Understanding Ambetter Insurance Coverage for Alcohol and Drug Rehab

Ambetter Insurance Coverage for Alcohol and Drug Rehab offers significant support for those seeking addiction treatment. Here’s a quick overview:

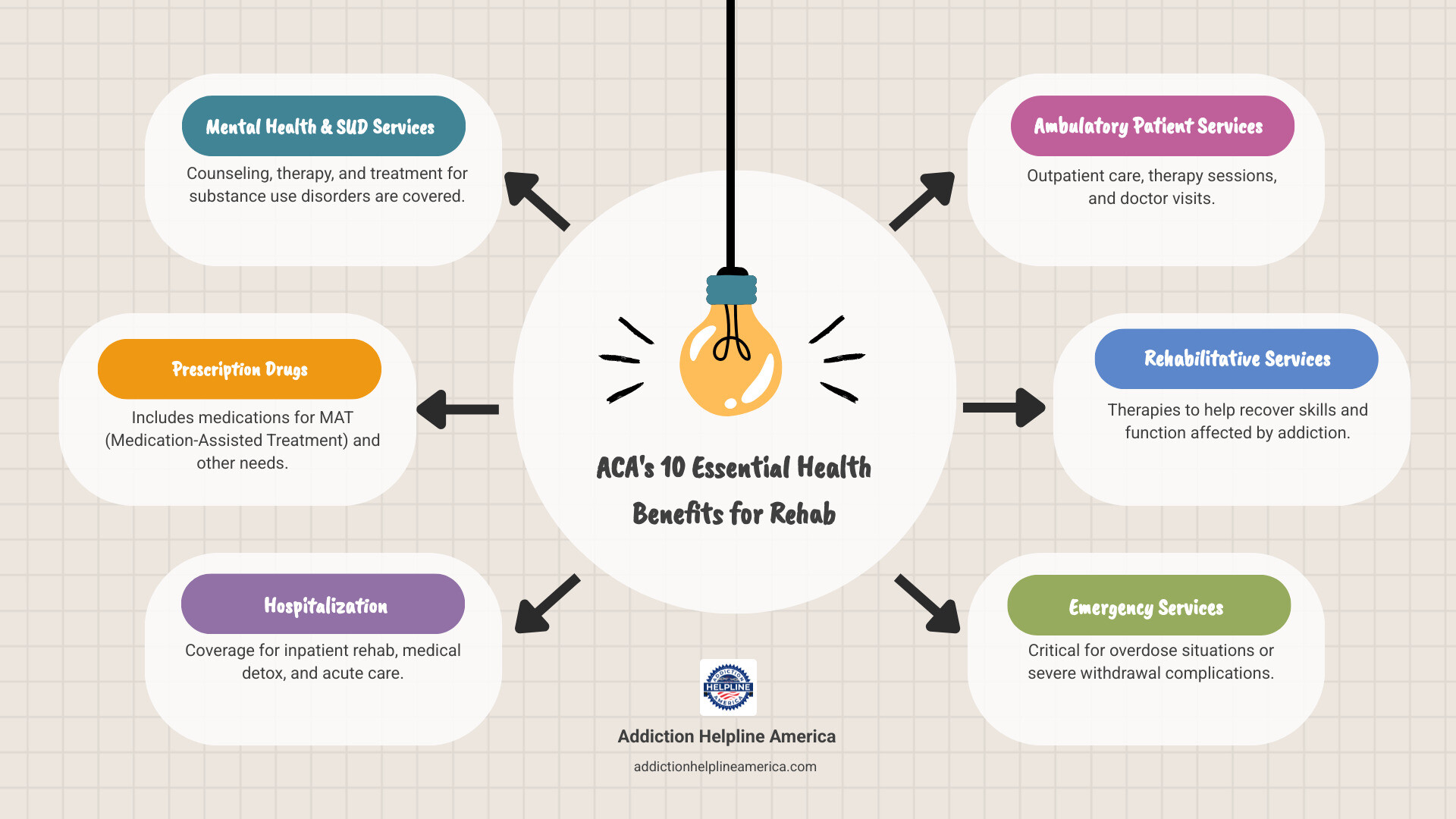

- Yes, Ambetter covers addiction treatment: As a Health Insurance Marketplace plan, Ambetter must cover substance use disorder treatment as an essential health benefit under the Affordable Care Act.

