Understanding How to Verify Rehab Insurance Without the Overwhelm

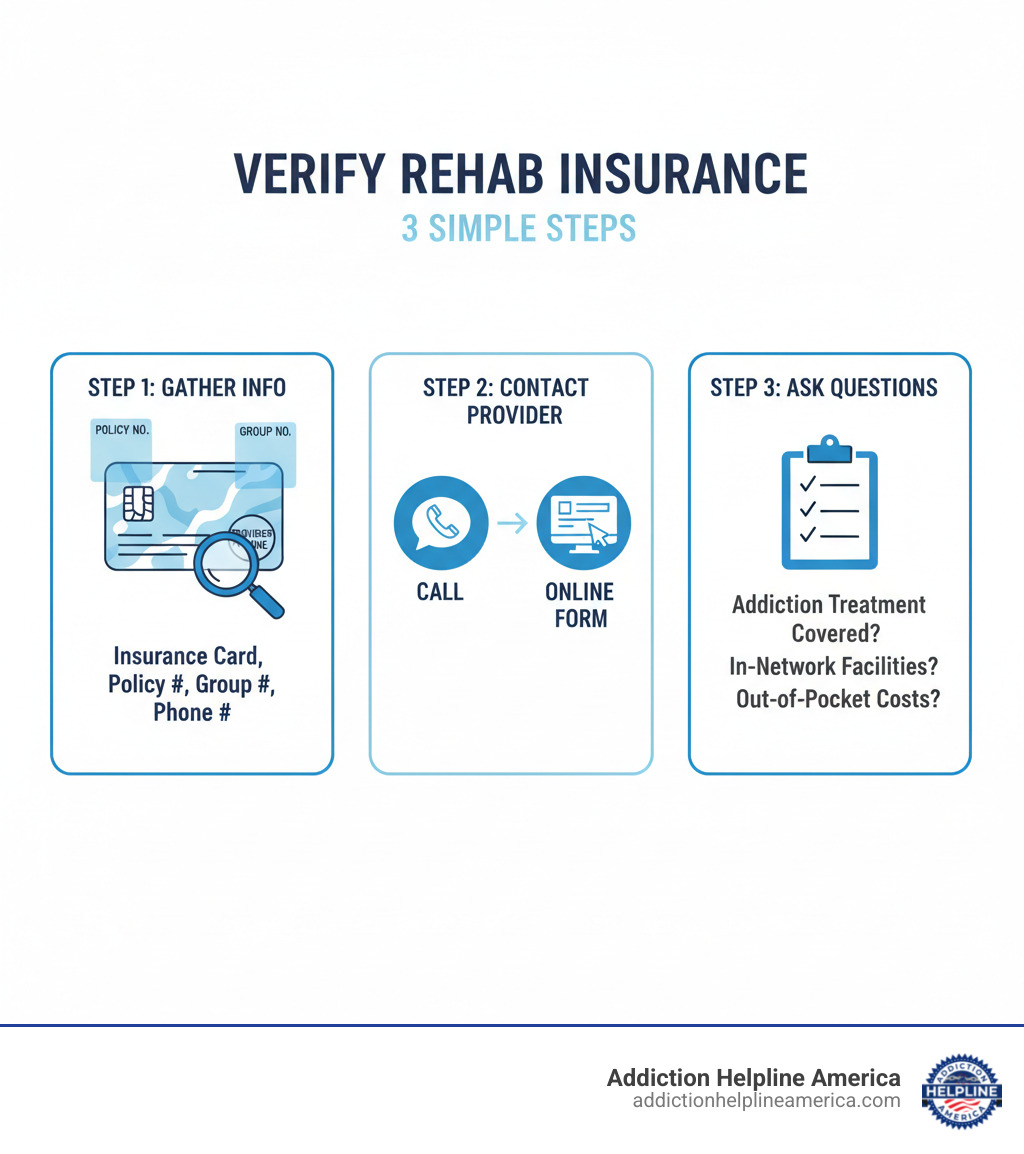

Trying to verify rehab insurance can feel overwhelming, but the process is more straightforward than you might think. Here’s a quick overview:

Quick Answer: How to Verify Rehab Insurance

- Gather your information – Get your insurance card and note the policy number, group number, and provider phone number.

- Contact your insurance company – Call the number on your card or use an online verification tool from a treatment center.

- Ask specific questions – Find out if addiction treatment is covered, which facilities are in-network, and what your out-of-pocket costs will be.

