Understanding Your Coverage: Does BCBS Pay for Addiction Treatment?

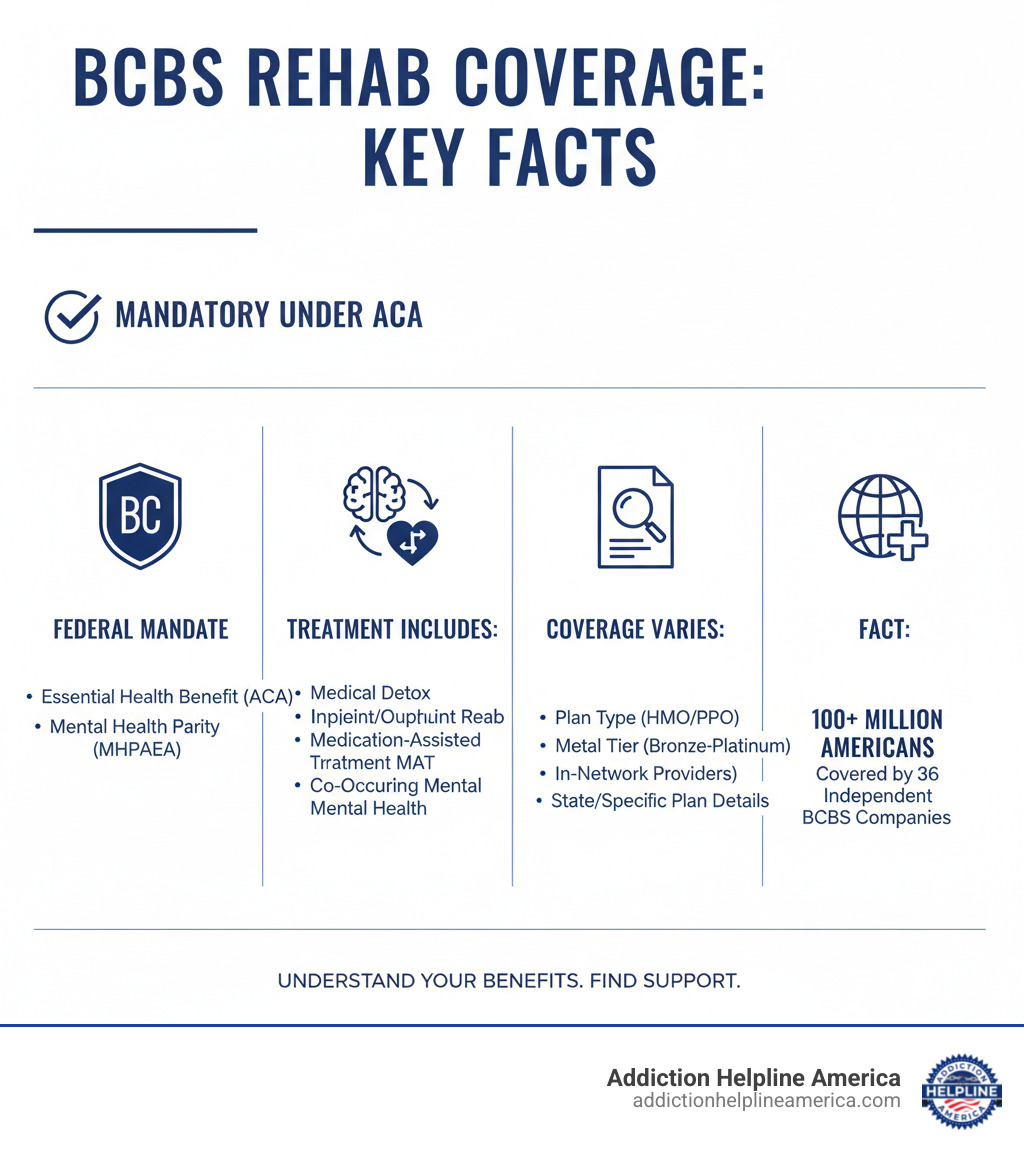

Does Blue Cross Blue Shield Cover Drug & Alcohol Rehab? Yes. Blue Cross Blue Shield (BCBS) plans cover drug and alcohol rehab as an essential health benefit under the Affordable Care Act (ACA). However, the level of coverage depends on your specific plan, state, and treatment needs.