- Multiple treatment types are covered: This includes medical detox, inpatient and outpatient rehab, medication-assisted treatment (MAT), and mental health services.

- Three plan tiers: Choose from Bronze (lower premiums, higher costs), Silver (balanced costs), and Gold (higher premiums, lower costs).

- In-network providers reduce costs: Using facilities in Ambetter’s network saves you money.

- Pre-authorization may be needed: Some treatments require approval before you start.

When you’re struggling with addiction, the cost of rehab can feel overwhelming. Ambetter health insurance, offered through Centene Corporation to over 2 million people, provides comprehensive benefits to ease that burden.

Under the Affordable Care Act (ACA) and the Mental Health Parity and Addiction Equity Act (MHPAEA), Ambetter is required to cover mental and substance use disorders just as it would other medical conditions, ensuring you have financial support for your recovery.

This guide explains what your Ambetter plan covers, your potential out-of-pocket costs, and how to access treatment. At Addiction Helpline America, we specialize in helping people steer their Ambetter Insurance Coverage for Alcohol and Drug Rehab to find the right program. Our team understands the urgency and is here to help.

Understanding Your Ambetter Plan: Coverage Tiers and Costs

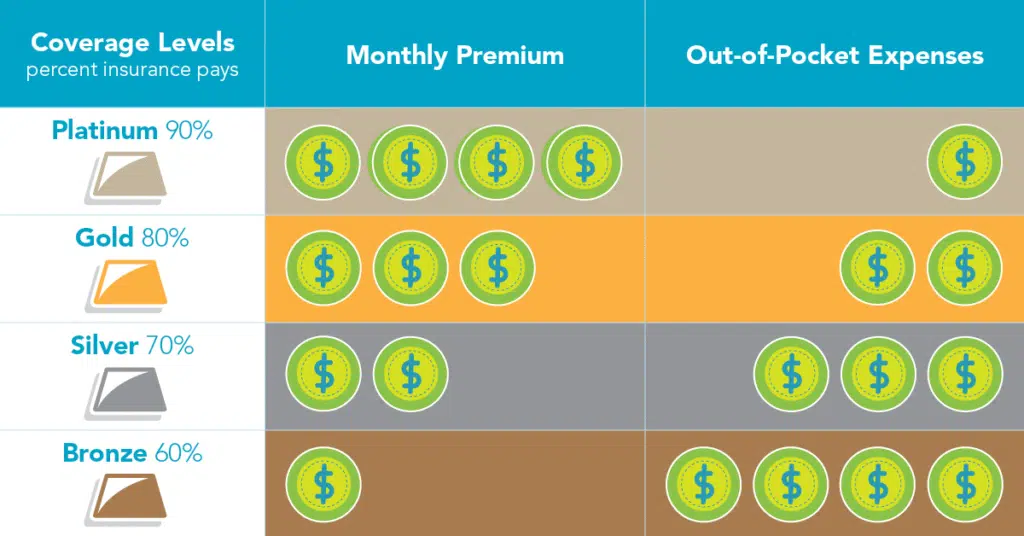

Understanding your Ambetter plan is essential when considering addiction treatment. Ambetter Insurance Coverage for Alcohol and Drug Rehab varies by plan tier, balancing your monthly premium against your out-of-pocket costs when you need care.

Ambetter offers three main plan tiers—Bronze, Silver, and Gold. Your choice directly impacts how much you’ll pay for rehab services.

| Plan Tier | Typical Premium | Deductible (Individual) | Coinsurance | Best For… |

|---|---|---|---|---|

| Bronze | Lower | Higher ($1,500 – $7,000+) | Higher (e.g., 50%) | Healthy individuals who rarely visit the doctor and want lower monthly payments. |

| Silver | Moderate | Moderate ($2,000 – $6,000) | Moderate (e.g., 30%) | Those who expect some medical care, might qualify for cost-sharing reductions, and want a balance between premiums and out-of-pocket costs. |

| Gold | Higher | Lower ($0 – $2,000) | Lower (e.g., 0-20%) | Individuals who anticipate frequent medical needs or high-cost care, preferring higher monthly payments for predictable, lower costs when receiving services. |

Note: These numbers are examples and can vary significantly based on your specific Ambetter plan, state, and location. Always check your plan’s Summary of Benefits and Coverage for exact details.