- Get it in writing – Request confirmation of your benefits via email or mail.

The cost of rehab shouldn’t stop you from getting help. Thanks to federal law, most insurance plans now cover addiction treatment as an essential health benefit. Since 2020, over 29,000 people have used their insurance for treatment, and verification forms were filled out over 12,000 times in 2024 alone.

Many worry that checking coverage will alert their employer, but the process is confidential and protected by federal privacy laws. It can often be completed in under 15 minutes. Understanding your insurance removes a major barrier to treatment. As one person shared, “It opened up options I didn’t know I had. I’ve been sober for over a year now.”

At Addiction Helpline America, we’ve helped thousands steer the insurance verification process. Our team connects callers with treatment resources and clarifies coverage options, making the path to recovery more accessible.

Handy Verify rehab insurance terms:

Why Your Health Insurance Likely Covers Addiction Treatment

If you’re hesitant to verify rehab insurance because you assume it’s not covered, you might be surprised. Thanks to major changes in healthcare law, substance abuse treatment is now a fundamental part of most insurance plans. In 2024 alone, over 8,000 people have used their insurance to access treatment at facilities nationwide, showing how much coverage has expanded.

Two key federal laws are responsible for this shift:

-

The Affordable Care Act (ACA): When the ACA became law, it classified substance abuse treatment as an “essential health benefit.” This means that since 2014, most health insurance plans must provide coverage for drug and alcohol rehab. This requirement fundamentally changed access to addiction treatment options across the country.

-

The Mental Health Parity and Addiction Equity Act (MHPAEA) of 2008: This law established that insurance coverage for mental health and substance use disorders must be equal to coverage for physical health conditions. Insurers cannot impose stricter limits or higher costs for addiction treatment than for other medical care, like treatment for diabetes or a broken bone. For most group health plans, this parity is the law.

Your privacy is also protected by federal law. Many people worry that verifying insurance will alert their employer, but this is a common misconception. A strict privacy regulation, 42 CFR Part 2, requires your written consent before a treatment program can release any records that identify you as a patient. This is designed to reduce stigma and remove fear as a barrier to getting help.

This means you’re starting from a strong position when you verify rehab insurance. Most plans include these benefits, and they must be comparable to other medical coverage. The next step is simply asking the right questions to understand your specific plan.

The Step-by-Step Guide to Verify Rehab Insurance

When you’re ready for recovery, the most practical first step is to verify rehab insurance coverage. This process gives you clarity and peace of mind about the financial side of treatment. Over 12,000 people have already filled out verification forms in 2024, taking this same step.

The process involves gathering your insurance details, choosing a verification method, and asking the right questions.

Step 1: Gather Your Insurance Information

Before you start, find your insurance card. It contains all the key information you’ll need.

Have this information ready:

- Policyholder’s name and date of birth

- Insurance company name (e.g., Aetna, Cigna, etc.)

- Policy number (or member ID)

- Group number (if applicable)

- Provider phone number (usually on the back of the card)

Having this ready will make the process much smoother.

Step 2: Choose Your Verification Method

You have three main options for verifying your coverage. Choose the one that feels most comfortable for you.

-

Call your insurance company directly: Use the member services number on your card. A representative can provide the most detailed, personalized information about your plan’s coverage for substance abuse treatment.

-

Use a rehab’s online verification tool: Many treatment centers offer confidential forms on their websites. You enter your insurance details and get a quick, private assessment of your coverage. This often happens without your insurer being contacted, giving you instant results without any commitment.

-

Call a helpline: A service like Addiction Helpline America provides personalized guidance. Our navigators can help you understand your policy, answer questions, and connect you with treatment options that match your coverage. We’re here to make the process less overwhelming. You can find help through our addiction and rehab hotlines anytime.

No matter which method you choose, your privacy is protected.

Step 3: Ask the Right Questions to Verify Rehab Insurance

Getting clear answers now prevents confusion and unexpected bills later. When verifying coverage, ask these specific questions:

- Coverage Basics: Does my plan cover substance abuse treatment, including detox and residential care? What are my in-network versus out-of-network benefits?

- Your Costs: What is my deductible, and have I met any of it? What is my copayment for services? What is my coinsurance percentage? What is my out-of-pocket maximum for the year?

- Plan Rules: Is pre-authorization required before starting treatment? Which levels of care are covered (detox, inpatient, PHP, IOP, outpatient)? Are there limits on the duration of treatment (e.g., number of days or sessions)?

