-network typically costing less

If you or someone you love is struggling with addiction, understanding your insurance benefits shouldn’t add to the stress. The good news is that Cigna provides comprehensive coverage for substance use disorder treatment, and you have more options than you might think.

The challenge? Figuring out what your specific plan covers, how much you’ll pay, and where you can go for treatment.

According to research, all Marketplace Cigna plans must cover behavioral health, mental health, and substance abuse disorder treatment as essential health benefits under the Affordable Care Act. Parity protections mean that coverage limits, deductibles, and copays for addiction treatment cannot be higher than for other medical conditions.

At Addiction Helpline America, we’ve helped thousands of individuals and families steer the complex process of using Cigna Insurance Coverage for Drug and Alcohol Rehab to access life-saving treatment. Our team understands both the insurance landscape and the urgency of getting help when addiction is destroying lives.

Understanding Your Cigna Insurance Coverage for Drug and Alcohol Rehab

If you’re wondering whether your Cigna plan will help pay for addiction treatment, there’s good news: federal law actually requires it. Thanks to two major pieces of legislation, Cigna Insurance Coverage for Drug and Alcohol Rehab isn’t just available—it’s mandated for most plans.

The Affordable Care Act (ACA) changed the game by making substance use disorder (SUD) treatment one of ten essential health benefits. This means if you bought your Cigna plan through the HealthCare.gov Marketplace, coverage for addiction treatment isn’t optional—it’s built in. You can learn more about mental health and substance abuse coverage under the ACA to see how these protections work.

But there’s another crucial law working in your favor: the Mental Health Parity and Addiction Equity Act (MHPAEA). This federal regulation ensures that insurance companies can’t treat mental health and substance use disorder benefits as “less important” than physical health benefits. In practical terms, Cigna can’t make you jump through more hoops or pay higher costs for addiction treatment than you would for, say, diabetes care or heart surgery.

Cigna has acceptd these requirements through their Behavioral Health division, which provides dedicated resources and support for people facing drug or alcohol addiction. Their commitment goes beyond just checking a legal box—they’ve built comprehensive networks and programs specifically designed to help people access the care they need. You can explore more about their approach at Cigna’s overview of SUD treatment.

The Role of Parity Protections

Parity protections are the legal foundation that makes Cigna Insurance Coverage for Drug and Alcohol Rehab truly accessible. These protections ensure addiction treatment gets the same respect and coverage as any other medical condition.

Here’s what parity means for you in real terms: Equal coverage guarantees that Cigna covers addiction treatment services at a level comparable to physical health issues. No higher deductibles or copays means you won’t face steeper out-of-pocket costs for rehab than you would for treating a broken bone or managing high blood pressure.

Treatment limits parity ensures that if Cigna places restrictions on the number of days or sessions for addiction treatment, those limits can’t be more restrictive than what they impose for medical or surgical care. And care management equality means that pre-authorization requirements or other administrative problems for SUD treatment must be similar to those for other medical conditions.

It’s worth noting that most Cigna plans must follow these parity rules, with one exception: certain “grandfathered plans” that existed before the ACA became law and haven’t made significant changes to their benefits. These older plans may not include all the same protections. If you’re curious whether your plan might be grandfathered, you can check out what are grandfathered plans for more details.

Cigna Plan Types and Tiers

Understanding your specific Cigna plan structure is essential for navigating your Cigna Insurance Coverage for Drug and Alcohol Rehab. Cigna offers several different plan types, each with its own network rules and cost-sharing arrangements.

HMO plans (Health Maintenance Organization) typically require you to choose a primary care provider within the network and get referrals for specialists or other services. Out-of-network care generally isn’t covered except in emergencies. PPO plans (Preferred Provider Organization) offer more flexibility—you don’t need a primary care doctor or referrals to see specialists, and you can use out-of-network providers, though you’ll pay more. EPO plans (Exclusive Provider Organization) are similar to HMOs but usually don’t require a primary care provider or referrals, though out-of-network care typically isn’t covered. POS plans (Point of Service) blend elements of both HMO and PPO structures—you may need a referral for out-of-network care, but it’s usually covered at a higher cost.

Beyond these network structures, Cigna plans sold through the ACA Marketplace come in what’s called “metal tiers”—Bronze, Silver, Gold, and Platinum. These tiers don’t indicate quality of care; instead, they show how costs are split between you and Cigna. Understanding your tier is crucial because it directly affects what you’ll pay for addiction treatment.