Quick Answer:

- ✓ Medical Detox – Covered when medically necessary

- ✓ Inpatient/Residential Treatment – Typically covered with pre-authorization

- ✓ Outpatient Programs (PHP, IOP, OP) – Generally covered

- ✓ Medication-Assisted Treatment (MAT) – Usually covered

- ✓ Co-Occurring Mental Health – Covered under mental health parity laws

- Note: Coverage levels depend on your plan type (HMO vs. PPO), metal tier (Bronze, Silver, Gold, Platinum), and whether you use in-network providers.

BCBS provides health coverage to over 100 million Americans through a federation of 36 independent companies. While all plans must cover addiction treatment, the specifics—like deductibles and copays—vary. Federal laws like the Mental Health Parity and Addiction Equity Act (MHPAEA) ensure that substance use disorder treatment is covered at the same level as other medical care, meaning your insurance should provide meaningful support for your recovery.

At Addiction Helpline America, we specialize in helping families steer the complexities of insurance for addiction treatment. This guide breaks down what BCBS covers, how to verify your benefits, and how to find a quality treatment center that accepts your plan.

What Types of Addiction Treatment Services Does BCBS Typically Cover?

BCBS plans generally cover a full continuum of care to address various stages of recovery. The specific services covered depend on your plan and medical necessity.

Here’s a list of services BCBS typically covers:

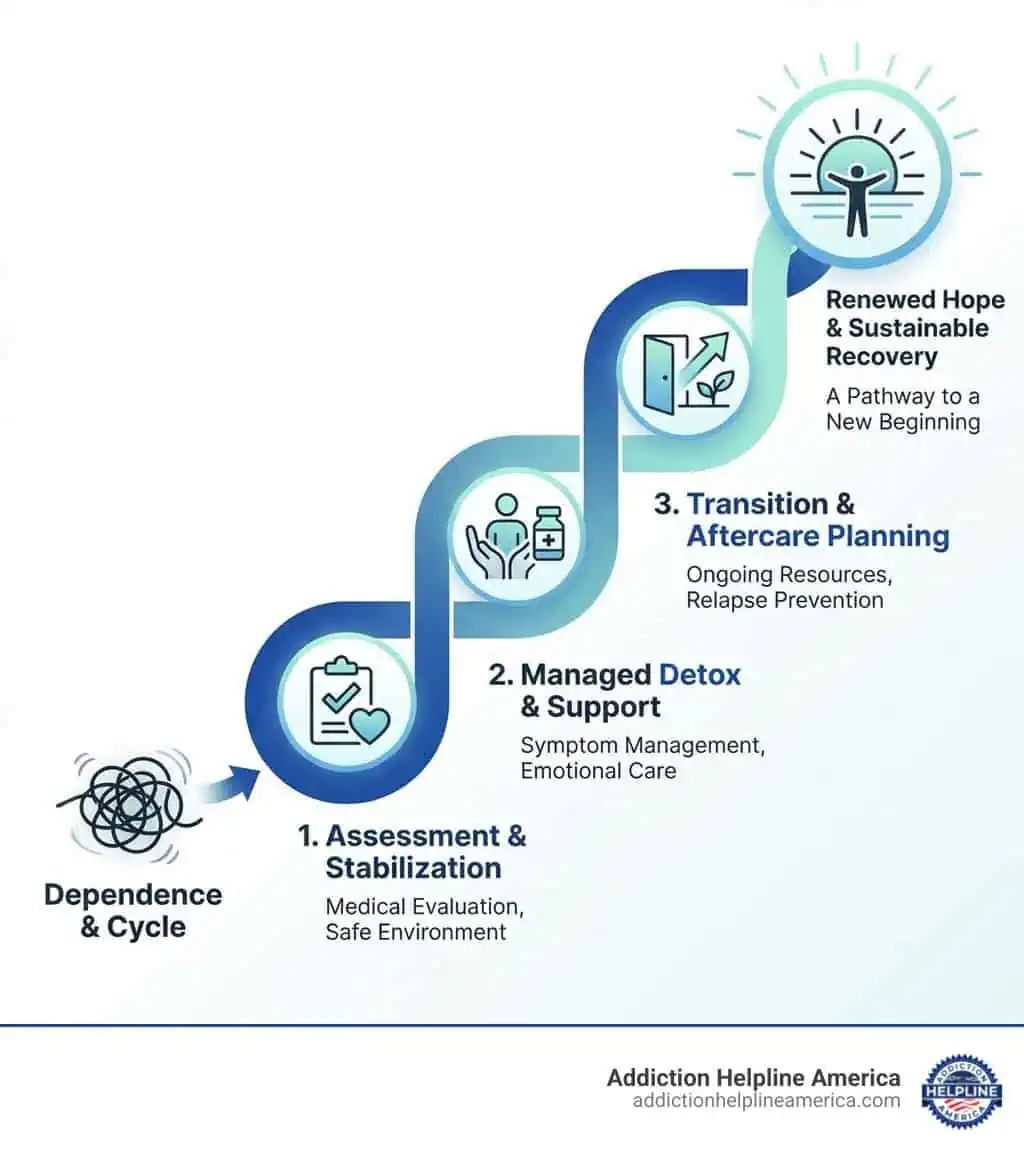

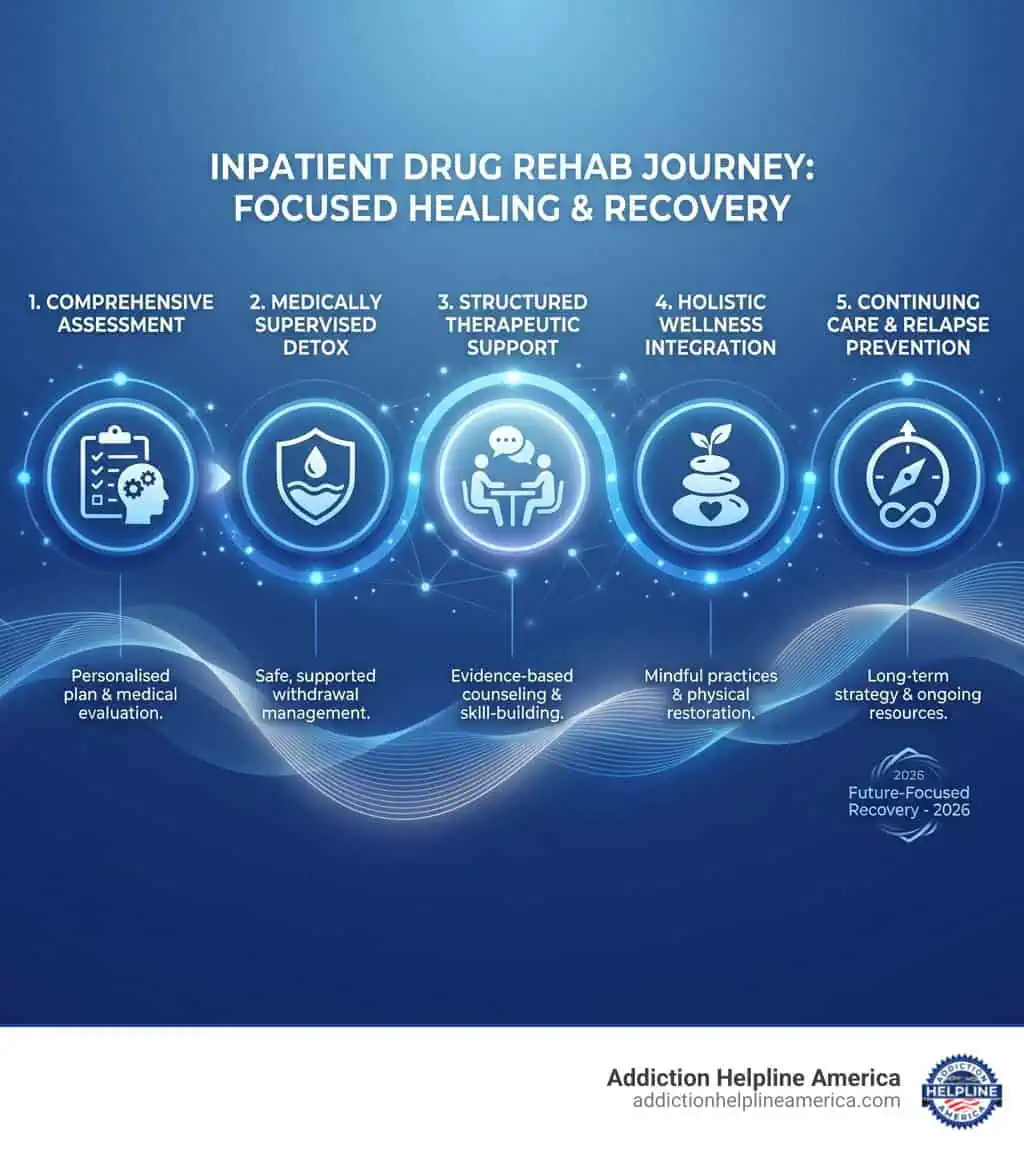

- Medical Detoxification (Detox): Supervised withdrawal in a safe environment, often with medication to manage symptoms. It is covered when deemed medically necessary. Learn more about the Detoxification Process.

- Inpatient/Residential Treatment: Provides 24/7 care in a structured, therapeutic facility. Pre-authorization is usually required. Explore this level of care on our Residential Treatment page.

- Partial Hospitalization Programs (PHP): A high level of structured care during the day, allowing patients to return home in the evenings.