Ambetter Bronze, Silver, and Gold Plans Explained

Ambetter Essential Care (Bronze) plans have lower monthly premiums but higher deductibles and out-of-pocket costs. They are a good fit for generally healthy individuals who want protection for major health events and can handle higher costs when treatment is necessary.

Ambetter Balanced Care (Silver) plans offer a balance between monthly premiums and out-of-pocket expenses. Importantly, Silver plans are the only tier eligible for cost-sharing reductions if your income qualifies. These reductions can significantly lower your deductibles and copayments, making addiction treatment much more affordable. For many, Silver plans offer the best value for rehab coverage.

Ambetter Secure Care (Gold) plans feature higher monthly premiums in exchange for much lower costs when you need care. Some Gold plans have $0 deductibles, meaning coverage starts immediately. If you anticipate needing extensive addiction treatment, a Gold plan can save you money overall by providing predictable costs.

Key Out-of-Pocket Costs for Rehab

Understanding these four terms will help you predict your rehab costs:

- Deductible: The amount you must pay for covered services before Ambetter begins to pay. For example, with a $3,000 deductible, you pay the first $3,000. Higher-tier plans usually have lower deductibles.

- Copayment (Copay): A fixed amount you pay for a specific service, like $40 for a therapy session. You pay this directly to the provider each time.

- Coinsurance: The percentage of costs you share with Ambetter after meeting your deductible. If your coinsurance is 20%, Ambetter pays 80% of the bill and you pay 20%.

- Out-of-Pocket Maximum: Your financial safety net. This is the absolute most you will pay for covered services in a year. Once you reach this limit, Ambetter pays 100% of covered costs for the rest of the year, providing a ceiling on your expenses.

At Addiction Helpline America, we help people steer these costs daily. Understanding your Ambetter Insurance Coverage for Alcohol and Drug Rehab is the first step toward getting the help you need without financial worry.

What Addiction Treatments Does Ambetter Cover?

Ambetter Insurance Coverage for Alcohol and Drug Rehab is comprehensive, covering a full spectrum of services. Thanks to the Affordable Care Act, Ambetter plans must treat addiction like any other medical condition. Coverage is determined by what is medically necessary, often using the American Society of Addiction Medicine (ASAM) criteria to ensure you receive evidence-based care.

Ambetter covers a continuum of care, meaning different levels of treatment that can adapt to your changing needs. Since 2020, over 1,500 people have successfully used their Ambetter coverage to access treatment, finding a path forward with real insurance support.

Medical Detoxification

For many, recovery starts with medical detoxification. When you stop using substances, withdrawal symptoms can be uncomfortable and even dangerous. Ambetter typically covers medical detox because it is often medically necessary for safety.

During detox, healthcare professionals monitor you 24/7, manage withdrawal symptoms with medication, and provide support. Inpatient detox offers this in a facility and is recommended for severe addictions (especially alcohol or benzodiazepines). Outpatient detox may be an option for milder cases, allowing you to live at home while receiving medical supervision.

Detox addresses the physical dependence, preparing you for the psychological work of recovery.

Inpatient and Residential Rehab

Inpatient and residential rehab programs provide a structured, supportive environment away from daily triggers. Ambetter generally covers these intensive programs, which offer a strong foundation for lasting sobriety.

You’ll receive 24/7 care, individual and group therapy, and learn vital coping skills. Programs can last 30, 60, or 90 days, and Ambetter often covers longer stays if medically necessary. These programs allow you to focus entirely on healing. For more details on how insurance supports this care, see our Insurance Rehab Coverage Guide.

Outpatient Programs

Outpatient programs offer flexibility, allowing you to live at home and maintain work or family responsibilities while receiving treatment. They are an excellent starting point for some or a crucial step-down after inpatient care.

Ambetter typically covers several levels:

- Partial Hospitalization Programs (PHP): Intensive daily treatment while you live at home.