- Provider Access: Can I get a list of in-network facilities? Is medication-assisted treatment (MAT) covered if my doctor recommends it?

These questions will give you a complete picture of your financial responsibility, allowing you to focus on recovery. For more on therapeutic approaches, see our guide on types of addiction therapy.

Understanding Your Rehab Insurance Plan

Once you verify rehab insurance, you’ll encounter terms that define your financial responsibility. Understanding these concepts helps you make confident decisions about treatment without worrying about surprise bills.

A few key concepts will give you the clarity needed to plan for your recovery with realistic financial expectations.

In-Network vs. Out-of-Network Coverage

One of the biggest factors affecting your costs is whether a rehab facility is “in-network” or “out-of-network.”

In-network facilities have a contract with your insurance company to provide services at a negotiated, lower rate. This means your insurance covers a larger share of the bill, and you pay significantly less. The facility also handles most of the billing directly with your insurer.

Out-of-network facilities do not have a contract with your insurer. Your plan might still offer some coverage, but usually at a lower percentage, leaving you with a higher bill. In some cases, your plan may not cover out-of-network care at all.

Your plan type, such as an HMO or PPO, also affects your choices. HMOs typically require you to stay within a specific network of providers, while PPOs offer more freedom to see out-of-network providers, but at a higher cost.

| Feature | In-Network | Out-of-Network |

|---|---|---|

| Cost to You | Lower (higher insurance coverage) | Higher (lower insurance coverage or none) |

| Provider Choice | Limited to contracted providers | More flexibility, but at a higher cost |

| Paperwork | Usually handled by the provider | Often requires you to file claims |

Our Finding a Rehab Centre Guide 2025 can help you find facilities that work with your insurance.