Bronze plans have the lowest monthly premiums but the highest deductibles and out-of-pocket costs. Cigna typically covers about 60% of costs after you meet your deductible, leaving you responsible for 40%. For in-network inpatient rehab, you might face 0% coinsurance after the deductible, but outpatient services could carry 0-50% coinsurance.

Silver plans strike a balance between premiums and out-of-pocket costs, with Cigna covering about 70% of costs after the deductible. You might see 30-50% coinsurance for in-network programs after meeting your deductible, plus a coinsurance percentage or copay for each outpatient visit.

Gold plans come with higher monthly premiums but lower deductibles and out-of-pocket costs, with Cigna covering about 80% of costs. For inpatient treatment, you might have 20-50% coinsurance after the deductible, and a small coinsurance percentage or copay per outpatient visit.

Platinum plans have the highest monthly premiums but offer the most comprehensive coverage, with Cigna covering about 90% of costs. You’ll see minimal coinsurance (10-30%) for both inpatient and outpatient services after meeting your deductible.

For a deeper dive into how these tiers work, Cigna provides a helpful guide on Bronze, Silver, Gold, and Platinum Health Plans. The specific details of your individual plan will determine your actual financial responsibility, so it’s always important to verify your benefits before starting treatment.

What Types of Addiction Treatment Does Cigna Cover?

When you’re facing addiction, knowing that your insurance will support your recovery journey makes all the difference. The good news? Cigna Insurance Coverage for Drug and Alcohol Rehab is designed to support what’s called a continuum of care—which is just a fancy way of saying they recognize that recovery isn’t a one-size-fits-all process. Different people need different types of help at different times.

Whether you need intensive 24/7 support or weekly counseling sessions while you continue working, Cigna’s got you covered. The key is that the treatment must be medically necessary, meaning a healthcare professional has determined it’s appropriate for your specific situation. Treatment centers and insurance companies typically use something called the ASAM criteria (American Society of Addiction Medicine) to figure out which level of care fits your needs best. Think of it as a roadmap that helps match you with the right treatment at the right time.

Cigna aims to cover the full spectrum of rehab treatment plans, including detox, inpatient and residential programs, outpatient care, and various behavioral therapies. This comprehensive approach means you can get the help you need without having to worry about whether a particular type of treatment is covered. You can read more about Cigna’s official stance on SUD treatment here.

Inpatient vs. Outpatient Rehab Coverage

Understanding the difference between inpatient and outpatient treatment—and knowing that Cigna covers both—can help you make the best decision for your recovery.

Medical Detox is often where the journey begins. This is the process of safely withdrawing from substances under medical supervision, and it’s especially important for alcohol, opioids, and benzodiazepines—substances where withdrawal can actually be dangerous or even life-threatening. Cigna typically covers medical detox because it’s a critical first step that keeps you safe while your body adjusts.

Inpatient or Residential Treatment means living at a treatment facility full-time, usually for anywhere from 15 to 90 days. You’re in a structured, supportive environment 24/7, away from the triggers and stresses of daily life. This level of care is particularly helpful if you’ve tried outpatient treatment before without success, if you’re dealing with severe addiction, or if you have co-occurring physical or mental health conditions that need close monitoring. Cigna generally covers inpatient and residential programs, recognizing that sometimes you need to step away from everything to truly focus on healing.

Partial Hospitalization Programs (PHP), sometimes called “day treatment,” offer a middle ground. You attend treatment during the day for several hours—usually five days a week—but you go home (or to a sober living facility) at night. It’s intensive care without requiring you to live at the facility. Cigna covers PHPs as either a step-down from inpatient care or for people who need more support than standard outpatient but have a safe place to stay.

Intensive Outpatient Programs (IOP) provide structured treatment while allowing you to maintain your daily responsibilities. You might attend sessions a few evenings a week for 10-20 hours total, which means you can continue working, going to school, or taking care of family. Cigna covers IOPs, and they work especially well if you have a stable home environment and a strong support system already in place.

Standard Outpatient Counseling is the most flexible option—regular therapy sessions at clinics or offices, usually once or twice a week. This allows you to maintain your normal routine while still getting professional support. Cigna covers individual therapy, group sessions, and family counseling as part of outpatient treatment, providing ongoing support throughout your recovery journey.

The specifics of your Cigna Insurance Coverage for Drug and Alcohol Rehab—like how much you’ll pay out-of-pocket—depend on your particular plan and whether you choose an in-network provider. But the important thing is that all these levels of care are available to you.