- Intensive Outpatient Programs (IOP): Several hours of therapy, a few days per week.

- Standard Outpatient Treatment: Weekly therapy sessions for ongoing support.

Outpatient care helps you apply recovery skills to real-world situations with professional guidance.

Medication-Assisted Treatment (MAT)

Addiction can alter brain chemistry. For opioid and alcohol use disorders, Medication-Assisted Treatment (MAT) can be life-saving. Ambetter typically covers MAT when medically necessary, as it is a highly effective, evidence-based approach.

MAT combines FDA-approved medications with counseling to treat addiction comprehensively. These medications, such as buprenorphine for opioid use disorder or naltrexone for alcohol use disorder, work by normalizing brain chemistry and reducing cravings. They are not a substitute for recovery but a tool to support it.

SAMHSA’s research confirms that MAT significantly improves long-term outcomes when paired with therapy.

Mental Health and Dual Diagnosis Treatment

Addiction often co-occurs with mental health conditions like anxiety, depression, or PTSD. This is known as a co-occurring disorder or dual diagnosis. Treating both simultaneously is critical for success.

Under federal law, Ambetter must cover mental health services on par with medical care. This means integrated treatment for dual diagnosis is typically covered. Ambetter covers effective behavioral therapies like:

- Cognitive Behavioral Therapy (CBT): Helps change destructive thought patterns.

- Dialectical Behavior Therapy (DBT): Teaches emotional regulation and distress tolerance.

As the National Institute of Mental Health notes, treating these conditions together leads to better outcomes. At Addiction Helpline America, we’ve seen how this holistic approach helps people achieve lasting recovery.

How to Use Your Ambetter Insurance Coverage for Alcohol and Drug Rehab

Using your Ambetter Insurance Coverage for Alcohol and Drug Rehab is manageable with a clear plan. At Addiction Helpline America, we’ve helped countless people through this process. We’ve broken it down into three straightforward steps to help you maximize your coverage and minimize surprise costs.

Step 1: Verify Your Specific Benefits

This first step is essential. Your specific coverage details vary based on your state, plan tier (Bronze, Silver, or Gold), and the specific plan you selected. Here’s how to verify your benefits:

- Review your Summary of Benefits and Coverage (SBC): This document details your plan’s coverage, including deductibles, copayments, and coinsurance.

- Call Ambetter: Use the phone number on your insurance card to speak with a representative. Ask detailed questions about coverage for medical detox, inpatient rehab, outpatient services, MAT, and mental health counseling.

- Use the online member portal: Log in to view your coverage details, track claims, and search for providers.

- Let a treatment center help: Most addiction treatment centers will verify your insurance benefits for you at no cost. They can provide a clear breakdown of what you’ll owe before you start treatment.

Step 2: Understand In-Network vs. Out-of-Network Care

This distinction is critical for managing costs. Choosing an in-network provider can save you thousands of dollars.

- In-network providers have contracts with Ambetter to provide services at pre-negotiated, lower rates. When you use an in-network facility, Ambetter pays a larger share of the bill, and your out-of-pocket costs are lower.

- Out-of-network providers do not have a contract with Ambetter. Using them for rehab can dramatically increase your costs. Some Ambetter plans offer limited out-of-network coverage, while others may offer none at all, leaving you responsible for the entire bill.

To avoid staggering costs, staying in-network is almost always the best financial choice. You can find in-network providers through Ambetter’s online directory or by asking treatment centers directly if they accept your plan.

Step 3: Get Pre-Authorization if Required

Pre-authorization (or prior authorization) is a process where Ambetter approves a treatment as medically necessary before you begin. This step is crucial to prevent your claim from being denied after you’ve already received care.

Your doctor or the treatment facility will submit a treatment plan to Ambetter for review. This plan justifies the need for a specific level of care. A detailed referral from your doctor explaining your addiction history and symptoms can help streamline this process.

Pre-authorization is typically required for inpatient, residential, PHP, and IOP programs under most Ambetter plans. It’s always best to confirm whether it’s needed for any service.

The good news is that reputable treatment centers handle pre-authorization as a standard part of their intake process. Their staff will work directly with Ambetter to secure the necessary approvals, allowing you to focus on your recovery.