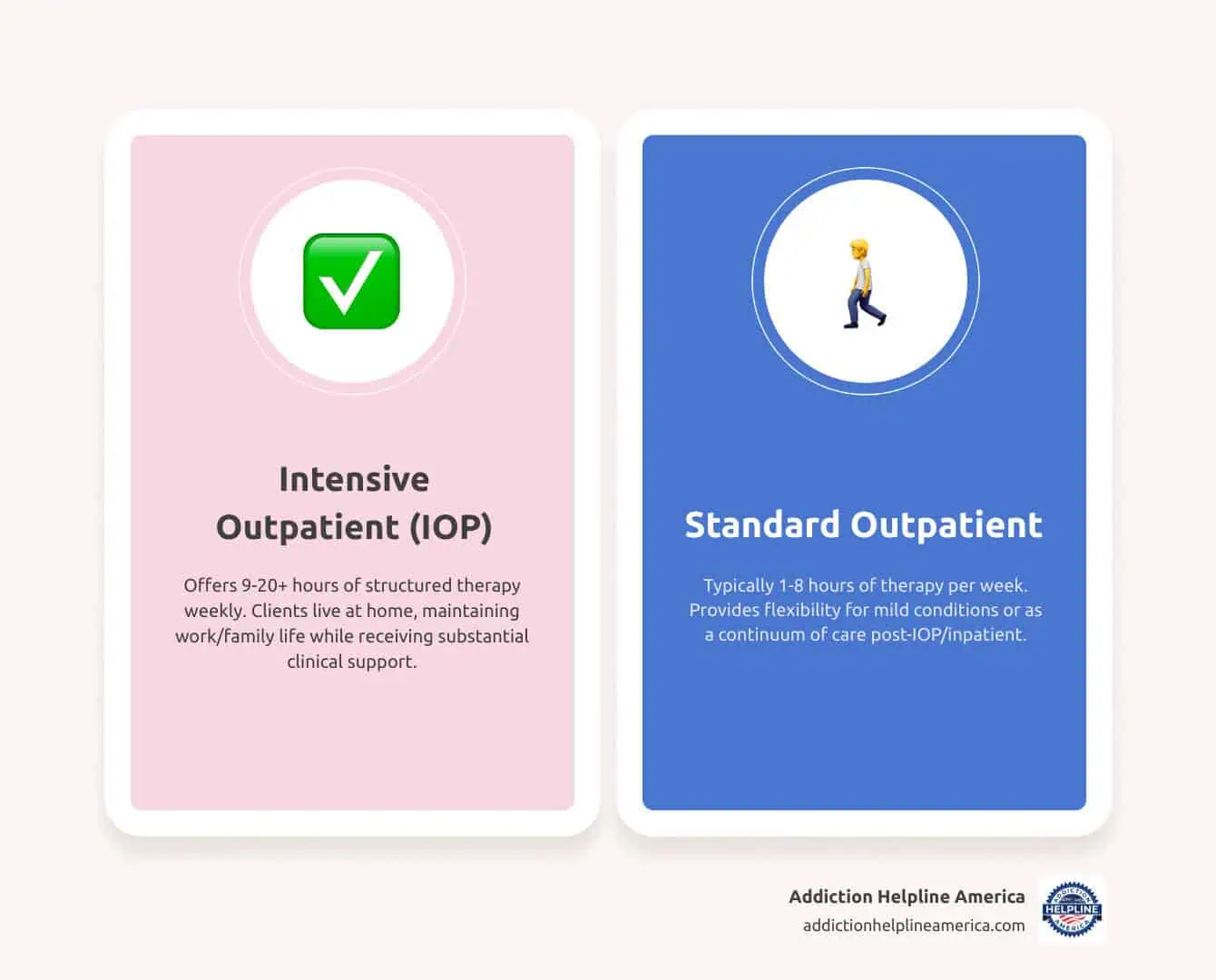

- Intensive Outpatient Programs (IOP): Flexible treatment schedules with fewer hours than PHP, allowing individuals to maintain work or family responsibilities.

- Standard Outpatient Programs (OP): The least intensive level of care, often used as a step-down from more intensive programs.

- Medication-Assisted Treatment (MAT): Combines FDA-approved medications (like Suboxone, Methadone, and Vivitrol) with counseling. It is widely covered for opioid and alcohol use disorders.

- Therapy and Counseling: Individual, group, and family therapy are fundamental components of treatment and are typically covered.

- Aftercare Planning and Support: Plans often support services that facilitate long-term recovery, such as ongoing therapy.

Does BCBS Cover Treatment for Co-Occurring Disorders?

Yes. Many people with a substance use disorder also have a co-occurring mental health condition like depression, anxiety, or PTSD, known as a “dual diagnosis.” Thanks to the Mental Health Parity and Addiction Equity Act (MHPAEA), BCBS is required to cover mental health services at the same level as medical care.

This means your plan should cover integrated treatment, which addresses both the substance use disorder and the mental health condition simultaneously. This holistic approach is the gold standard of care. We can help you find facilities that specialize in treating co-occurring disorders within your BCBS network. For more information, see our Rehab Center for Depression Guide.

How Your Specific BCBS Plan Affects Rehab Coverage

Not all BCBS plans are the same. Because BCBS is a federation of 36 independent companies, your specific coverage for rehab depends on your plan type, its metal tier, and your choice of providers. Understanding these factors is key to managing your treatment costs. You can learn more about how BCBS is structured through their official page on BCBS Companies and Licensees.

Comparing Plan Types: HMO vs. PPO

Your plan type—HMO or PPO—determines how you access care and what it costs.

- HMO (Health Maintenance Organization): These plans require you to use providers within a specific network and get a referral from a Primary Care Physician (PCP) to see a specialist or enter rehab. While more restrictive, HMOs generally have lower monthly premiums and out-of-pocket costs.

- PPO (Preferred Provider Organization): These plans offer more flexibility, allowing you to see both in-network and out-of-network providers without a referral. This freedom comes with higher monthly premiums, and you’ll pay significantly more for out-of-network care.

For addiction treatment, an HMO requires you to find an in-network facility. With a PPO, you have more choices, but staying in-network is the most cost-effective option.

Understanding Metal Tiers: Bronze, Silver, Gold, and Platinum

If you have a marketplace plan, it’s categorized by a metal tier, which indicates how you and your plan share costs.

- Bronze: Lowest monthly premium, but highest out-of-pocket costs. Covers about 60% of your medical expenses.

- Silver: A middle ground with moderate premiums and costs. Covers about 70% of expenses.