Specific Therapies and Co-Occurring Disorder Treatment

Addiction rarely exists in a vacuum. Often, there are underlying mental health issues or specific patterns of thinking and behavior that need to be addressed for recovery to stick. That’s why Cigna’s coverage extends beyond just “going to rehab” to include specific, evidence-based therapies that actually work.

Medication-Assisted Treatment (MAT) combines FDA-approved medications with counseling and behavioral therapies. If you’re struggling with opioid or alcohol addiction, medications like buprenorphine or naltrexone can significantly improve your chances of success by reducing cravings and withdrawal symptoms. Cigna typically covers MAT because it’s considered a gold standard in addiction treatment—not a crutch, but a legitimate medical tool that helps your brain heal.

Behavioral therapies form the foundation of most addiction treatment programs, and Cigna covers several types. Cognitive Behavioral Therapy (CBT) helps you identify and change the negative thought patterns and behaviors that fuel substance use. Dialectical Behavior Therapy (DBT) focuses on managing emotions, tolerating distress, and improving relationships—skills that are especially helpful if you’re dealing with trauma or other mental health challenges alongside addiction. Other approaches like motivational interviewing and contingency management are also typically covered.

Here’s something really important: Dual Diagnosis treatment for co-occurring disorders is a critical part of Cigna’s coverage. If you’re battling both addiction and mental health conditions like anxiety, depression, PTSD, or bipolar disorder, you’re not alone—this combination is incredibly common. Thanks to parity laws, Cigna plans must cover integrated treatment that addresses both issues at the same time. Treating just the addiction without addressing the underlying mental health condition (or vice versa) rarely works long-term, so this integrated approach is essential.

Family therapy is another covered service that often gets overlooked but can be incredibly powerful. Addiction affects everyone who loves you, and healing often needs to happen on a family level. Cigna recognizes this and typically covers family therapy sessions, which help your loved ones understand what you’re going through, improve communication, and heal together.

The breadth of Cigna Insurance Coverage for Drug and Alcohol Rehab means you can access comprehensive, whole-person treatment that addresses not just your substance use but all the factors contributing to it. That’s what gives you the best shot at lasting recovery.

Navigating Costs and Finding Cigna-Approved Providers

Let’s talk about the practical side of things—what you’ll actually pay and how to find treatment centers that work with your Cigna plan. While Cigna Insurance Coverage for Drug and Alcohol Rehab is comprehensive, you’ll likely have some out-of-pocket expenses. The amount depends on your specific plan, whether the provider is in-network, and where you are in meeting your annual deductible.

One important thing to know upfront: many addiction treatment services require something called preauthorization. This means Cigna needs to approve the treatment before you start. It might sound like a hassle, but it’s actually protecting you—without preauthorization, you could end up responsible for the entire cost of care. The good news is that treatment centers handle this process all the time and can often take care of it for you.

Understanding Your Out-of-Pocket Costs

Insurance terminology can feel like learning a foreign language, but let’s break down the three main costs you’ll encounter:

Your deductible is the amount you pay before Cigna starts covering services. Think of it like a threshold—once you cross it, your insurance kicks in. If your deductible is $1,500, you’ll pay the first $1,500 of covered expenses yourself, then Cigna begins contributing. The Healthcare.gov glossary offers more details if you want to dive deeper.

Copayments, or copays, are fixed amounts you pay for specific services after meeting your deductible. You might pay $25 for an outpatient therapy session, for example. It’s straightforward—same service, same copay.

Coinsurance is where it gets a bit trickier. Instead of a fixed amount, you pay a percentage of the total cost. If your coinsurance is 20%, and an inpatient treatment day costs $1,000, you’d pay $200 and Cigna covers the remaining $800. This applies after you’ve met your deductible.

The metal tier of your Cigna plan—Bronze, Silver, Gold, or Platinum—dramatically affects these costs. Here’s what you might expect for in-network rehab services:

| Cigna Plan Tier | In-network Inpatient Rehab (after deductible) | In-network Outpatient Rehab (after deductible) |

|---|---|---|

| Bronze | 0% – 40% Coinsurance | 0% – 50% Coinsurance or higher copay |

| Silver | 30% – 50% Coinsurance | Coinsurance % or Copay per visit |

| Gold | 20% – 50% Coinsurance | Small Coinsurance % or Copay per visit |

| Platinum | 10% – 30% Coinsurance | Minimal Coinsurance or Copay |

These are general ranges—your actual costs will be detailed in your plan’s Summary of Benefits and Coverage document. And here’s something that might ease your mind: every plan has an out-of-pocket maximum. Once you’ve spent that amount in a year on covered services, Cigna pays 100% of everything else. It’s a financial safety net that prevents unlimited expenses.