Decoding Common Insurance Terms

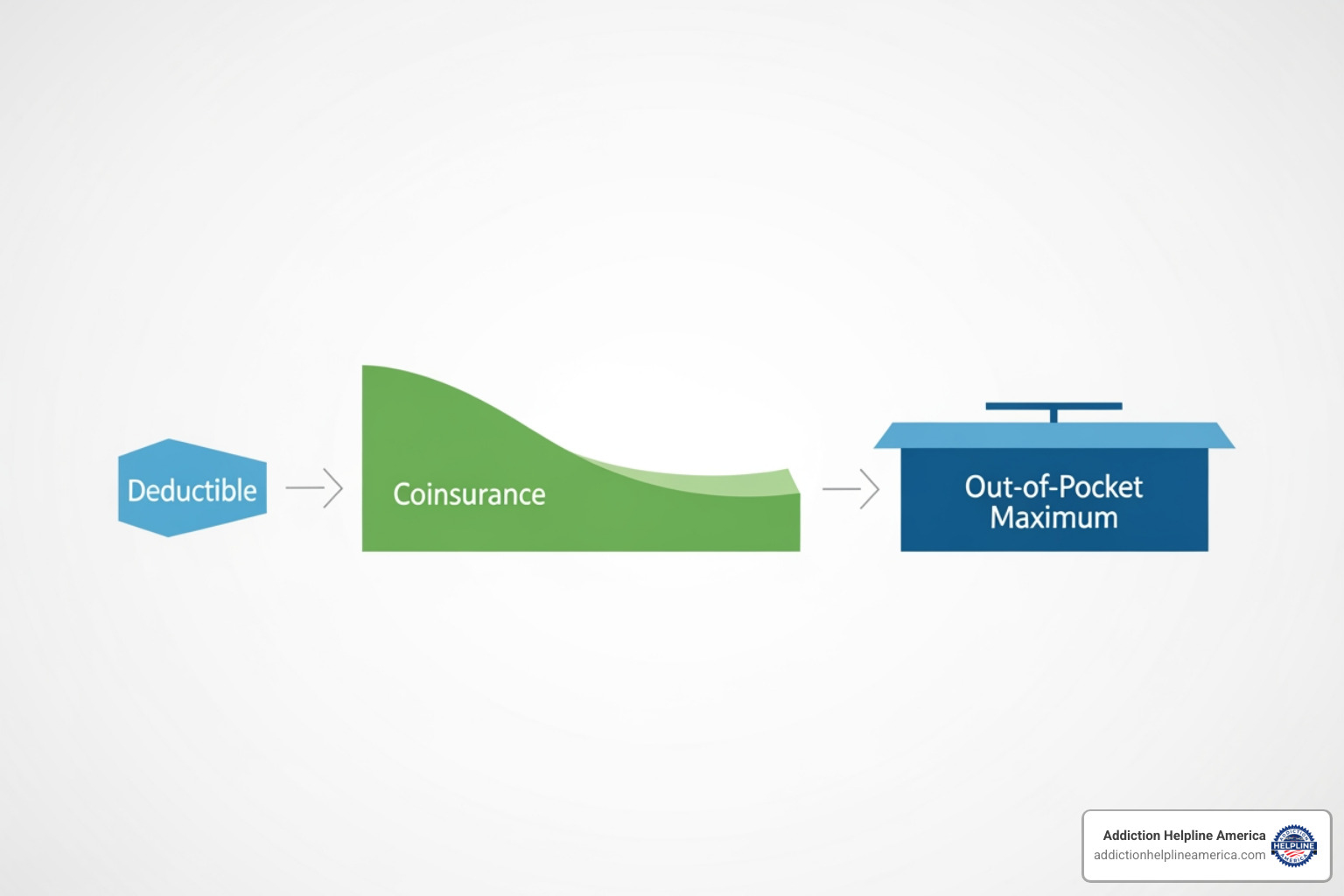

When you verify rehab insurance, you’ll hear these terms that directly affect what you pay:

-

Deductible: The amount you must pay out-of-pocket for covered services before your insurance plan starts to pay. For example, if your deductible is $3,000, you pay the first $3,000 of treatment costs. This amount typically resets annually.

-

Copayment (or Copay): A fixed amount you pay for a specific service, like a $40 fee for each therapy session. Copays are predictable and help with budgeting.

-

Coinsurance: The percentage of costs you pay for covered services after you’ve met your deductible. If your plan has 80/20 coinsurance, your insurer pays 80% and you pay 20%.

-

Out-of-Pocket Maximum: The absolute most you will have to pay for covered services in a plan year. Once you reach this limit, your insurance pays 100% of covered costs for the rest of the year. This protects you from catastrophic expenses.

Understanding these terms removes uncertainty and lets you focus on recovery, whether you’re exploring outpatient programs or specialized care like cocaine addiction treatment.

What to Do After Verifying Your Coverage

You’ve taken an important step by verifying your rehab insurance. Now you can turn that information into action. This is where you’ll work with treatment providers to create a plan for recovery.

If Your Insurance is Accepted

If your insurance is accepted, you’ve cleared a major hurdle. An admissions navigator from the treatment center will typically contact you to guide you through the next steps. They will explain your treatment options and confirm your financial responsibility. Over 78% of people who submit a verification form are accepted into one of our network facilities, showing a high success rate for those who take this step.

Before starting, confirm these details:

- Your program start date and expected duration.

- Any required paperwork or pre-admissions assessments.

- What to bring with you and what to leave at home.

- The exact amount you will need to pay out-of-pocket.

Once everything is set, you can focus on preparing for treatment. Our guide on How to Choose the Right Rehab can offer additional support during this stage.

What If You Have No Insurance or Coverage is Denied?

If you don’t have insurance or your coverage is denied, don’t lose hope. You still have many options for accessing affordable care.

- Payment Options: Many centers offer flexible payment plans, private financing, or accept major credit cards.

- State-Funded Programs: Most states offer publicly funded treatment through Medicaid or state grants for those with limited financial resources.

- Sliding-Scale Fees: Some facilities adjust their costs based on your income and ability to pay.

- Grants and Scholarships: Non-profit organizations sometimes offer financial aid that can cover a significant portion of treatment costs.

If your claim was denied, you have the right to appeal the decision. An admissions team can often help you with this process. Sometimes, an insurer denies a high level of care but will approve a lower one, like an intensive outpatient program (IOP).

No matter your financial situation, there is a path forward. Our Free Rehab Centers Near Me Complete Guide provides detailed information on low-cost and no-cost treatment options.

Frequently Asked Questions about Verifying Rehab Insurance

How can I quickly find out if my specific insurance plan covers rehab?

To quickly verify rehab insurance, you have three main options:

- Call your insurance provider: Use the member services number on your insurance card. A representative can give you the most accurate details about your specific plan’s coverage for substance abuse treatment.

- Use an online verification tool: Many treatment centers offer confidential online forms. You can submit your insurance details and get immediate, private feedback on your coverage, often without your insurer being contacted.