- Gold: Higher monthly premiums, but lower costs when you need care. Covers about 80% of expenses.

- Platinum: Highest premium, but the most comprehensive coverage. Covers about 90% of expenses.

While all tiers cover addiction treatment, your financial responsibility will vary greatly. A Gold or Platinum plan means lower costs during treatment, while a Bronze or Silver plan has lower monthly payments. For more details, BCBS offers a helpful explanation at What is the Difference between Bronze, Silver and Gold Plans?.

What Factors Influence How Much BCBS Covers for Drug & Alcohol Rehab?

Several other variables affect your final bill for addiction treatment:

- Medical Necessity: Your plan will only cover treatment that a healthcare professional deems medically necessary based on a clinical assessment.

- Length of Stay: Longer programs require stronger medical justification to ensure continued coverage.

- Level of Care: BCBS covers the level of care that is clinically appropriate for your condition, whether it’s inpatient, outpatient, or another setting.

- In-Network vs. Out-of-Network Status: Choosing an in-network facility always results in lower costs. Out-of-network care is significantly more expensive and may not be covered at all by some plans.

- Specific Policy Details: Every policy has unique benefit limits and exclusions. It’s important to review your plan documents.

- Type of Facility: Insurance covers medically necessary treatment, not luxury extras like spa services or gourmet meals often found in Luxury Rehab Programs.

Navigating Costs and the Approval Process with BCBS

Once you understand your plan, the next step is to steer the costs and approval process. While BCBS provides coverage, you will likely have some out-of-pocket expenses. Here’s a breakdown of what to expect.

What Are the Potential Out-of-Pocket Costs?

Even with good insurance, you’ll have some personal costs. Understanding them upfront helps you plan and avoid surprises.

- Deductible: The amount you must pay for covered services before your insurance plan starts to pay.

- Copayment (Copay): A fixed amount you pay for a covered health care service after you’ve paid your deductible.

- Coinsurance: The percentage of costs you pay for a covered health service after your deductible is met.

- Out-of-Pocket Maximum: The most you have to pay for covered services in a plan year. After you reach this limit, your insurance pays 100% of the cost of covered benefits.

These costs vary significantly based on your plan’s metal tier and whether you stay in-network. BCBS provides helpful resources explaining these concepts in more detail at How Do Deductibles, Coinsurance, and Copays Work?.

The Approval Process: Pre-Authorization and Documentation

For many services, especially inpatient or residential programs, you’ll need pre-authorization (or prior authorization) from BCBS before starting treatment. This process ensures the care you receive is medically necessary.

It begins with a clinical assessment from a healthcare professional. The treatment facility then submits documentation—including your medical history, diagnosis, and treatment plan—to BCBS for review. The facility’s admissions team typically handles this for you.

Always get pre-authorization before starting treatment. Skipping this step can lead to a denial of coverage, leaving you responsible for the full cost. Reputable treatment centers have experienced staff who can guide you through this process. For more guidance on admissions, check out our How to Get Into Rehab resource.

What Are Common Limitations or Exclusions?

While BCBS coverage is comprehensive, some limitations and exclusions apply. Being aware of them helps set realistic expectations.

- Experimental Treatments: Only evidence-based therapies with proven effectiveness are covered.

- Non-Medical Amenities: Luxury services like gourmet meals, private suites, or spa treatments are not covered by insurance.

- Out-of-Network Penalties: Using an out-of-network provider results in much higher costs or no coverage at all, depending on your plan.

- Treatment Length: While there are no hard caps, longer stays require ongoing medical justification to extend coverage.

- Lack of Medical Necessity: BCBS may deny a higher level of care if a less intensive option is deemed clinically appropriate.

- Administrative Denials: These can occur due to paperwork errors and are often resolvable through an appeal. If you’re exploring all options, our Free Addiction Programs Complete Guide provides information on alternative resources.

So, Does Blue Cross Blue Shield Cover Drug & Alcohol Rehab? A Step-by-Step Guide to Finding Care

Now that you understand the basics of your BCBS coverage, here is a step-by-step guide to finding a treatment center and starting your recovery journey. With the right information, you can quickly locate quality care. BCBS also provides tools like their provider search to help you Find a doctor or facility.