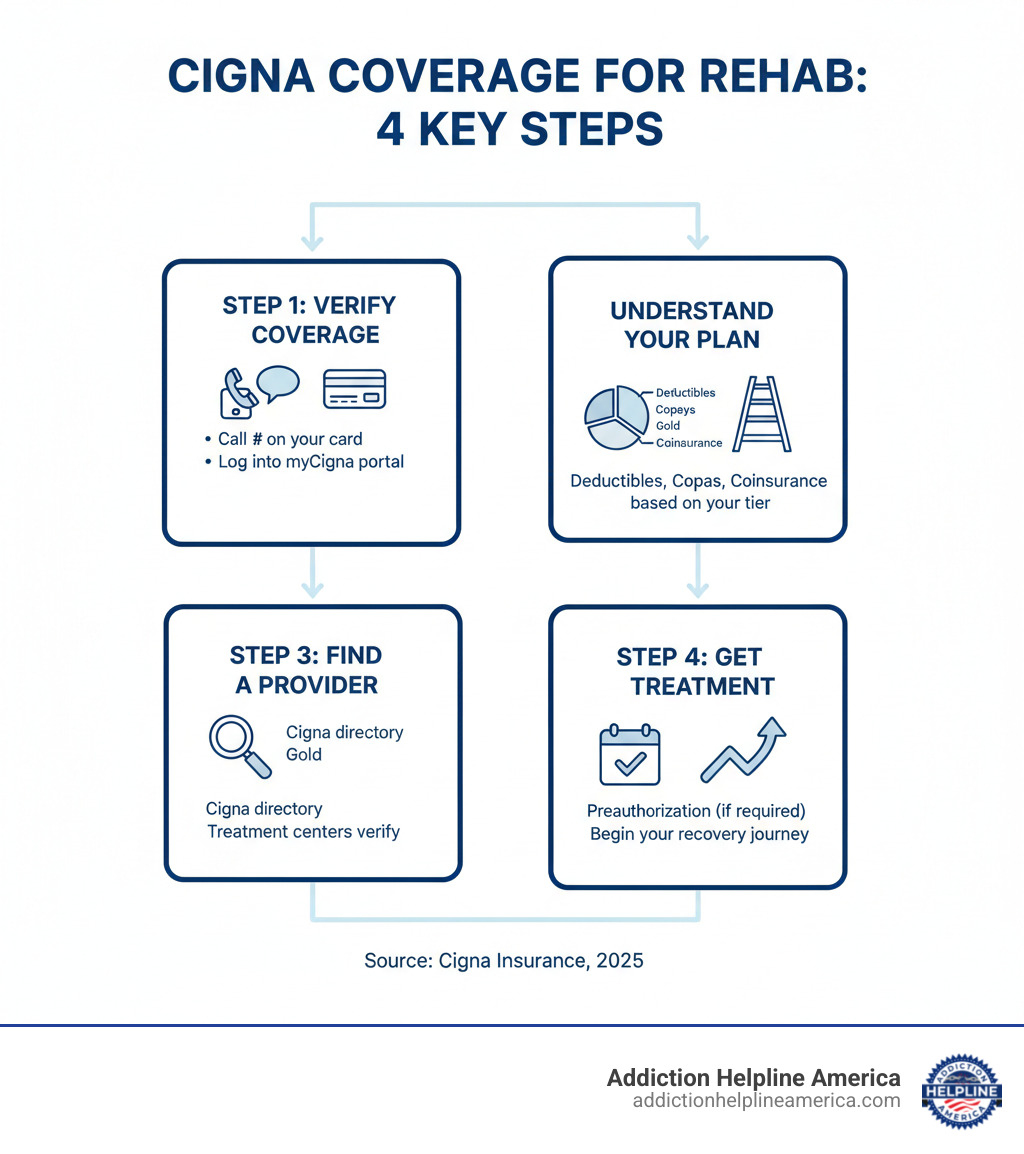

How to Find and Verify Cigna Insurance Coverage for Drug and Alcohol Rehab

Finding the right treatment center and understanding exactly what your plan covers doesn’t have to be overwhelming. We’ve seen thousands of people steer this successfully, and there are clear steps that make it manageable.