At Addiction Helpline America, we can help you with all these steps. Our team can verify your benefits, find in-network options, and connect you with facilities that will handle the authorization process for you.

Frequently Asked Questions about Ambetter Rehab Coverage

Navigating insurance can be confusing. Here are clear answers to common questions about Ambetter Insurance Coverage for Alcohol and Drug Rehab.

How does Ambetter’s rehab coverage work compared to other insurance options?

As a Health Insurance Marketplace plan, Ambetter must follow Affordable Care Act (ACA) and Mental Health Parity and Addiction Equity Act (MHPAEA) rules. This means it must cover substance use disorder treatment as an essential health benefit, on par with medical or surgical care.

Compared to other insurance types, the details can differ. Employer-sponsored plans may have different provider networks or cost structures. Government plans like Medicaid also offer robust coverage, and if you are eligible for both, Medicaid is typically your primary coverage. You cannot have both a Marketplace plan like Ambetter and Medicare simultaneously. Because Ambetter operates in 27 states, your specific coverage also depends on your location.

Ambetter provides solid, federally mandated coverage. For more context, see our Ambetter Insurance Coverage Guide, but always consult your specific plan documents for exact details.

How many times will Ambetter pay for addiction treatment?

Ambetter does not set a hard limit on the number of times it will cover addiction treatment. Instead, coverage is based on medical necessity. Addiction is a chronic disease, and relapse can be part of the recovery process. If a healthcare professional determines you need treatment again, your Ambetter plan can cover it, provided it meets the criteria for being medically necessary.

Each treatment episode is evaluated on its own merits. Whether it’s your first time seeking help or you need additional support, you are not automatically disqualified from coverage. Your costs will depend on your plan’s deductible and out-of-pocket status for the year. Needing treatment more than once does not prevent you from using your benefits.

Where can I find rehab centers that accept Ambetter Insurance?

You have several reliable options for finding a quality, in-network rehab center:

- Use Ambetter’s Provider Directory: Access the “Find a Provider” tool on your online member portal or your state’s Ambetter website to find in-network facilities, which will lower your costs.

- Call Treatment Centers Directly: Most facilities can quickly tell you if they accept Ambetter and can often verify your benefits over the phone.

- Check Your State-Specific Ambetter Website: Plans vary by state, so your local Ambetter site (e.g., Ambetter from Sunshine Health in Florida) will have the most accurate provider information.

- Contact Addiction Helpline America: Our free, confidential service simplifies the search. We understand Ambetter Insurance Coverage for Alcohol and Drug Rehab and can quickly connect you with a quality treatment center in our network that accepts your plan. We cut through the confusion to get you help fast.

Conclusion: Start Your Recovery Journey with Ambetter

This guide has shown how Ambetter’s plans cover a full range of addiction treatments and outlined the steps to use your benefits effectively. The key takeaway is that Ambetter Insurance Coverage for Alcohol and Drug Rehab provides the support you need to heal. Under federal law, substance use disorder treatment is an essential health benefit, meaning you are not facing the financial burden of recovery alone.

Recovery is within your reach. Don’t let worries about cost or confusion about insurance hold you back. The support you deserve is available now, and we’ve seen over 1,500 Ambetter members access treatment since 2020.

At Addiction Helpline America, we remove the barriers between you and treatment. Our service is free, confidential, and personalized to your specific Ambetter plan and needs. We will help you understand your benefits and connect you with a quality, in-network treatment center.

Taking the first step is the hardest part, but you don’t have to do it alone. We are here to answer your questions and make the path to recovery as clear as possible. Recovery is happening every day for people just like you.

Reach out today. Let us help you use your Ambetter benefits to find the right program for your journey.

Find out if your insurance covers rehab today

Our helpline is 100%

free & confidential

If you or someone you care about is struggling with drug or alcohol addiction, we can help you explore your recovery options. Don’t face this challenge alone—seek support from us.

Programs

Resources

Will my insurance

cover addiction

treatment?

We're ready to help

Find the best

drug or alcohol treatment

center

Are you or a loved one struggling with addiction? Call today to speak to a treatment expert.