Step 1: Verify Your Specific BCBS Coverage

Before doing anything else, confirm your exact benefits. The quickest way is to call the member services number on your insurance card or log into your BCBS online portal. You can also review your Summary of Benefits and Coverage (SBC) document.

Be ready to ask about:

- Your deductible, copays, and coinsurance for substance abuse treatment.

- Pre-authorization requirements.

- In-network vs. out-of-network costs.

- Your out-of-pocket maximum.

For additional contact options, you can visit BCBS Member Services. At Addiction Helpline America, we can also help you interpret your benefits.

Step 2: How Do I Find a Rehab Center That Accepts My BCBS Plan for Drug & Alcohol Rehab?

Once you know your coverage, it’s time to find a suitable treatment center. Here’s how:

- Use the BCBS provider directory: Search their website for in-network behavioral health facilities. This ensures you’re looking at providers with pre-negotiated rates.

- Look for Blue Distinction Centers: This designation is awarded by BCBS to facilities that meet high standards for quality care and patient outcomes. Learn more at the official Blue Distinction program page.

- Contact Addiction Helpline America: Our team can help you identify reputable, in-network centers that match your clinical needs. Our Find Drug Rehab Center Guide is a great place to start.

Step 3: Contact the Rehab Facility

After you’ve identified potential centers, reach out to their admissions department. They are experienced in working with insurance and can guide you smoothly through the next steps.

They will typically:

- Conduct a confidential assessment to understand your needs.

- Handle the insurance verification process for you by contacting BCBS directly.

- Provide a clear estimate of your out-of-pocket costs.

Always confirm the facility is in-network with your specific BCBS plan to avoid surprise bills. If you need immediate, confidential guidance, our team is available through our Addiction & Rehab Hotlines.

Frequently Asked Questions About BCBS and Rehab

Navigating insurance can be confusing. Here are clear, honest answers to some of the most common questions we hear about BCBS coverage for rehab.

How long will BCBS cover my rehab stay?

There is no universal time limit. The length of your stay is determined by medical necessity, based on what your clinical team determines is essential for your recovery. This could be a 30, 60, or 90-day program, or another duration. The treatment facility will work with BCBS to authorize the appropriate length of stay and request extensions if continued care is medically necessary.

Does BCBS cover out-of-state rehab programs?

Yes, but coverage depends on your plan type. PPO plans offer the most flexibility for out-of-state care, especially through the BlueCard Program, which provides access to a national network of providers. HMO plans are more restrictive and typically only cover out-of-state care in emergencies. Always verify your out-of-state benefits with BCBS before making a decision.

What if my BCBS claim for rehab is denied?

A denial is not the final word. You have the right to appeal.

- Understand the reason for the denial. BCBS is required to provide a clear explanation.

- Work with your treatment provider to file an internal appeal. They can submit additional documentation and a letter of medical necessity to support your case.

- If the internal appeal fails, request an external review. An independent third party will evaluate your case and make a binding decision.

Many denials, especially those due to administrative errors, are successfully overturned through the appeals process. Persistence is key. At Addiction Helpline America, we can offer guidance if you’re facing a denied claim.

Your Path to Recovery Starts Here

Navigating insurance while dealing with addiction is tough, but you don’t have to do it alone. At Addiction Helpline America, we simplify the process of finding treatment that accepts your BCBS plan.

Our team offers free, confidential guidance to connect you with the right program from our nationwide network of vetted treatment centers. We handle the insurance verification and help you understand your costs, so you can focus on what matters most: your recovery.

Taking the first step is often the hardest part, but you’ve already shown courage by seeking information. Let us help you turn that courage into action. Your journey to a healthier, substance-free life can start today.

Our helpline is 100%

free & confidential

If you or someone you care about is struggling with drug or alcohol addiction, we can help you explore your recovery options. Don’t face this challenge alone—seek support from us.

Programs

Resources

Will my insurance

cover addiction

treatment?

We're ready to help

Find the best

drug or alcohol treatment

center

Are you or a loved one struggling with addiction? Call today to speak to a treatment expert.