The most reliable way to verify your Cigna Insurance Coverage for Drug and Alcohol Rehab is to call the number on the back of your Cigna ID card. You’ll speak with a representative who has access to your specific plan details. They can tell you your exact deductible, copays, coinsurance percentages, whether preauthorization is required, and which treatment centers are in your network. Have your member ID and group number handy when you call.

If you prefer doing things online, logging into the myCigna member portal gives you 24/7 access to your benefits information. You can review your plan documents, check how much of your deductible you’ve met, see your claims history, and search for in-network behavioral health providers in your area. The portal is especially helpful if you like having everything in writing.

Here’s a secret that can save you time and stress: let the rehab facility’s admissions team verify your coverage for you. Most treatment centers—including the facilities we work with at Addiction Helpline America—offer free insurance verification. They do this every day, so they know exactly what information to gather and what questions to ask. They’ll contact Cigna on your behalf and provide you with a clear breakdown of your expected costs at their specific facility. It’s one less thing for you to worry about during an already stressful time.

When anyone is verifying your coverage, you’ll need to provide your Cigna member ID number, your group number (if you have employer-sponsored insurance), and details about the specific services you’re seeking—whether that’s medical detox, inpatient treatment, outpatient counseling, or a combination.

To find treatment centers that accept Cigna, you can use the Cigna provider directory, which allows you to filter by location and specialty. Our network at Addiction Helpline America includes facilities across the country that work with Cigna, which can streamline your search considerably.

What happens if Cigna denies coverage? First, don’t panic—denials happen, and they can often be overturned. You have the right to understand why coverage was denied and to appeal the decision. Start by contacting Cigna to get the specific reason for the denial. Common reasons include needing more documentation of medical necessity or missing preauthorization. Then follow their formal appeals process, which typically involves your treatment provider submitting additional medical records or a letter explaining why the treatment is medically necessary. We’ve helped many people successfully steer appeals, and we’re here to guide you through the process if you need support.

insurance coverage for rehab exists to help you access the care you need. Don’t let confusion about benefits delay getting treatment—reach out to us at Addiction Helpline America, and we’ll help you figure out exactly what your Cigna plan covers and connect you with the right facility.

Frequently Asked Questions about Cigna Rehab Coverage

We know that figuring out insurance can feel overwhelming, especially when you’re dealing with something as important as addiction treatment. You’re not alone in having questions—we hear them every day from families just like yours. Let’s walk through some of the most common concerns people have about Cigna Insurance Coverage for Drug and Alcohol Rehab.

Does Cigna cover treatment for co-occurring mental health disorders?

Here’s some really good news: yes, Cigna covers integrated treatment for what’s called “dual diagnosis.” This means if you’re struggling with both addiction and a mental health condition—like depression, anxiety, PTSD, or bipolar disorder—your treatment can address both issues at the same time.

This isn’t just a nice-to-have feature. It’s actually required by federal parity laws like the MHPAEA we mentioned earlier. Cigna can’t charge you more or place stricter limits on mental health treatment than they do for other medical care. In practical terms, this means your therapist can work on both your substance use and your anxiety together, rather than treating them as separate problems.

Many people don’t realize how common co-occurring disorders are. In fact, most individuals with substance use disorders also have an underlying mental health condition. Treating both simultaneously gives you the best chance at lasting recovery. Your Cigna Insurance Coverage for Drug and Alcohol Rehab recognizes this reality and provides comprehensive support for your whole well-being, not just one piece of the puzzle.

What should I do if my Cigna plan denies coverage for rehab?

A denial can feel like a door slamming shut, but please don’t give up. You have rights, and denials can often be overturned. Think of it as the first “no” in a conversation, not the final answer.

Start by understanding why. Call Cigna directly and ask for a detailed explanation of the denial—and get it in writing. Sometimes the reason is something simple, like missing pre-authorization paperwork or the facility being out-of-network. Other times, Cigna might have decided the treatment wasn’t “medically necessary” based on their criteria.

Gather your evidence. Work closely with your treatment provider to collect all relevant medical documentation. This includes assessments, detailed treatment plans, and a letter of medical necessity from your doctor explaining why this specific level of care is essential for your recovery. The more thorough your documentation, the stronger your case.

Follow the appeals process. Cigna has a formal internal appeals process, and it’s important to follow their instructions carefully. Submit all requested documentation within their timelines—missing a deadline can hurt your case. If the internal appeal is denied, you typically have the right to request an external review by an independent third party who isn’t affiliated with Cigna.