- Contact a treatment center’s admissions team: Admissions professionals work with insurance companies daily and can quickly verify your benefits while answering questions about their programs.

Our team at Addiction Helpline America can assist you with any of these methods. For insights on treatment lengths, see our guide on 30 Day Inpatient Program Tips 2025.

Is the insurance verification process confidential?

Yes, the process is confidential and protected by federal law. HIPAA (Health Insurance Portability and Accountability Act) sets strict rules about who can access your health information. Your employer will not be notified when you check your benefits.

For addiction treatment specifically, an even stricter law, 42 CFR Part 2, provides extra protection. It requires your written consent before a treatment program can release any information that identifies you as a patient. This is designed to reduce stigma and encourage people to seek help without fear. Your privacy is a top priority throughout the verification process. For more on privacy rights, you can visit cookiedatabase.org/tcf/purposes/.

What types of addiction treatment are typically covered by insurance?

Thanks to federal parity laws, most insurance plans cover a full range of addiction treatment services, known as the “continuum of care.”

Coverage typically includes:

- Medical Detoxification: Medically supervised withdrawal management, usually lasting 7-10 days.

- Inpatient/Residential Treatment: 24/7 care in a structured facility, often for 30 days or more.

- Partial Hospitalization Program (PHP): Intensive daily treatment (about 6 hours/day, 5 days/week) while living at home or in sober living.

- Intensive Outpatient Program (IOP): Less time-intensive treatment (about 3 hours/day, 3 days/week) that allows for work or family obligations.

- Regular Outpatient Therapy: Weekly individual or group counseling sessions for ongoing support.

- Dual Diagnosis Treatment: Integrated care that addresses both a substance use disorder and a co-occurring mental health condition like depression or anxiety. This is crucial for long-term success, and you can find help at a dual diagnosis treatment facility.

To know exactly what your plan covers, you must verify rehab insurance with your provider or a treatment center.

Take the Next Step Towards Recovery

You’ve made it through this guide, and that alone shows courage. Understanding how to verify rehab insurance isn’t just about paperwork—it’s about opening a door that might have seemed locked. We’ve walked through the verification process together, from gathering your insurance card details to asking the right questions, and hopefully, you now see that this first step is more manageable than you might have feared.

Here’s what matters most: The cost of rehab should never be the reason you or someone you love doesn’t get help. Federal laws like the Affordable Care Act and the Mental Health Parity and Addiction Equity Act exist specifically to ensure that addiction treatment is covered just like any other medical condition. Your health insurance very likely covers a significant portion of treatment costs, and even if coverage is limited or you don’t have insurance, alternative options—state-funded programs, sliding-scale fees, grants, and payment plans—are available.

We’ve heard from thousands of people who felt overwhelmed by the financial aspect of treatment. Jessica’s story, which we shared earlier, is just one example. She thought rehab was financially out of reach until she verified her insurance. Now she’s been sober for over a year. That verification process, which took less than 15 minutes, changed her life.

At Addiction Helpline America, we’ve helped thousands of individuals and families across all 50 states find the right path to recovery. Our team provides free, confidential guidance because we believe everyone deserves access to quality treatment, regardless of their financial situation. We work with a nationwide network of treatment centers, which means we can help you find a program that fits your needs and your coverage.

Whether you’re seeking help for yourself or supporting a loved one through this process, you don’t have to figure this out alone. Our navigators can help you verify rehab insurance benefits, understand your options, and connect you with treatment centers that are the right fit. We can explain the difference between PHP and IOP programs, help you understand what dual diagnosis treatment involves, or simply answer questions that keep you up at night.

The journey to recovery starts with a single step, and verifying your insurance is often that step. It removes the uncertainty, clarifies your options, and transforms recovery from an abstract possibility into a concrete plan. You can explore our resources to understand different types of treatment programs, or reach out to us directly—whatever feels right for you.

Your recovery matters. The fact that you’re reading this guide means you’re already moving in the right direction. Don’t let questions about insurance or cost keep you from taking the next step. Reach out today, and let’s work together to find the treatment that will change your life.

Our helpline is 100%

free & confidential

If you or someone you care about is struggling with drug or alcohol addiction, we can help you explore your recovery options. Don’t face this challenge alone—seek support from us.

Programs

Resources

Will my insurance

cover addiction

treatment?

We're ready to help

Find the best

drug or alcohol treatment

center

Are you or a loved one struggling with addiction? Call today to speak to a treatment expert.