We understand this process can be frustrating and confusing. That’s exactly why Addiction Helpline America is here. Our team has walked countless families through insurance appeals and can offer guidance and support every step of the way. You don’t have to figure this out alone.

Does Cigna cover specific therapies like Medication-Assisted Treatment (MAT)?

Yes, and this is something we’re really glad to talk about. Cigna typically covers Medication-Assisted Treatment (MAT), which combines FDA-approved medications with counseling and behavioral therapies. This approach has been proven incredibly effective for treating opioid use disorder and alcohol use disorder.

MAT uses medications like buprenorphine (often known by brand names like Suboxone), naltrexone (Vivitrol), or acamprosate to help reduce cravings and withdrawal symptoms. These aren’t “replacing one drug with another”—they’re legitimate medical treatments that help stabilize brain chemistry while you work on the psychological and behavioral aspects of recovery.

The research is clear: people who receive MAT are significantly more likely to stay in treatment, less likely to relapse, and have better long-term outcomes than those who try to quit without medication support. Cigna’s coverage of MAT reflects the medical community’s understanding of addiction as a chronic disease that often requires medication, just like diabetes or high blood pressure.

When you’re verifying your benefits, you can specifically ask about coverage for MAT medications and the associated therapy sessions. Most Cigna plans cover both components as part of their comprehensive approach to substance use disorder treatment.

If you have other questions that we haven’t covered here, please don’t hesitate to reach out to us at Addiction Helpline America. We’re here to help you understand your Cigna Insurance Coverage for Drug and Alcohol Rehab and connect you with the right treatment program for your situation.

Taking the Next Step Toward Recovery

You’ve made it to the end of this guide, and if you’re reading this, you’re already moving in the right direction. Understanding your Cigna Insurance Coverage for Drug and Alcohol Rehab might have seemed overwhelming at first, but now you know the essentials: Cigna covers a comprehensive range of addiction treatments, from the initial stages of medical detox through inpatient residential care, all the way to outpatient counseling and specialized therapies like Medication-Assisted Treatment. Federal laws like the Mental Health Parity and Addiction Equity Act ensure that substance use disorder treatment receives the same coverage as any other medical condition—no higher deductibles, no stricter limits, no second-class treatment.

The reality is that your specific Cigna plan—whether it’s Bronze, Silver, Gold, or Platinum, HMO or PPO—will determine your out-of-pocket costs and which providers are in your network. That’s why verifying your specific benefits before starting treatment is so important. It’s the difference between being blindsided by unexpected costs and walking into treatment with confidence and clarity about what you’ll pay.

Here’s what we want you to remember: cost should never be a barrier to getting the help you need. Addiction doesn’t wait for the perfect moment or the perfect plan, and neither should your recovery. Too many people delay treatment because they’re worried about insurance complications or expenses, but the truth is that help is available, and it’s more accessible than you might think.

At Addiction Helpline America, we’ve built our entire service around removing those barriers. We connect individuals nationwide to addiction and mental health treatment centers that accept Cigna, and we do it through free, confidential, personalized guidance. No judgment, no pressure, no cost to you. Our team can help you verify your Cigna Insurance Coverage for Drug and Alcohol Rehab, understand exactly what your benefits include and what you’ll pay, find in-network treatment centers that match your specific needs, and steer the pre-authorization process if your plan requires it.

We work with a vast network of treatment centers across the country, which means we can help you find the right fit—whether you need medical detox, inpatient care, outpatient therapy, dual diagnosis treatment, or specialized programs for specific substances. Every person’s journey is different, and we’re here to help you find yours.

If you’re ready to take that next step, or if you just want to explore your options without any commitment, we’re here. You can reach out to us any time, and we’ll walk you through everything. We’ll answer your questions, verify your coverage, and help you find a path forward that works for your life and your situation. You can also find out if your insurance covers rehab by visiting our dedicated page: Find out if your insurance covers rehab.

Recovery is possible. It starts with one decision, one phone call, one step forward. Let us help you take it.

Our helpline is 100%

free & confidential

If you or someone you care about is struggling with drug or alcohol addiction, we can help you explore your recovery options. Don’t face this challenge alone—seek support from us.

Programs

Resources

Will my insurance

cover addiction

treatment?

We're ready to help

Find the best

drug or alcohol treatment

center

Are you or a loved one struggling with addiction? Call today to speak to a treatment expert.